Harry Markopolos, Nov 7 2005

SEC Submission On Madoff

The $50 Billion Madoff Ponzi scheme has received enormous coverage, so I won’t bother repeating what everybody already knows. Rather, like many people, I’m betting dollars to doughnuts that he wasn’t able to pull this off on his own. At the very least, from day 1, I’ve stated that his sons had to be involved. Turning him in was merely a poor attempt to let Dad take the fall while making the sons look like heroes. (I see a Law & Order episode coming).

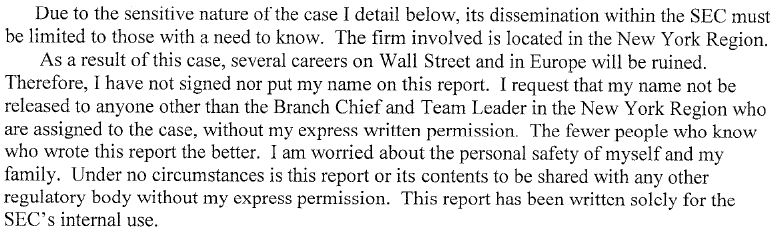

However, the train doesn’t stop there. A $50 Billion scam in the securities markets requires the cooperation and silence of a lot of people. To this end, the SEC is taking a lot of heat for failing to investigate Madoff despite very compelling information being presented to it. Specifically, fellow Greek Harry Markopolos submitted a paper to the SEC titled “The World’s Largest Hedge Fund Is A Fraud“.

How accurate is it? Paul Kedrosky best described as “indefatigable, honest and empirical in making his case”.

WAS BERNIE MADOFF A LONE THREAT TO MARKOPOLOS SAFETY, OR A LARGER WORSE GROUP?

Markopolos deserves accolades for not only providing irrefutable evidence – but for being courageous enough to do the right thing at the risk of his personal and family’s safety. You have to ask yourself why was he concerned? Was he afraid of the actions of just one man, Bernie Madoff, after being uncovered? Or did Madoff require the involvement of nefarious characters to pull off a scam of this magnitude?

It all comes down to whether you believe in the lone gunman theory or not. I don’t. When making your decision, consider this:

MADOFF NIECE (and Compliance Officer) MARRIED SENIOR SEC INSPECTION OFFICIAL

Yep, you read that right. A top SEC compliance official (Eric Swanson) who worked for the SEC – when it found no problems at Bernard Madoff’s firm in 2005 – just happened to start dating and eventually marry Madoff’s niece, who was a compliance lawyer for Madoff’s company.

Now, they could have just met in a bar somewhere or, as Swanson claims, at an industry conference. However, I can think of another way for an Senior SEC inspection official and a compliance lawyer to meet. Like, during a preliminary investigation?

Madoff is going to be the crowining jewel of fraud in US capital markets – let’s just hope it doesn’t extend to actual corruption in US regulatory markets. It all comes down to whether the SEC was simply grossly incompetent, or on the take. It’s 50-50 right now …. but the relationship between an inspection official and a compliance officer puts my money on the latter.

Othewise, I can’t imagine why the SEC would ignore a complaint when the submitter basically tells you the life of him and his family could be on the line. Under this circumstance, why was he ignored by the SEC?

Regards,

George

It does not surprise me one bit to read that Markopolos feared for his and his family’s safety.

Madoff ought to be labeled a GANGSTER in every sense of the term. I love how the media only labels Italian and black people as “gangsters.” This guy is a true crook. Also, SEC is looking into the role of Frank Dipascali’s role in the “fund”- if you can even call it one. This kind of scheme could only last for so long through methods of gangsterism, which of course involve paying people in authority off (politicians, (SEC), threats of physical violence to gain compliance, etc. Let this gangster rot in jail like John Gotti.

Thanks for the read…I would bet on the SEC corruption based upon what I have read so far.

MM