Every entrepreneur today is thinking of ways to manage their company from a sales and accounting perspective. Of equal importance is corporate recordkeeping, an aspect of business management that’s often overlooked – to a company’s detriment.

One of the crucial corporate records that needs more attention is the capitalization table, or cap table as it’s frequently called. Microsoft Excel has been the leading platform for cap table management for years. However, it’s becoming increasingly evident that old solutions like these are unable to match the pace of modern entrepreneurs and their recordkeeping needs.

What is a cap table?

Simply put, a cap table is a breakdown of a company’s equity ownership among shareholders. It reflects the percentage of equity ownership for founders and investors, as well as changes to equity value and dilution over time.

That’s just the simplified version. A cap table is much more than a list of transactions; it includes legal documents, sales, stock issuances, transfers, debt-to-equity conversions, and many other data. Sometimes, the term is applied broadly, and used to describe all records pertaining to company stakeholders: in other words, a lot of vital information.

How should the contemporary company track all of this crucial data?

How to manage a cap table in the Twenty-First Century

As a CFO I’m often responsible for the cap table management of the companies I work with. As a custodian I have a responsibility to make sure the information contained in the cap table is up-to-date, secure, and accessible to relevant parties.

Now, there’s a great tool that not only manages my cap table but also connects me to all the important documents in my company minute book. This tool offers an efficient management system that helps me keep track of all company shareholders in one secure environment. As my company grows, it saves me time and money that I would have wasted filling out paperwork, making hard copies, and sending digital files through unsafe email servers.

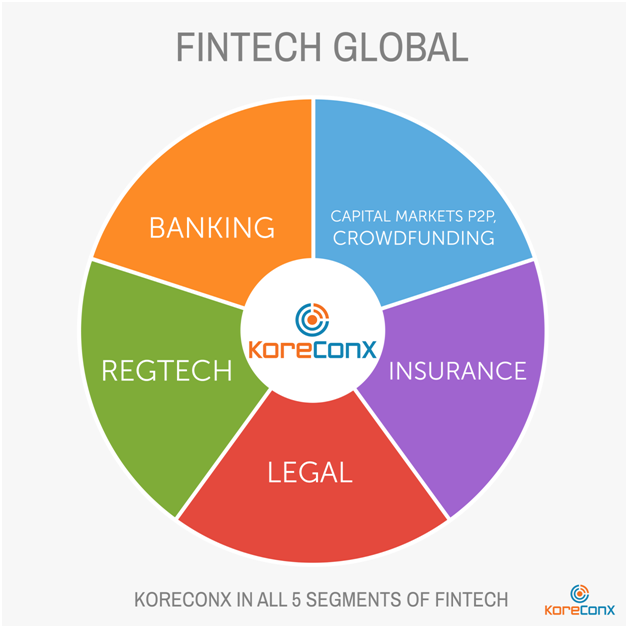

KoreConX is a FREE corporate management tool designed to facilitate the process of raising equity capital by bridging the communication gap between businesses and shareholders in a secure and transparent way. With KoreConX, I can release the contents of my cap table to shareholders looking to access their private holdings from investments. I can grant them access to relevant company reports and other information as needed.

The Four Cs

At the heart of it all, a cap table should be clear, comprehensive, current, and compliant. Clear to all those who need it for reference; comprehensive in its contents; current as of the latest development; legally compliant.

The great thing about KoreConX is that it is an all-in-one solution that ensures my cap table checks all the four Cs.

Clear: I can keep everyone on the same page without compromising the integrity of my records. With KoreConX, I can share as little or as much as I like, preventing staff from being bombarded with information not directly relevant to them and restricting access to confidential documents.

Comprehensive: Without a storage limit, I can store all my detailed information with KoreConX and work with collaborators in a secure digital environment.

Current: I can update the cap table virtually without having to make photocopies of the latest version, or without having to send everyone a revised spreadsheet through a risky email system.

Compliant: By law, members of the company’s Board of Directors must be able to access the minute book. KoreConX allows all members of the board to see the contents of the minute book. It also offers integrated tools to schedule meetings and assign tasks. The platform also saves time and money by reducing excess legal fees by taking a proactive approach to record management.

KoreConX is truly a tool for the modern entrepreneur. As companies of all sizes evolve and adapt to the pace of business today, our recordkeeping and information-sharing technologies should always be one step ahead.