BECOME A URANIUM ‘CONTRARIAN’: PROFIT FROM PANIC!

Dear Investor,

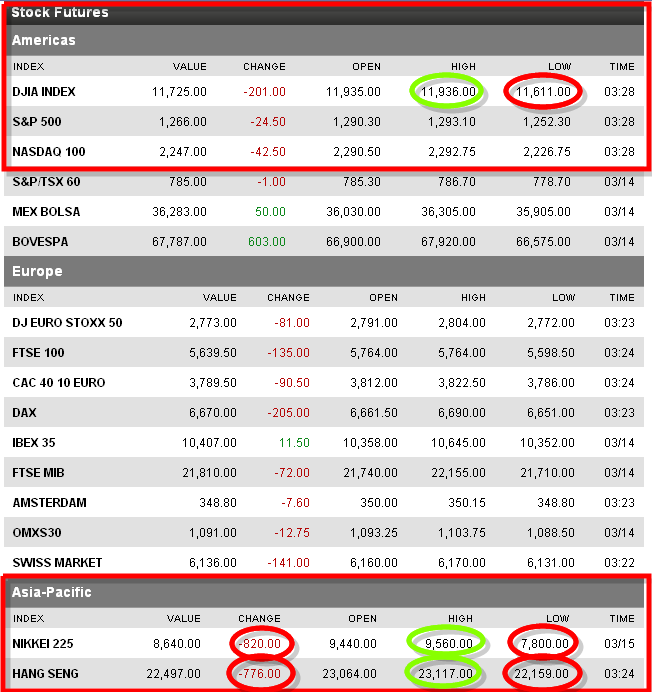

While most investors have their eye on the precious metals, there is one very special sector poised for a massive surprise rebound – one that may outshine the precious metal sector – and that is uranium stocks! In March, investors sold uranium stocks in a panic as an earthquake and a Tsunami damaged Japan’s nuclear reactors.

However, those investors, driven by sheer herd mentality, will soon regret their actions. For one thing I’ve learned is that when a large group acts so decidedly in one way, they end up making the wrong decision. For indeed, once every seller has sold, prices have no choice but to rise. And I believe that’s where uranium shares are now.

13 bullish points for uranium investors to consider:

1) A major delay in the uranium bull market has been FULLY priced into uranium shares and therefore, once sentiment begins to shift (as it invariably will) or even if we begin to see uranium stock takeovers at these low prices, uranium shares will be making a bee-line higher!

2) China is not delaying. In fact, it announced it will proceed with construction of its nuclear power plants. The fast-industrializing nation is simply too busy growing to stop – and with its air full of smog and pollution due to a rapidly growing population there is simply no better clean energy option available to them.

3) 56 plants are under construction (mostly in China) and 200 more are being planned.

4) The US announced it will not delay its building plans for nuclear power plants. It is moving ahead!

5) Over 430 nuclear power plants are in operation, producing 15% of the world’s power.

6) Coal and uranium combined provide for about 90% of America’s energy needs. Coal supplies the bulk, at 70 percent! What no one in the press reports, is that coal also accounts for the deaths of between 10,000 to 20,000 people per year, while there has not been a single reported death from nuclear power in the US! In 1975, 30 dams in China failed due to flooding and an estimated 230,000 people perished. And yet, no one is calling hydro-power a demon! ☺

7) Insiders are now buying shares of uranium companies. Insiders only buy for one reason – when they know a company is dirt cheap. For an insider knows the value of their own company better than anyone! In fact, one influential and very-well respected resource investor recently bought 300,000 shares, increasing his stake in a well-known uranium producer by 40 percent! Another investor with a truly amazing reputation for buying bargain resource stocks was busy buying shares of a 30-cent uranium stock for his own personal account. Ted Dixon, CEO of Ink Research (whose company expertly tracks and analyzes executive buying and selling) considers both of these purchases (in addition to some others I’ve noted) significant enough for investors to take notice.

8) Only 62% of all uranium produced comes from uranium mines. A large part of the remainder comes from plutonium from dismantled Cold War nuclear weapons stockpiles (warheads, etc) and that uranium should only last until … 2013. How’s a major uranium shortage for a near-term catalyst?

9) “Half of the [uranium demand] growth over the next 10 years is all coming from China,†said Orest Wowkodaw, an analyst at Canaccord Genuity.

10) Future uranium supply is going to need be secured in advance, for practical reasons. That will create advance pressure on uranium demand!

11) The World Nuclear Association expects uranium demand to increase 33% from 2010-2030.

12) By 2012, out of the 10 largest producing uranium mines operating today, SIX will be depleted, two will be in their final stages, one will be upgrading and one will be producing.

13) Uranium demand will greatly outstrip supply which has peaked! Uranium wealth bubble here we come!

Charted below is the price of uranium versus the price of gold. We can see uranium is ripe to break up through its down-trend line any day now (my guess – within the next 10 days). Furthermore, the MACD signal on the chart is rising, showing positive divergence, which reveals underlying strength, a subtle momentum change and the likelihood of a move to the upside.

What I’ve learned and now shared, is that the issues surrounding Japan are not going to affect uranium’s long-term bull market which is just now getting started. In fact, those who choose to be contrarian and buy valuable assets on the cheap, are those who end up profiting handsomely! And that is exactly what happened when investors began acquiring gold and silver-leveraged companies when gold was $400 and silver was $7 or less.

In fact gold was so out of favour by 1999 that England’s finance minister (and future prime minister) Gordon Brown sold a gold cache containing half of England’s centuries-old treasure (a whopping 400 tons!) for less than $300 an ounce! Warren Buffet who many consider the world’s greatest investor, sold his entire stake of 130 million ounces of silver at $7 an ounce in 2006, settling for a pitiful $2 per ounce profit! Talk about two ‘experts’ who were wrong at the bottom! Clearly, being contrarian is the way to go!

Near-term outlook: The amazing chart above (labeled U.TO) shows how quickly uranium panics tend to rebound. This resilience in the price of uranium also shows the tremendous underlying strength in the commodity. What investors should also know is that the last 4 extreme sell-off lows (labeled with green arrows) have resulted in uranium prices rising on average 40 percent! And uranium stocks are likely to provide even more leverage to the upside! At present, we’ve generated another green BUY arrow, meaning there really is no better opportunity for uranium stock investors to buy shares than the one you see today!

BUY NOW! DON’T WAIT FOR THE MEDIA’S ‘EXPERT’ VOTE OF APPROVAL

To profit from the explosive uranium bull market ahead, join my elite uranium advisory (HHN) Hedgehog Nuke! In fact, our Alpha Forecasts indicate major gains for us over the next few weeks! And it’s true – the media will be all over this uranium-turnaround story like all others they cover – but unfortunately, their ‘valuable analysis’ will come after the fact. By the time uranium is judged a solid investment again by the masses, our elite uranium stocks will have rocketed higher!

After all, the media told you tech stocks were going to the moon in 2000, then they told you stocks were never coming back after the 2008 market crash, they missed the gold and silver bull, the oil crash; the list of the media’s misses literally goes on and on. Soon we’ll add Uranium’s Revenge to that list and you’ll have read it here first!

Don’t forget, we are also sharing with our Hedgehog Nuke (HHN) subscribers our one year uranium forecast, a number of valuable insider buys and sell transactions we’ve noted over the past few weeks and our top rated elite uranium recommendations. Don’t miss out!

About Nicholas Winton: Nicholas is editor-in-chief of HedgehogTrader.com whose website provides unique and accurate forecasting and analysis of the broad markets, resource stocks and commodities with contrarianism, insider buying, and his proprietary Alpha Signals. His advisories and uncanny predictions have amazed and enriched resource investors since 2006! He is also a consultant to Hedge Funds and wealth management advisors. You can follow his commentary on his blog, and on his informative and entertaining Twitter feed! http://www.twitter.com/hedgehogtrader ]

George’s Note: This article contains the opinions of Hedgehog trader and are not an offer to buy or sell securities by AGORACOM. Having said that, I have followed the HedgeHog Trader newsletter for a couple of months now and find the information to be extremely valuable in helping me formulate my own investment decisions. If you are looking for a well researched newsletter covering junior resource companies, I strongly suggest considering HHT.