Much of my time this week has been spent flagging calls from small-cap CEO’s asking what they should be doing about Investor Relations in this market. Â Given the fact I can’t get on the phone with all of you, I’ve listed 8 effective things you should be doing right now to take control of your investor relations during this market turmoil.

GETTING INTO THE RIGHT MINDSET

Before even starting on my 8 best practices below, you are going to need to get into the right mindset.  Specifically, it is important to understand that during this kind of market environment, investor relations is not just about increasing your share price. Every company is getting hit, so to think you can buck that trend isn’t realistic.

Rather, your goals in this environment are:

- Short Term – To mitigate, even stop any further losses to your market capitalization.

- Longer Term – To take advantage of competitors with weak or non-existent strategies and attract new investors.

Both goals are heavily dependent on choosing the right philosophy. Â Specifically:

(+) Â If you listen to me and get proactive, a properly executed strategy will yield great short and long-term results.

(-) Â If, as some small cap CEO’s have told me, you choose to run for cover and fail to communicate, Â you are creating a guaranteed recipe for disaster.

THE 8 BEST INVESTOR RELATIONS PRACTICES DURING THIS MARKET TURMOIL

With all this in mind, here is the AGORACOM recipe for success during periods of market turmoil.

1]Â Â Silence Is Death -Â Have you ever had a friend or family member owe you money but suddenly become hard to get a hold of? How did you feel? Do not make your shareholders feel this way or they’ll write you off as a bad debt and wash their hands clean of you. This is no time to duck for cover if you believe in your business, your plan, your management team and your board.

2]  Provide Long-Term Vision – Investors are worried by these short-term market gyrations. It is your job to get shareholders to look beyond this gyration and remind them that you are building a long-term business that will survive and thrive far beyond 2012.

3]  Accentuate Your Strengths – Provide shareholders with a press released corporate update that discusses the strength of your product / services / project / technology. Be sure to also address the long-term viability and strength of your industry. Remind investors that there will always be demand for your products and you are one of the companies that will be benefiting from it.

4]  State Of The Union – Support your corporate update with a multi-media “state of the union”. Specifically, tape an audio or video address for your shareholders that conveys confidence. If your text based corporate update in step 2 provides the facts that assure investors, your multi-media address will provide your shareholders with confidence they are in the right hands. No matter what the context, people need to hear from their leaders.  Think Winston Churchill in WW II, or George Bush after 9/11.

5]  You’re Not Bullet Proof – Be honest about any negative impacts to your operations.  Shareholders don’t expect you to be bullet-proof, so openly telling them about the 1 or 2 items in your business that have been impacted demonstrates an honest and realistic management team.

6]Â Â Differentiate Yourself From The Pack -Â Though you should never specifically name a competitor, do to tell investors about any significant general problems with your competitors, some of whom will not make it through this period due to poor planning or business models. Differentiate yourself from the pack.

7]  Business As Usual - Do not hold back communications as part of a “market timing” strategy. Yes, be careful not to issue press releases on a specific morning where futures are showing significant weakness due to a macro event – but it is otherwise business as usual, so get on with your business and continue issuing press releases.

8]  Capitalize On New Blood - Never, ever stop looking for new investors. You are in a position to benefit from the following two ways:

First, we all know that a significant portion of small-cap and micro-cap stocks are unfortunately built upon unviable business models. That is the nature of the business. Shareholders in those companies will see the writing on the wall, take their tax losses and start looking for high-quality alternatives that can help them get back above water over the next 12-24 months. Be that alternative!

Second, investors that were smart enough to raise cash earlier in the year will be looking to come back into the markets over the next few months. They will be looking for good companies with good management teams executing a plan that will succeed over the next 2-3 years. Be there when they come knocking!

CONCLUSION

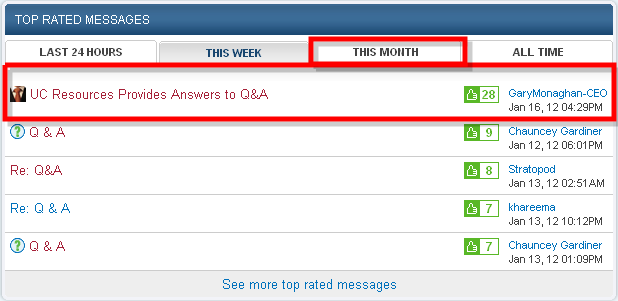

If you need any more proof about the validity of this plan, I ask you to once again follow the AGORACOM experience. Despite the fact markets are going through tough times, we have managed to maintain a status quo and actually grow while other investor relations firms suffer.

Why? We practice what we preach:

A] Â We openly communicate with and help our customers as much as ever during this turmoil. Â We don’t go silent.

B] Â We continue marketing ourselves via search engines, our blog and newsletters to attract new customers.

If you follow our plan, never lose site of the fact that you currently have great shareholders and remember there are millions of other shareholders looking for companies like yours, you will succeed in mitigating short-term losses while maximizing long-term success.

Regards,

George

Did You Find This Article Helpful? Â What To Do Next …

1]  Read George’s Small-Cap CEO Lessons For Free Powerful Advice On Great Investor Relations

2] Â Contact AGORACOM To Discuss Your Online Investor Relations Needs and Solutions

Â