Introduction:

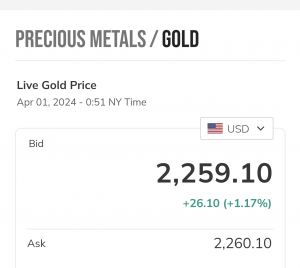

As gold surges to new all-time highs, driven by a combination of strong central bank buying, geopolitical tensions, and expectations of U.S. interest rate cuts, Stelmine Canada finds itself strategically aligned to capitalize on these industry trends. With gold prices expected to continue their upward trajectory, Stelmine Canada’s recent milestones position the company to leverage this bullish market, underscoring its potential as a key player in the gold mining sector.

Industry Outlook & Stelmine Canada’s Trajectory

The gold market’s current rally is just beginning, according to ING’s Ewa Manthey, with prices expected to reach new heights as the U.S. Federal Reserve gears up for interest rate cuts. Stelmine Canada, with its strategic focus on gold exploration in underexplored regions, is well-positioned to benefit from this favorable market environment. As gold continues to be a safe haven amid global uncertainties, Stelmine’s ongoing projects are set to align perfectly with the growing demand for the precious metal.

Voices of Authority

Ewa Manthey, Commodities Strategist at ING, highlights the imminent start of the Fed’s rate-cutting cycle as a strong and sustained driver for gold’s price action. Her insights mirror Stelmine Canada’s strategic vision of increasing its gold assets in response to rising market demand, making the company’s recent explorations and expansions more significant in this bullish environment.

Stelmine Canada’s Highlights

Within Stelmine’s portfolio, the Courcy Property emerges as a testament to the company’s commitment to innovation and discovery. Courcy embodies the spirit of exploration and potential, setting new standards for gold development in Northern Quebec. Courcy hosts Geological similarities to Newmont’s Eleonore mine (Gold production since 2015) 215k OZs of annual production (2022). Courcy isn’t confined to gold; it’s a treasure trove of critical minerals.

The Mercator gold-bearing corridor became the canvas for Stelmine’s geological artistry, where the company not only uncovered gold deposits but also expanded the corridor’s length substantially through meticulous exploration and leveraging historical data.

Strategic Exploration: Stelmine has secured 100% ownership of 1,815 claims, spanning 933 km² in Northern Quebec’s gold-rich regions.

Leadership in Focus: The recent appointment of Christian de Saint-Rome as interim President and CEO brings over 25 years of international mining and capital markets experience to the helm.

Key Projects: The Courcy and Mercator Projects are at the forefront of Stelmine’s exploration efforts, with significant potential to unlock new gold reserves in under-explored areas.

Real-world Relevance

Stelmine Canada’s strategic moves can be likened to securing a front-row seat in a rapidly appreciating asset class. Just as savvy investors look for early opportunities in a bullish market, Stelmine’s expansion into high-potential gold territories can be seen as a timely and calculated move.

Looking Ahead with Stelmine Canada

With gold’s upward momentum set to continue into 2025 and beyond, Stelmine Canada’s forward-looking goals include further exploration and potential expansion of its gold assets. By aligning its strategies with the broader industry outlook, Stelmine is not only preparing to meet current market demands but is also positioning itself to thrive as a dominant player in the gold mining industry.

Conclusion:

Stelmine Canada’s strategic initiatives align perfectly with the current bullish trends in the gold market. As the precious metal continues to rally, Stelmine’s proactive approach and recent milestones make it a compelling opportunity for investors looking to benefit from the ongoing surge. With a clear vision and strategic positioning, Stelmine Canada stands out as a company poised to capitalize on the gold market’s growth.

YOUR NEXT $STH STEPS

$STH HUB On AGORACOM: https://agoracom.com/ir/stelminecanada

$STH 5 Minute Research Profile On AGORACOM: https://agoracom.com/ir/stelminecanada/profile

$STH Official Verified Discussion Forum On AGORACOM: https://agoracom.com/ir/stelminecanada/forums/discussion

DISCLAIMER AND DISCLOSURE

This record is published on behalf of the featured company or companies mentioned (Collectively “Clients”), which are paid clients of Agora Internet Relations Corp or AGORACOM Investor Relations Corp. (Collectively “AGORACOM”)

AGORACOM.com is a platform. AGORACOM is an online marketing agency that is compensated by public companies to provide online marketing, branding and awareness through Advertising in the form of content on AGORACOM.com, its related websites (smallcapepicenter.com; smallcappodcast.com; smallcapagora.com) and all of their social media sites (Collectively “AGORACOM Network”) . As such please assume any of the companies mentioned above have paid for the creation, publication and dissemination of this article / post.

You understand that AGORACOM receives either monetary or securities compensation for our services, including creating, publishing and distributing content on behalf of Clients, which includes but is not limited to articles, press releases, videos, interview transcripts, industry bulletins, reports, GIFs, JPEGs, (Collectively “Records”) and other records by or on behalf of clients. Although AGORACOM compensation is not tied to the sale or appreciation of any securities, we stand to benefit from any volume or stock appreciation of our Clients. In exchange for publishing services rendered by AGORACOM on behalf of Clients, AGORACOM receives annual cash and/or securities compensation of typically up to $125,000.

Facts relied upon by AGORACOM are generally provided by clients or gathered by AGORACOM from other public sources including press releases, SEDAR and/or EDGAR filings, website, powerpoint presentations. These facts may be in error and if so, Records created by AGORACOM may be materially different. In our video interviews or video content, opinions are those of our guests or interviewees and do not necessarily reflect the opinion of AGORACOM.

From time to time, reference may be made in our marketing materials to prior Records we have published. These references may be selective, may reference only a portion of an article or recommendation, and are likely not to be current. As markets change continuously, previously published information and data may not be current and should not be relied upon.

NO INVESTMENT ADVICE

This record, and any record we publish by or on behalf of our clients, should not be construed as an offer or solicitation to buy or sell products or securities.

You understand and agree that no content in this record or published by AGORACOM constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable or advisable for any specific person and that no such content is tailored to any specific person’s needs. We will never advise you personally concerning the nature, potential, advisability, value or suitability of any particular security, portfolio of securities, transaction, investment strategy, or other matter.

Neither the writer of this record nor AGORACOM is an investment advisor. Both are neither licensed to provide nor are making any buy or sell recommendations. For more information about this or any other company, please review their public documents to conduct your own due diligence.

If you have any questions, please direct them to [email protected]

For our full website disclaimer, please visit https://agoracom.com/terms-and-conditions