ESGold Corp. (CSE: ESAU / OTC: ESAUF) is on the brink of a major breakthrough at its Montauban project in Quebec, and investors are paying close attention. The company has identified striking geological similarities between Montauban and Broken Hill, one of the world’s richest metal deposits, valued at over $100 billion. If these parallels hold, ESGold may be standing on a mineralized system of immense scale..

Geological Parallels to a $100 Billion Giant

The recent discovery of rhodonite, a mineral strongly associated with Broken Hill-type deposits, further reinforces the geological potential of Montauban. Historically, these deposits have yielded some of the world’s most valuable metal resources, including high-grade silver, gold, and base metals.

“For the first time, we are applying a disciplined, modern exploration approach to Montauban, similar to how Broken Hill was systematically uncovered,” said André Gauthier, Senior Geologist at ESGold. “Our goal is to use modern technology to answer the key question—just how big is Montauban?”

Cutting-Edge Exploration: Seeing Below the Surface

Unlike historical exploration efforts, ESGold is deploying ambient noise tomography (ANT), a revolutionary technique that scans up to 400 meters below surface. This non-invasive method provides the first-ever deep visualization of the mineralized system, allowing ESGold to strategically plan its next drilling phase.

“Broken Hill was not fully recognized until advanced exploration techniques were applied—this is the exact playbook we are following at Montauban,” added Brad Kitchen, President of ESGold. “Our ANT survey will give us the first-ever deep visualization of the deposit, guiding our next drilling phase to unlock the true scale of this mineralized system.”

Near-Term Cash Flow: Tailings Production Begins Soon

While exploration continues, ESGold is already preparing to generate near-term revenue from tailings reprocessing. Within the next six months, the company will commence gold and silver extraction from Montauban’s tailings, ensuring a steady cash flow without dilution to shareholders.

Financial Projections at a Glance:

- $23M Year 1 Revenue from tailings production based on current gold and silver prices.

- $106.9M in Total Tailings Revenue projected in the Preliminary Economic Assessment (PEA), with potential upside to $315M over five years.

- Rapid Payback Period: Only 0.9 years at $1,750/oz gold, demonstrating strong financial viability.

What’s Next for ESGold?

The coming months will be pivotal for ESGold as it advances its multifaceted growth strategy:

- Finalized ANT Results (4-6 Weeks): This underground scan will define high-priority drill targets.

- Drilling Phase (6-9 Months): Once the data is analyzed, ESGold will launch a strategic drilling campaign to confirm the full potential of Montauban’s mineralization.

- Updated PEA: A revised economic assessment will integrate the latest findings, further refining ESGold’s growth projections.

Summary

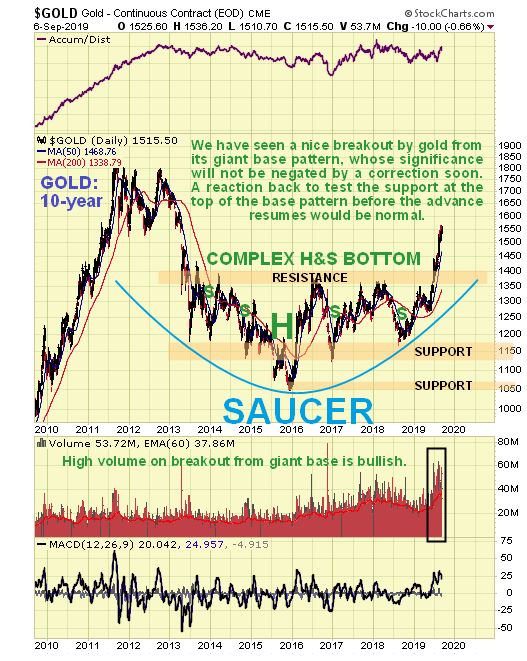

With gold prices soaring and investor demand for high-margin, high-growth projects increasing, ESGold is uniquely positioned to capitalize on both near-term production and long-term exploration upside.

Proven Geological Model: Montauban shares characteristics with one of the world’s richest deposits.

Advanced Exploration Tech: First-ever deep scan using ANT provides unprecedented insight.

Near-Term Revenue: Tailings production ensures cash flow without shareholder dilution.

Strategic Quebec Location: Low-cost hydro, strong mining infrastructure, and supportive regulations.

ESGold Corp. may present a compelling opportunity for those interested in the gold sector. The company is led by a strong leadership team and leverages advanced technology as it works towards identifying and potentially unlocking significant gold discoveries in Canada.