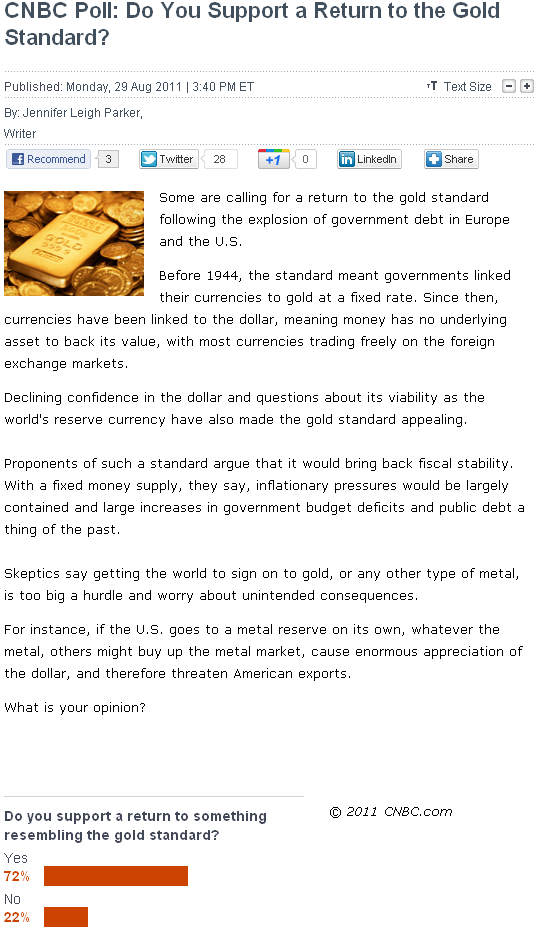

In a remarkable turn of events, gold prices have soared to new record highs, reflecting the impact of a surprising weakness in a key U.S. economic report. On Friday, April gold reached an unprecedented $2,187.50, marking a robust increase of $21.30. This surge was triggered by the February employment situation report from the Labor Department, which revealed unexpected frailty in the U.S. job market.

Despite the non-farm jobs number exceeding expectations at 275,000, the report highlighted concerning aspects, including a downward revision of January’s figures and an uptick in the unemployment rate to 3.9%. These revelations have aligned with the sentiments of U.S. monetary policy doves, who advocate for prompt interest rate cuts to address economic challenges.

This bullish trend in gold prices has captured the attention of investors and analysts, emphasizing the metal’s role as a safe-haven asset during uncertain economic times. As the market reacts to these developments, several gold exploration companies are poised to benefit from the ongoing gold boom. Let’s delve into some of these small cap gold companies that stand to benefit.

Stelmine Canada (STH: TSXV)

Stelmine is developing a new gold district (in northeastern Quebec); an under-explored part of the otherwise prolific James Bay region of Quebec, Canada. This region of the planet is expected to substantially increase its production of gold mineral resources. Led by Isabelle Proulx (CEO), Stelmine’s management team has a proven track record in the Quebec resources sector and has created an attractive gold exploration target through a high profile geological team including Dr. Normand Goulet, considered one of Canada’s greatest structural geologists.

The Mercator gold-bearing corridor became the canvas for Stelmine’s geological artistry, where the company not only uncovered gold deposits but also expanded the corridor’s length substantially through meticulous exploration and leveraging historical data. Their Flagship Courcy property hosts Geological similarities to Newmont’s Eleonore mine (Gold production since 2015) 215k OZs of annual production (2022). Courcy isn’t confined to gold; it’s a treasure trove of critical minerals.

Green River Gold Corp. (CCR: CSE) (CCRRF: OTC)

Green River stands out with its strategic acquisition of the core part of the Fontaine Project and a package of placer claims, resulting in a substantial land package of 200 square kilometers. The company gained additional attention when Osisko Gold Royalties Ltd. purchased Barkerville Gold Mines Ltd. for $338 million Canadian, bringing a well-established player into the Cariboo District. A B.C. environmental assessment certificate has been issued to Osisko Development Corp. for the Cariboo Gold project in Wells, east of Quesnel. When completed, the mine is expected to produce about 25 million tonnes of ore over 16 years and employ 500 workers during its operation and up to 300 during construction. Construction costs alone are expected to contribute an estimated $588 million to the economy over four years, and operations about $466 million. Green River is well-positioned to capitalize on the renewed interest in this district.

Cross River Ventures (CRVC: CSE)

Cross River Ventures is actively developing a portfolio of projects in some of the most prolific mining districts globally. With a focus on exploration, the company is poised to leverage its presence in strategic locations, contributing to the overall growth and diversification of its assets. The company is located in some of the most prolific greenstone belts in Canada. The company’s senior management team and board boast decades of experience.

Xali Gold (XGC: TSXV) (CDGXF: OTC)

Xali Gold has initiated a comprehensive growth strategy, targeting gold and silver projects with exploration and near-term production potential. The acquisition of the SDA Plant, suitable for treating high-grade gold and silver mineralization, represents a significant step in this strategy. The flagship asset, El Oro, a district-scale gold project in Mexico, adds a compelling dimension to Xali Gold’s portfolio, further solidifying its position in the evolving gold market.

As the gold market continues to capture headlines and investor interest, these companies are well-poised to navigate and thrive in the dynamic landscape, providing promising opportunities for those seeking to capitalize on the current bullish trend in precious metals.

Disclaimer and Disclosure

This record is published on behalf of the featured company or companies mentioned (Collectively “Clients”), which are paid clients of Agora Internet Relations Corp or AGORACOM Investor Relations Corp. (Collectively “AGORACOM”)

AGORACOM.com is a platform. AGORACOM is an online marketing agency that is compensated by public companies to provide online marketing, branding and awareness through Advertising in the form of content on AGORACOM.com, its related websites (smallcapepicenter.com; smallcappodcast.com; smallcapagora.com) and all of their social media sites (Collectively “AGORACOM Network”) . As such please assume any of the companies mentioned above have paid for the creation, publication and dissemination of this article / post.

You understand that AGORACOM receives either monetary or securities compensation for our services, including creating, publishing and distributing content on behalf of Clients, which includes but is not limited to articles, press releases, videos, interview transcripts, industry bulletins, reports, GIFs, JPEGs, (Collectively “Records”) and other records by or on behalf of clients. Although AGORACOM compensation is not tied to the sale or appreciation of any securities, we stand to benefit from any volume or stock appreciation of our Clients. In exchange for publishing services rendered by AGORACOM on behalf of Clients, AGORACOM receives annual cash and/or securities compensation of typically up to $125,000.

Facts relied upon by AGORACOM are generally provided by clients or gathered by AGORACOM from other public sources including press releases, SEDAR and/or EDGAR filings, website, powerpoint presentations. These facts may be in error and if so, Records created by AGORACOM may be materially different. In our video interviews or video content, opinions are those of our guests or interviewees and do not necessarily reflect the opinion of AGORACOM.

From time to time, reference may be made in our marketing materials to prior Records we have published. These references may be selective, may reference only a portion of an article or recommendation, and are likely not to be current. As markets change continuously, previously published information and data may not be current and should not be relied upon.

NO INVESTMENT ADVICE

This record, and any record we publish by or on behalf of our clients, should not be construed as an offer or solicitation to buy or sell products or securities.

You understand and agree that no content in this record or published by AGORACOM constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable or advisable for any specific person and that no such content is tailored to any specific person’s needs. We will never advise you personally concerning the nature, potential, advisability, value or suitability of any particular security, portfolio of securities, transaction, investment strategy, or other matter.

Neither the writer of this record nor AGORACOM is an investment advisor. Both are neither licensed to provide nor are making any buy or sell recommendations. For more information about this or any other company, please review their public documents to conduct your own due diligence.

If you have any questions, please direct them to [email protected]

For our full website disclaimer, please visit https://agoracom.com/terms-and-conditions