Introduction: Victory Square Technologies ($VST) stands out as a beacon of innovation and growth. This article will delve into the key highlights of VST, shedding light on why it’s worth considering for your investment portfolio.

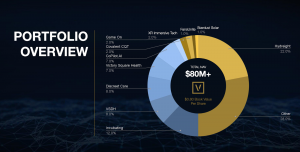

Diverse Portfolio: At the heart of Victory Square Technologies lies a diverse portfolio comprising 25+ innovative companies from across the globe. These companies span various sectors, including Digital Health, Artificial Intelligence (AI), Blockchain/Web3, Virtual & Augmented Reality (VR/AR), Gaming, and Climate Tech. Such diversity not only mitigates risk but also presents ample opportunities for growth in burgeoning industries.

Venture Builder Model: Unlike traditional investment approaches, VST adopts a unique venture builder model. Rather than merely investing in startups, VST actively participates in their growth journey. With an incubator and a vast international network comprising over 250 founders, investors, and tech accelerators, VST provides unparalleled support to its portfolio companies. This hands-on approach ensures that startups receive the guidance and resources necessary to thrive in today’s competitive landscape.

Financial Strength: A crucial aspect of any investment decision is the financial health of the company. In this regard, Victory Square Technologies demonstrates robust financial performance. With revenue surpassing $12 million in 2023 and a healthy cash position of over $4.9 million, VST exemplifies stability and growth potential. Moreover, the company’s strategic focus on monetizing investments and reinvesting gains underscores its commitment to long-term value creation.

Cutting-Edge Technologies: In the rapidly evolving tech landscape, staying ahead of the curve is essential. Victory Square Technologies excels in this aspect by investing primarily in leading-edge technologies such as AI, ML, blockchain, and gaming. These disruptive technologies not only drive innovation but also offer immense growth opportunities. By positioning itself at the forefront of technological advancements, VST ensures that investors are poised to benefit from emerging trends and market shifts.

ESG Integration: In addition to financial performance, ethical considerations play an increasingly significant role in investment decisions. Victory Square Technologies integrates Environmental, Social, and Corporate Governance (ESG) principles into its operations. By highlighting minority entrepreneurs and supporting community initiatives, VST exemplifies its commitment to social responsibility. This holistic approach not only aligns with ethical investing principles but also contributes to sustainable, long-term growth.

Conclusion: With its diverse portfolio, venture builder model, strong financial performance, focus on cutting-edge technologies, and ESG integration, VST embodies the essence of innovation and growth. As you embark on your investment journey, exploring the potential of Victory Square Technologies ($VST) may pave the way for opportunities in the ever-evolving tech landscape.

YOUR NEXT STEPS

Visit $VST HUB On AGORACOM: https://agoracom.com/ir/VictorySquareTechnologies

Visit $VST 5 Minute Research Profile On AGORACOM:https://agoracom.com/ir/VictorySquareTechnologies/profile

Visit $VST Official Verified Discussion Forum On AGORACOM:

https://agoracom.com/ir/VictorySquareTechnologies/forums/discussion

Watch $VST Videos On AGORACOM YouTube Channel:

https://www.youtube.com/watch?v=bsowj8LRvXw

DISCLAIMER AND DISCLOSURE

This record is published on behalf of the featured company or companies mentioned (Collectively “Clients”), which are paid clients of Agora Internet Relations Corp or AGORACOM Investor Relations Corp. (Collectively “AGORACOM”)

AGORACOM.com is a platform. AGORACOM is an online marketing agency that is compensated by public companies to provide online marketing, branding and awareness through Advertising in the form of content on AGORACOM.com, its related websites (smallcapepicenter.com; smallcappodcast.com; smallcapagora.com) and all of their social media sites (Collectively “AGORACOM Network”) . As such please assume any of the companies mentioned above have paid for the creation, publication and dissemination of this article / post.

You understand that AGORACOM receives either monetary or securities compensation for our services, including creating, publishing and distributing content on behalf of Clients, which includes but is not limited to articles, press releases, videos, interview transcripts, industry bulletins, reports, GIFs, JPEGs, (Collectively “Records”) and other records by or on behalf of clients. Although AGORACOM compensation is not tied to the sale or appreciation of any securities, we stand to benefit from any volume or stock appreciation of our Clients. In exchange for publishing services rendered by AGORACOM on behalf of Clients, AGORACOM receives annual cash and/or securities compensation of typically up to $125,000.

Facts relied upon by AGORACOM are generally provided by clients or gathered by AGORACOM from other public sources including press releases, SEDAR and/or EDGAR filings, website, powerpoint presentations. These facts may be in error and if so, Records created by AGORACOM may be materially different. In our video interviews or video content, opinions are those of our guests or interviewees and do not necessarily reflect the opinion of AGORACOM.