It seems like Tye Burt can’t build a company on his own. Â Rather he prefers to act as an opportunist, as was well documented in our very heated and public battle over the Kinross “take over” of Aurelian Resources. Â Despite the unanimous “approval” of an Aurelian Board that happened to stock up on millions of options just before the Kinross “offer”, the AGORACOM community fought and battled Kinross into renewing their offer several times before obtaining the requisite number of shares … an industry first.

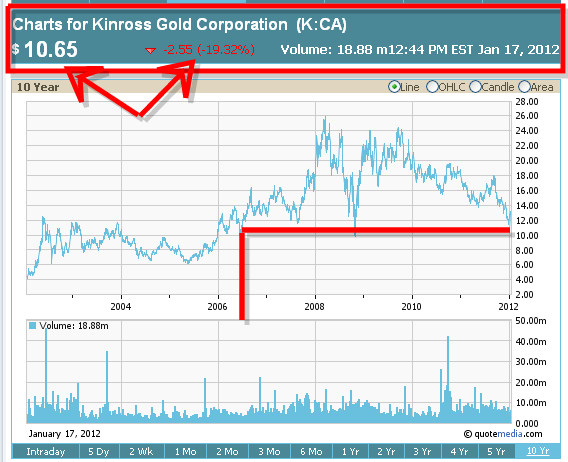

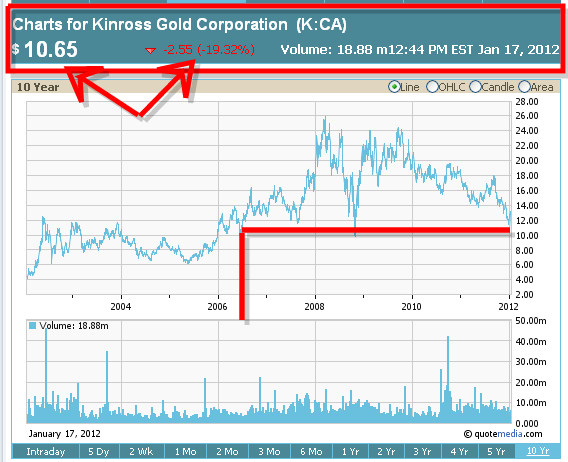

Tye was so confident, that he gave Aurelian investors a warrant to purchase Kinross shares at $32 … when it was trading around $18 … and attached a value to that warrant that made up a good portion of the ridiculous consideration Aurelian shareholders received.  So how did that work out? It never got over $24 and expired worthless:

Now, had Tye taken Aurelian and built an even better company for the benefit of all, you could argue the move was the right one. Â Unfortunately, Tye was such a bad CEO that Kinross tossed him after – and I quote the Dacha press release below:

“Mr. Tye W. Burt was terminated as Chief Executive Officer of Kinross Gold Corp. after presiding over a reported US$2.49 billion loss related to the acquisition of Red Back Mining, the largest single loss in the company’s history.”

Here’s a little more imagery to help drive the Dacha point home:

Now, if you didn’t know these facts, you’d have to consider the possibility that Dacha management are simply saying whatever they can to keep their jobs … but now you know better when you read the following Dacha statements below:

Now, if you didn’t know these facts, you’d have to consider the possibility that Dacha management are simply saying whatever they can to keep their jobs … but now you know better when you read the following Dacha statements below:

- DISSIDENT NOMINEES CANNOT BE TRUSTED TO RUN YOUR COMPANY

- DISSIDENT NOMINEES ARE NOT QUALIFIED TO CREATE YOUR SHAREHOLDER VALUE

- DISSIDENT NOMINEES ARE NOT QUALIFIED TO CREATE YOUR SHAREHOLDER VALUE

The most troubling part of the press release below is that the dissident group which proposed him as a board member secretly acquired shares, despite good faith negotiations by Dacha management to agree to a compromise without a battle for the board. Â This comes as no surprise to me.

Dacha shareholders be forewarned, if Tye gets his hands on Dacha by squeezing out this board, you stand to be the next ones to be squeezed out.

Last Friday we were notified that a group of four shareholders is trying to take control of your company and the value of your investment. The group, which includes funds managed by Goodwood Inc. (“Goodwoodâ€) and Salida Capital L.P. (“Salidaâ€), seeks to replace the entire Dacha board with eight connected nominees at the annual and special meeting of Dacha shareholders, to be held on November 28, 2012. In addition to Goodwood and Salida, the group also includes Takota Asset Management Inc. and Longford Energy Inc. Their actions have launched a costly and distracting proxy contest to advance their own agenda rather than the best interests of the majority of Dacha’s shareholders or Dacha.

Your board opposes this initiative for the reasons detailed in this Circular. Join us in voting the BLUE Proxy to stop Goodwood and Salida. We believe Goodwood and Salida are attempting a coercive takeover of Dacha and its valuable assets, without paying shareholders the premium they are owed.

DISSIDENT NOMINEES CANNOT BE TRUSTED TO RUN YOUR COMPANY

The rare earth element (REE) business is a highly specialized and complex international market, with no open and transparent exchange supporting REE transactions. The market relies on trusted relationships with professionals who understand the sophisticated chemistry associated with these metals as counterparties contract directly with one another to purchase rare earth elements primarily from specific plants and suppliers who have met stringent pre-qualification. Additionally, the market has high regulatory barriers to entry, with most of its trade being conducted primarily via Chinese state owned enterprises that hold a limited number of export quotas to remove rare earths from the country. Sourcing rare earths in China for inventory is very difficult and requires a combination of chemical expertise, relationships, knowledge and experience that Goodwood, Salida and their director nominees clearly lack.

Your board and management team understands the intricacies of this highly specialized international marketplace and has the proven expertise and experience to maximize shareholder value through investment in REE. Very few individuals in the world can do this type of work and that is the competitive advantage of Dacha’s current management team. Goodwood, Salida and their nominees do not have the experience, expertise or relationships to manage or grow the assets that have been diligently built by Dacha’s highly-experienced management team.

DISSIDENT NOMINEES ARE NOT QUALIFIED TO CREATE YOUR SHAREHOLDER VALUE

Members of the dissident slate have in the past demonstrated self-serving activism, value destruction, and strategic miscues. Unsuccessful investment strategies have left Goodwood and Salida with a limited ability to raise investor funds and with a motivation to instead raid cash rich public companies. We fear that Goodwood, Salida and the other members of the dissident group intend to do the same with Dacha, and seize the value that rightly belongs to our shareholders without paying anything. To advance this goal, Mr. Puccetti, Goodwood’s founder, Chairman and Chief Investment Officer, with the support of Salida, has put forward a slate of connected nominees with no track record in the REE industry, with demonstrated underperformance and who are not necessarily motivated to act in the best interests of the shareholders of Dacha as a whole.

Notably:

Mr. Tye W. Burt was terminated as Chief Executive Officer of Kinross Gold Corp. after presiding over a reported US$2.49 billion loss related to the acquisition of Red Back Mining, the largest single loss in the company’s history.

Mr. Ian W. Delaney has several connections with Goodwood and is reportedly currently barred from entering the United States because of dealings with a dictatorship.

Mr. Peter H. Puccetti is the founder, Chairman and Chief Investment Officer of Goodwood Inc., a Toronto-based hedge fund whose Goodwood Fund A, B, Capital and 2.0 each have negative returns for the three and five year period, underperforming the S&P/TSX composite TRI, which has yielded positive returns for those periods.

Mr. Timothy E. Thorsteinson presided over 97.2% stock price decline as CEO of Enablence Technologies, a former Goodwood portfolio investment.

We do not believe that the members of the dissidents’ slate possess the expertise to lead Dacha into the future and enhance total shareholder value within the dynamic nature of the REE industry.

DISSIDENTS HAVE ACQUIRED SHARES WITHOUT DISCLOSURE

Following a good faith settlement with Goodwood and certain dissident nominees over Longford, Forbes & Manhattan Inc. (“Forbes & Manhattanâ€) was prepared to work constructively with Goodwood for the benefit of all shareholders. Unfortunately, Goodwood put up a false front of cooperation while simultaneously and secretly, along with Salida, acquiring shares of Dacha. Apparently, the dissident group rapidly accumulated a stake of 31.5% without any disclosure of its purchase.

DACHA AND FORBES & MANHATTAN – A TRACK RECORD OF CREATING VALUE

Dacha, a Forbes & Manhattan company, has a history of creating value for shareholders in a volatile market. Dacha has posted a 93% return on sales transactions and a 135% return on investment capital since January 2010, and has done so while aggressively managing SG&A to levels that are comparable with its peers.

Together with Forbes & Manhattan, whose investment model combines industry leading expertise, exceptional capital markets access and the strongest deal flow for resource assets to produce consistently strong returns, Dacha is focused on building on this record to generate incremental value for all shareholders.

Forbes & Manhattan’s active management approach, which mitigates risk through hands-on involvement competitively positions its partner companies through more efficient approaches to general and administrative expenses. Forbes & Manhattan’s strategies significantly decrease costs, such that G&A of those companies are in line with, if not better than, their competitors. The track record shows that by bringing deep, hands-on expertise in geology and mining engineering, capital markets expertise, and by providing portfolio companies with economies of scale, Forbes & Manhattan enables the development of assets that might not have been developed as stand-alone companies with traditional management structures.

YOUR HIGHLY QUALIFIED AND EXPERIENCED MANAGEMENT NOMINEES

Dacha’s highly qualified incumbent director nominees have the necessary skills and knowledge to maximize the rare earth assets that the company currently holds, grow net asset value and drive share price appreciation. In addition, management has nominated for election as a director of Dacha, Mr. Jim Rogers, a commodities investment expert, author and a financial commentator who has been a successful international investor since 1980. Mr. Rogers will be appointed non-executive Chairman following the meeting, replacing Mr. Stan Bharti who will not stand for re-election.

Mr. Rogers has frequently been featured in Time, The Washington Post, The New York Times, Barron’s, Forbes, Fortune, The Wall Street Journal and The Financial Times among others. He has been a regular columnist at WORTH Magazine since 1995, and a regular commentator on CNBC since 1998. Mr. Rogers has written four books on investment, including ‘Investment Biker: On the Road with Jim Rogers’ (1994), ‘Adventure Capitalist: The Ultimate Road Trip’ (2003), ‘Hot Commodities: How Anyone Can Invest Profitably in the World’s Best Market’ (2005) and ‘A Gift to My Children: A Father’s Lessons for Life and Investing’ (2009). Mr. Rogers holds a B.A. in History from Yale University and a B.A. and M.A. in Politics, Economics and Philosophy from Oxford University.

Dacha also plans to nominate Hon. J. Trevor Eyton, David S. Warner and Ken Taylor. The incumbent management nominees are G. Scott Moore, President and Chief Executive Officer; Alastair Neill P.Eng, MBA, Executive Vice President and Director; and General (Ret) Ron Hite, Director.

Dacha encourages shareholders to carefully review its proxy circular and other materials and vote only their BLUE Proxy by no later than Monday, November 26, 2012 at 10:00 a.m. (Toronto time) in advance of the proxy voting deadline. If you have any questions and/or need assistance in voting your shares, please call Kingsdale Shareholder Services at 1-866-229-8263 toll-free in North America, or 1-416-867-2272 outside of North America (collect calls accepted).

Do not let Goodwood and Salida’s representatives take the value that belongs to you! The highly-qualified and experienced Dacha board of directors is completely dedicated to maximizing shareholder value and strengthening the company. We encourage you to vote for management’s nominees and look forward to your support.

“G. Scott Mooreâ€

G. Scott Moore

President and CEO

Dacha Strategic Metals Inc.

About Dacha

Dacha Strategic Metals Inc. is an investment company focused on the acquisition, storage and trading of strategic metals with a primary focus on Rare Earth Elements. Dacha is in the unique position of holding a commercial stockpile of Physical Rare Earth Elements. Its shares are listed on the TSX Venture Exchange under the symbol “DSM” and on the OTCQX exchange under the symbol “DCHAF”.

Except for statements of historical fact relating to the Company, certain information contained herein constitutes “forward-looking information†under Canadian securities legislation. Forward-looking information includes, but is not limited to, statements with respect to the Company’s ability to trade in rare earth elements, the realization value of Dacha’s physical inventory portfolio, proposed investment strategy of the Company, and general investment and market trends. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plansâ€, “expects†or “does not expectâ€, “is expectedâ€, “budgetâ€, “scheduledâ€, “estimatesâ€, “forecastsâ€, “intendsâ€, “anticipates†or “does not anticipateâ€, or “believesâ€, or variations of such words and phrases or statements that certain actions, events or results “mayâ€, “couldâ€, “wouldâ€, “might†or “will be takenâ€, “occur†or “be achievedâ€. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Dacha to be materially different from those expressed or implied by such forward-looking information. Although management of Dacha has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. Dacha does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE