Global Demand and Supply Imbalance Elevate Platinum and Palladium Potential

The demand for platinum and palladium has surged in recent years, driven by expanding automotive, renewable energy, and electronics sectors, creating a bullish outlook for these precious metals. Global supply constraints, largely due to limited mining operations in key locations such as Russia and South Africa, contribute to the volatility in the palladium and platinum markets. With palladium used extensively in catalytic converters for vehicles and platinum playing a pivotal role in hydrogen energy applications, these metals have become essential components in modern industrial growth and the green energy transition.

Recent analysis from industry experts highlights that while platinum’s primary uses are in catalytic converters and electronics, a shift towards hydrogen energy presents new opportunities for long-term growth. According to MoneyWeek, a supply deficit for platinum is predicted to persist into 2024, with demand from hydrogen fuel cell production estimated to grow by 3% annually. Palladium, on the other hand, remains critical for gasoline vehicle production, but constrained by geopolitical challenges, the global market is witnessing a dynamic shift in sourcing strategies.

New Age Metals: Positioning for Strategic Growth in Precious Metals

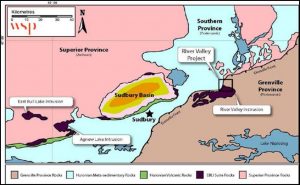

New Age Metals Inc. (NAM) is well-positioned to capitalize on the growing demand for these critical metals. NAM holds 100% ownership of its River Valley Palladium Project, North America’s largest undeveloped primary palladium project, located in Ontario, Canada. The River Valley Project presents significant strategic value, particularly as North America seeks to strengthen domestic supply chains for critical materials and reduce reliance on foreign sources. This impressive project boasts a NI 43-101 resource estimate of 2.25 million ounces of palladium, platinum, and gold in the measured and indicated category, with an additional 1.59 million ounces in inferred resources.

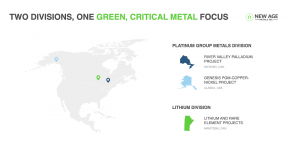

One of NAM’s notable advantages lies in its diversified portfolio of green metals, which includes platinum, palladium, and lithium assets. In addition to the palladium-heavy River Valley Project, NAM also explores lithium through its partnerships with Australia’s fifth-largest lithium producer, further diversifying its portfolio in alignment with evolving market needs. Notably, NAM’s diversification reflects a strategic response to the market’s appetite for clean energy technologies, positioning it as a key player within North America’s emerging battery and green metals ecosystem.

Investments in North American Mining Present New Opportunities

Geopolitical tensions and supply chain challenges have made North American mining assets more attractive to investors. Eric Sprott, a notable Canadian billionaire and resource investor, holds a 24.5% interest in NAM, underscoring confidence in NAM’s potential to meet North American demand for precious metals. NAM’s exploration budget, allocated at $7.3 million for 2023-2024, reflects its commitment to accelerating project timelines. The investment supports NAM’s goal of producing the first comprehensive economic feasibility study for the River Valley Project, further demonstrating its proactive approach to ensuring project success and stability.

Building Towards a Sustainable Future

NAM’s commitment to sustainable mining practices aligns with market demand for responsible sourcing and environmental stewardship. With the River Valley Project located in a stable jurisdiction, NAM benefits from Canada’s stringent environmental standards, which ensure high accountability and minimal ecological impact throughout the extraction process. Additionally, the project’s location in Ontario offers the advantage of proximity to established infrastructure, including road access, water supply, and power, minimizing development costs and facilitating future scalability.

NAM’s forward-thinking approach and carefully planned investments showcase its potential to contribute to a more sustainable and secure North American supply chain. Its lithium partnerships and diverse commodity focus align with key green energy markets, setting the stage for steady growth amidst rising global demand.

Future Outlook for Investors

As industries and governments worldwide prioritize critical metals for both economic growth and sustainability, New Age Metals stands out as a strategic investment in palladium and platinum. The company’s well-advanced River Valley Project, backed by industry experts reinforces its potential to lead North America’s palladium supply, addressing both current and future market demands.

Source: https://moneyweek.com/investments/silver-and-other-precious-metals/will-platinum-and-palladium-rise

YOUR NEXT STEPS

Visit $NAM HUB On AGORACOM: https://agoracom.com/ir/NewAgeMetals

Visit $NAM 5 Minute Research Profile On AGORACOM: https://agoracom.com/ir/NewAgeMetals/profile

Visit $NAM Official Verified Discussion Forum On AGORACOM:

https://agoracom.com/ir/NewAgeMetals/forums/discussion

Watch $NAM Videos On AGORACOM YouTube Channel:

https://www.youtube.com/playlist?list=PLfL457LW0vdLbNGQy7XX-5_B8l0kYTajA

DISCLAIMER AND DISCLOSURE

This record is published on behalf of the featured company or companies mentioned (Collectively “Clients”), which are paid clients of Agora Internet Relations Corp or AGORACOM Investor Relations Corp. (Collectively “AGORACOM”)

AGORACOM.com is a platform. AGORACOM is an online marketing agency that is compensated by public companies to provide online marketing, branding and awareness through Advertising in the form of content on AGORACOM.com, its related websites (smallcapepicenter.com; smallcappodcast.com; smallcapagora.com) and all of their social media sites (Collectively “AGORACOM Network”) . As such please assume any of the companies mentioned above have paid for the creation, publication & dissemination of this article / post.

You understand that AGORACOM receives either monetary or securities compensation for our services, including creating, publishing and distributing content on behalf of Clients, which includes but is not limited to articles, press releases, videos, interview transcripts, industry bulletins, reports, GIFs, JPEGs, (Collectively “Records”) and other records by or on behalf of clients. Although AGORACOM compensation is not tied to the sale or appreciation of any securities, we stand to benefit from any volume or stock appreciation of our Clients. In exchange for publishing services rendered by AGORACOM on behalf of Clients, AGORACOM receives annual cash and/or securities compensation of typically up to $125,000.

Facts relied upon by AGORACOM are generally provided by clients or gathered by AGORACOM from other public sources including press releases, SEDAR and/or EDGAR filings, website, powerpoint presentations. These facts may be in error and if so, Records created by AGORACOM may be materially different. In our video interviews or video content, opinions are those of our guests or interviewees and do not necessarily reflect the opinion of AGORACOM.