By: Matthew Leising

-

Test of tracking equity swaps with blockchain deemed a success

-

Firms including Goldman Sachs, JPMorgan did a six-month trial

The program, managed by blockchain startup Axoni, kept track of the swaps contracts after they were executed, recording things like amendments or termination of the deals, stock splits and dividends, and achieved a “100 percent success rate,†Axoni said in a statement Monday. Other participants include the Canada Pension Plan Investment Board, Citigroup Inc., BNP Paribas SA and Credit Suisse Group AG.

“We’re on a path to take this forward,†Axoni Chief Executive Officer Greg Schvey said in an interview. “We know the thing works now.â€

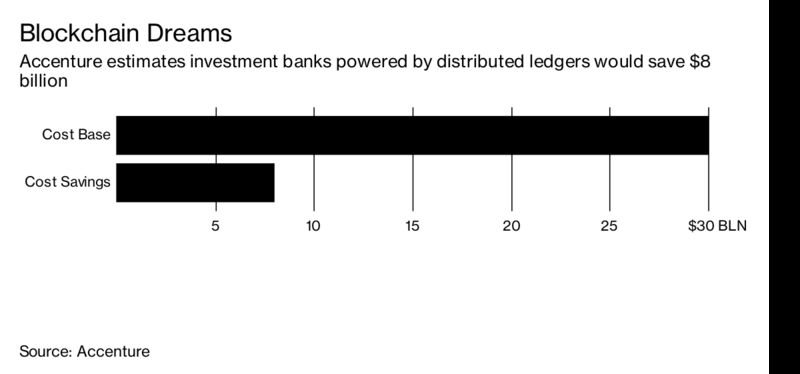

Blockchain software has captivated Wall Street because it could vastly reduce the cost of back-office operations and speed up trade clearing and settlement times. Banks have to set aside capital while they wait for transactions to be settled, so billions of dollars could be freed up for other uses if trade times go down to minutes from days or even weeks.

Axoni is far from alone in offering banks the ability to experiment with blockchain. Its competitors include Digital Asset Holdings, Symbiont, R3 and Chain.

Read More: All About Bitcoin, Blockchain and Their Crypto World

A blockchain system for equity swaps works to speed transaction times because the banks and asset managers all become members of a network that shares a so-called distributed ledger. Each member has an up-to-date copy of the ledger, so when payments need to go from one participant to another they can be processed almost in real time.

“Fewer valuation disputes, less reconciliation and real-time access to data would benefit all of the industry,†Adam Herrmann, global head of prime finance at Citigroup, said in the statement.

Smart Contracts

The program was all done in a test environment with no real trades being processed by Axoni’s AxCore blockchain software. No money changed hands either; the plan is that current systems like Fedwire or Swift will be used if the program goes live, Schvey said. He declined to say when blockchain for the equity swaps market will be done for real.

A similar test to move parts of the credit-default swap market onto a blockchain for post-trade processing uses the same system as in the equity-swaps model, Schvey said. AxCore uses smart contracts, the heart of the ethereum blockchain network, with a few tweaks.

“It looks and feels a lot like ethereum, but with a lot of differences,†such as changes to enhance scalability, privacy and security, Schvey said.

Source: https://www.bloomberg.com/news/articles/2017-11-20/blockchain-gets-a-wall-street-win-we-know-the-thing-works-now

Tags: 360 Blockchain Inc., Hive Blockchain Technologies Ltd.