SPONSOR: Tartisan Nickel (TN:CSE) Kenbridge Property has a measured and indicated resource of 7.14 million tonnes at 0.62% nickel, 0.33% copper. Tartisan also has interests in Peru, including a 20 percent equity stake in Eloro Resources and 2 percent NSR in their La Victoria property. Click her for more information

—————————-

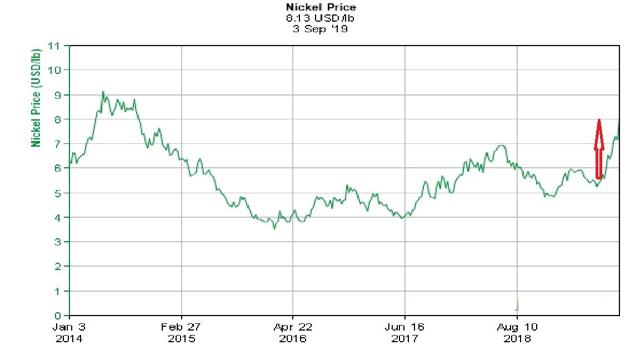

Nickel Is Hot Right Now – The Nickel Boom May Have Just Begun

- Indonesia announced they will ban nickel ore exports beginning 2020.

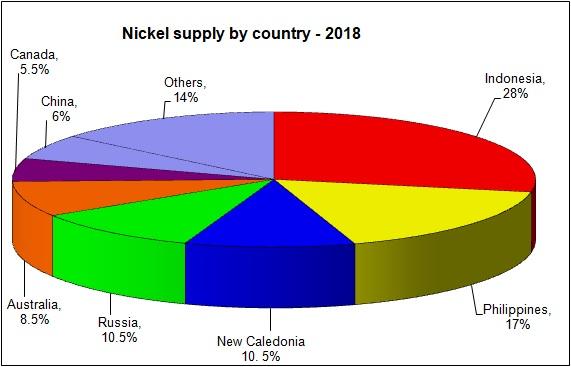

- Indonesia currently accounts for about 27-28% of global nickel ore supply.

- Other sources of nickel supply appear somewhat constrained, while demand for nickel looks strong, especially boosted by EVs.

Nov. 5, 2019

By: Matt Bohlsen

Indonesia has declared that they will ban nickel ore exports as of January 1st, 2020 (previously scheduled for 2022). However, on Monday, September 2, 2019, Indonesia’s Energy and Mineral Resources Ministry confirmed plans to move the ban up and place it ahead of schedule. Indonesia currently accounts for about 27-28% of global nickel ore supply. Nickel prices surged higher on the news.

Source: InfoMine

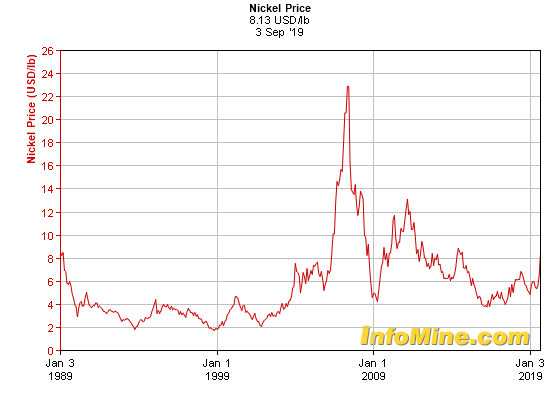

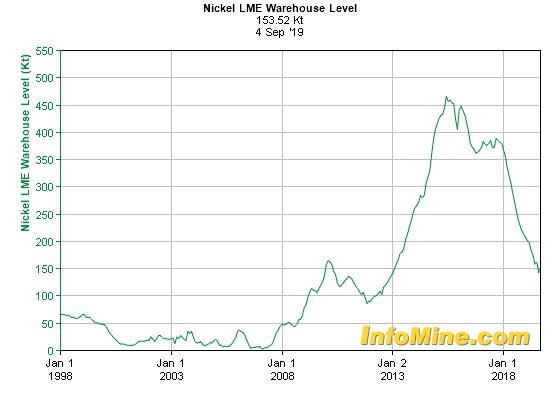

The 2007/08 nickel spike coincided with record low LME nickel inventory levels (see chart below) and a China construction boom. Today, LME nickel inventory is at 153,000 tonnes and has been falling steadily for some time now. The Indonesia export ban could easily send nickel inventories back below 50,000 tonnes in 2020 and cause another huge nickel price spike.

Nickel 30-year price chart

Source: InfoMine

LME nickel inventory levels are heading to lows not seen in a decade

Source: InfoMine

Indonesia’s Coal and Minerals Director General Bambang Gatot Ariyono stated: “The government decided, after weighing all the pros and cons, that we want to expedite smelter building. So we took the initiative to stop exports of nickel ores of all quality.â€

Indonesia will soon have 36 smelters, and if exports were to continue, there would have been only enough reserves for seven to eight years. These smelters can process low-grade nickel ores and they can be used for batteries to help Indonesia meet its electric-vehicle goals. Bambang continued: “We already exported 38 million tons up until July this year. At this rate, we would need to think about our reserves especially if we keep issuing exports permits.â€

Put simply, Indonesia has long wanted to encourage investments within Indonesia that can value-add to their nickel ore. The end game would be for Indonesia to be able to produce their own finished nickel, stainless steel, and lithium-ion batteries (NMC batteries require plenty of nickel).

Last month Reuters reported:

“Indonesia currently has 13 operating nickel smelters with input capacity of 24.52 million tonnes. Government data showed that 22 more nickel miners are currently under development with additional capacity of 46.33 million tonnes. Lengkey said the installed capacity will not be enough to process the country’s ore output.”

Nickel supply by country

Source: Own chart with data sourced from Investing News

Other sources of nickel supply

The Philippines is the number two global nickel supplier. No doubt Philippine nickel miners will try to boost ore production next year when the Indonesia export ban kicks in. The Philippines has 29 nickel mines and two nickel processing plants. However, strict environmental law changes in the Philippines in recent years have reduced their nickel supply. Also, it is said that many Chinese buyers prefer higher-grade ores from Indonesia. Current Philippine nickel ore production has dropped to about 340,000 tonnes in 2018 due to the closure of 23 mines as the government seeks to curb environmental damage from mines in the Philippines.

Perhaps the boost will come from New Caledonia, Russia, Australia, Canada, China and some contributions from the new Indonesian smelters. But will this be enough?

Overall, it appears for now that very large new sources of nickel supply appear somewhat constrained, especially given the Philippines recent focus on environmental protection and nickel mine closures.

Nickel demand looks set to increase boosted by electric vehicles

All experts agree that demand for nickel sulphate is set to go through the roof as electric vehicles [EVs] take off. Fastmarkets stated last year:

“Demand for nickel in the EV space is expected to total 36,000 tonnes in 2018… That figure is expected to surge to 350,000-500,000 tonnes by 2025.â€

That’s more than a tenfold increase, in just 7 years. Wow!

The best source of nickel sulphate will come from the nickel sulphide miners.

No doubt new sources of nickel will start to fill the supply gap that Indonesia will leave, but this takes time. Indonesia will also step up their processing of ores, but this will take several years to raise capital and then build out the processing plants. Many companies that halted nickel sales due to the recent bear market years for base metals will start to come back online, as will new nickel projects assuming the nickel price stays strong. Will we see nickel over USD 10/lb in 2020? Yes, I would say this is very possible, as with most severe supply disruptions, the industry usually takes a couple of years to catch up.

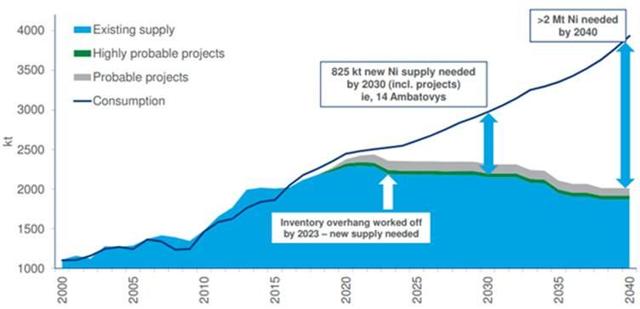

The chart below shows nickel is forecast to be in deficit after ~2020-2022 (and this was before factoring in the Indonesia ban).

Source: Wood Mackenzie

Nickel Companies to consider

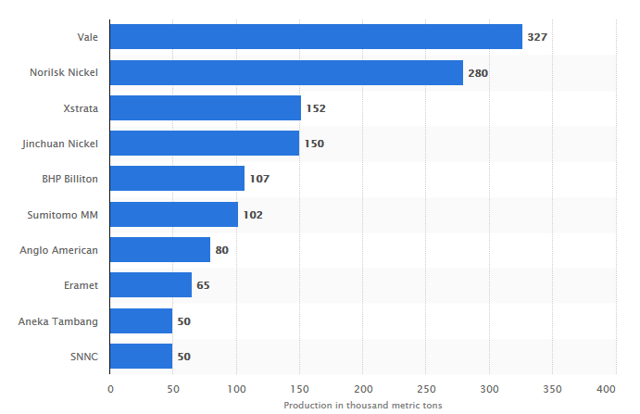

The top global nickel producers by nickel production volume are Vale [BZ: VALE3](NYSE:VALE), Norilsk Nickel [LSX: MNOD] (OTCPK:NILSY), Jinchuan International Group Resources [HK:2362], Glencore (OTCPK:GLCNF)[LSX:GLEN], and BHP Group [ASX:BHP] (NYSE:BHP). Good smaller producers include Independence Group [ASX:IGO] (OTC:IIDDY) and Western Areas [ASX:WSA](OTCPK:WNARF). Some top nickel developers with very large resources include RNC Minerals [TSX:RNX] (OTCQX:RNKLF), Ardea Resources [ASX:ARL] (OTCPK:ARRRF), and Australian Mines [ASX:AUZ].

Rather than repeat information from my other recent nickel articles here, I refer to the further reading section below that gives plenty of company information.

Forecast leading companies based on finished nickel production worldwide in 2020 (in 1,000 metric tons)

Source: Statista

Note: Glencore took over Xstrata’s nickel assets.

Risks

- A China or global slowdown could reduce demand for nickel. China and the stainless steel industry are by far the largest consumers of nickel.

- Nickel prices falling. Indonesia may reverse their decision, or other countries may bring on excess new supply. Also, the new Indonesian smelters once running will be a new source of nickel supply from Indonesian nickel ore. Noting Indonesia already has 13 operating smelters.

Further Reading

- Nickel Monthly News For The Month Of August 2019

- Top 5 Nickel Producers And Other Smaller Producers To Consider

- Top 5 Nickel Sulphide Miners To Consider

Conclusion

This article is for the purpose of alerting Trend Investing members that the nickel boom may have just begun. Certainly all the signs are there.

The further reading section above gives plenty of good information on the better nickel plays. My standout nickel miner continues to be Norilsk Nickel due to their massive (sulphide) resources, very low cost of production when taking into account by-products (palladium, copper), low valuation (2020 PE of 8.3), and high dividend yield (2020 estimate 10.9%). Vale offers some attraction right now after recent price falls, but is mostly an iron ore miner. My top nickel developers are RNC Minerals, Ardea Resources, and Australian Mines.

Source: https://seekingalpha.com/article/4302579-nickel-hot-right-now-nickel-boom-may-just-begun