SPONSOR: New Age Metals Inc. The company owns one of North America’s largest primary platinum group metals deposit in Sudbury, Canada. Updated NI 43-101 Mineral Resource Estimate 2,867,000 PdEq Measured and Indicated Ounces, with an additional 1,059,000 PdEq Ounces Inferred. Learn More.

Summary

- The palladium market will remain tight and pressure prices higher.

- Sibanye Gold with the Stillwater Mine has plunged back into SA.

- The Aberdene palladium ETF and Canadian palladium juniors are the best proxies.

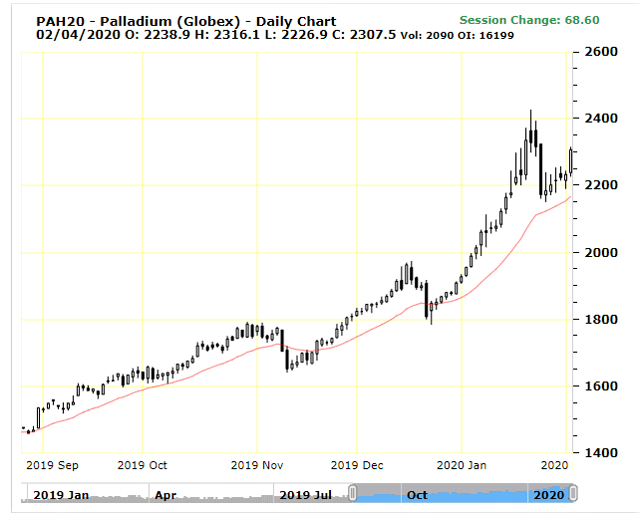

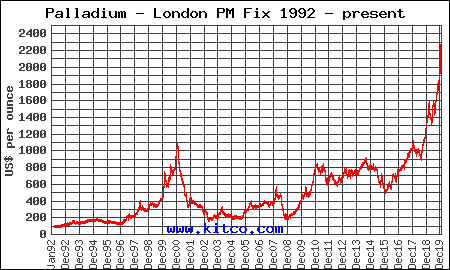

Palladium has been the best performing commodity in the past two years or so, jumping over 100% and there is more to go. This palladium bull market is much different than the last one. The bull market from 1997 to 2000 was about 3 years and then palladium dropped giving up most of the gains in less than a year. There was a nice bump up from the 2008 crisis and then the price traded sideways for several years. The price bottomed at the end of 2015 with the severe bear market in precious metals. Since then, the price has been going steadily higher with a major break out in 2016. This bull market is not going to end anytime soon for the reasons below.

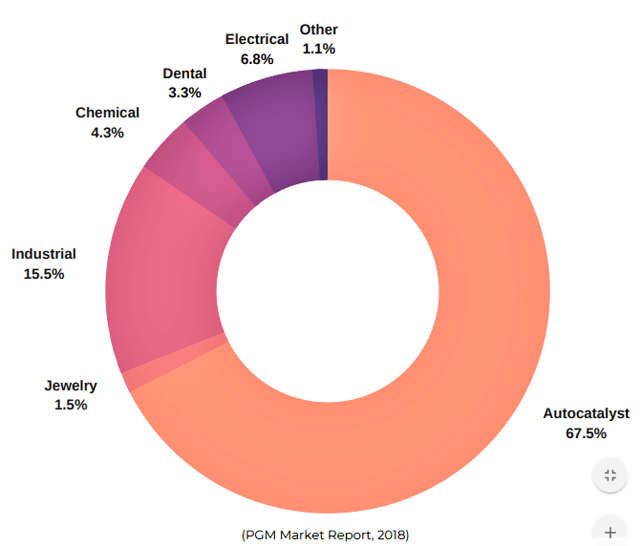

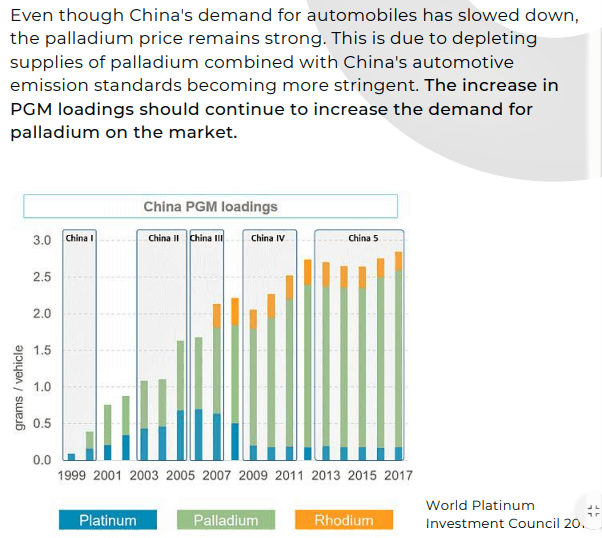

Palladium is mostly used in the auto industry for pollution control with catalytic converters. Electric vehicles will be a long time coming to replace any significant amount of gasoline/diesel driven vehicles. Meanwhile, pollution standards are being tightened that will keep demand high. China has been gobbling up palladium since their China 5 pollution standards took effect in 2013. China 6 will now be coming into effect that will increase loads per vehicle of palladium. Many analysts have been commenting that China has been secretly stock piling the metal and is driving prices.

Palladium demand by Sector

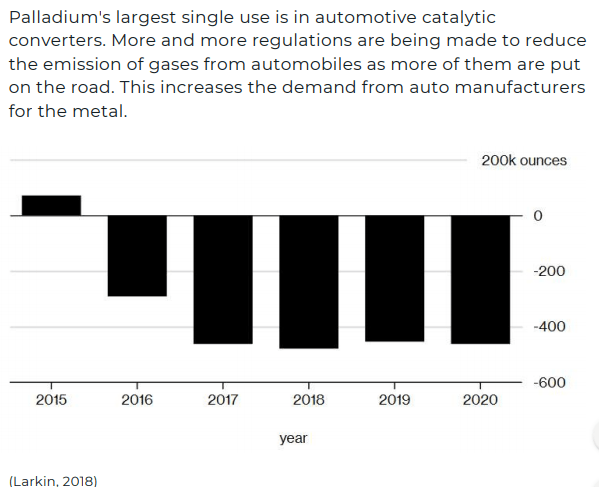

There is no doubt the demand will remain strong, but the real story is on the supply side. This next graphic illustrates the supply deficit since 2016.

It is obvious to expect an increased demand from China as pollution regulations are tightened with ‘China 6’.

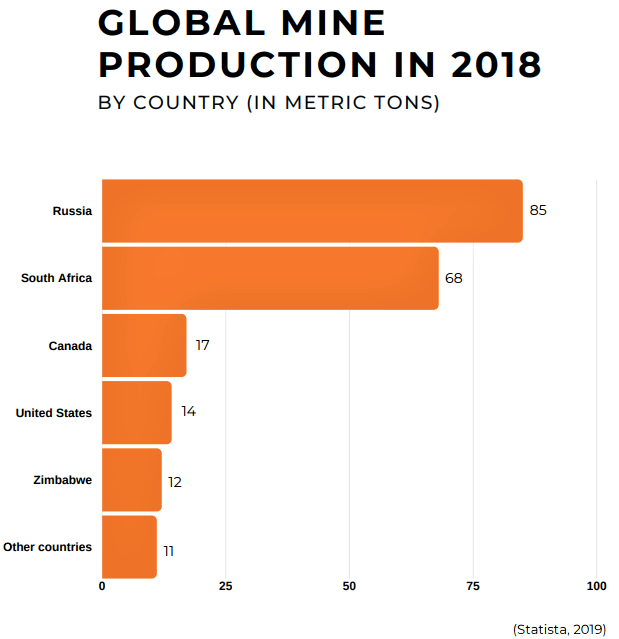

This next graphic of global mine production is very important because of the palladium supply is in a very unstable region.

The Russian supply from Norilsk Nickel has always been quite stable and is of no concern, but as investors, we cannot participate there. South Africa is the other big producer and that country is becoming very unstable and more worrisome, that is where most of the future reserves are.

The world’s largest PMG reserves are in South Africa, precisely in the Bushveld Complex (in the central-Northern part of the country) which alone accounts for about 50% of the world’s palladium resources, but, overall, South Africa has reserves of 63 million kilograms which represent over 91% of the worldwide availability.

South African (SA) mines have always been plagued with labour issues, strikes, and high costs. To make matters worse, the country is now facing an energy crisis with rolling blackouts shutting down mines. The country will probably become much more unstable, with unemployment hitting 10-year highs. Half of their youth are unemployed and the company that provides 95% of the electricity (when it can) is reporting record financial losses. This is a country teetering on the brink of chaos that will likely be very disruptive to PGM mine supply. I am avoiding palladium and platinum investments there.

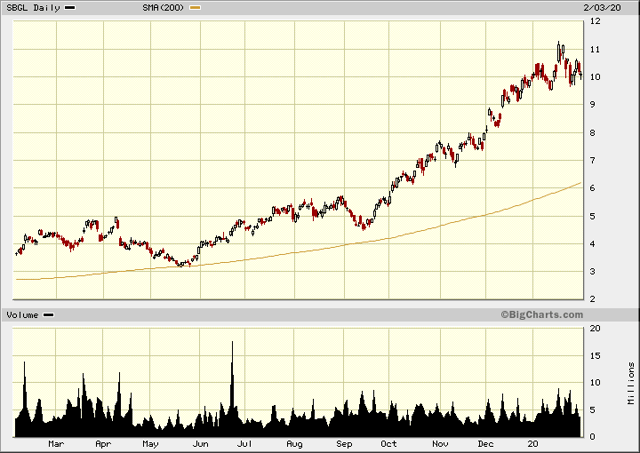

With all the issues in SA, Sibanye Gold (SBGL) began diversifying out of the country and acquired the Stillwater PGM mine in the US. That use to be my favourite stock to play palladium bull markets. However, they jumped right back into the fray, acquiring Lonmin in 2019, a struggling SA, PGM producer. They promptly cut 5,000 jobs at the mine and it now appears Sibanye is moving more into PGMs from gold. According to what was released in the acquisition news, Sibanye PGM production will increase from around 1.7M ounces per year to 2.8M ounces/year. This compares to about 600,000 ounces/year at the US Stillwater complex plus about 700,000 ounces produced through the recycling unit, noted from the 2018 annual report.

Sibanye is now predominantly a SA PGM and gold producer. In their H1 2019 production update ending June 2019:

- SA PGM production was 627,991 ounces (this will increase significantly with Lonmin acquisition)

- SA gold production was 344,752 ounces (this amount is well below normal because of mine strike)

- US PGM production was 284,773 ounces

- US PGM recycling was 421,450 ounces

The stock has done well with the rising palladium price, but at these stock prices and the move back to SA, it has become too risky. I would suggest selling at these prices.

To highlight risks further, the Q1 2019 financial report highlights a -63% decline in SA gold production in Q1 2019 compared to Q1 201 because of the labour strike. This news out on February 2nd states that 19 attacks on SA gold facilities nearly doubled from last year. On December 15, 2019, attackers took hostages and plundered the smelting plant at Gold Fields Ltd.‘s South Deep mine. “Mining companies are being attacked by thugs and armed gangs and there is a lack of police response,” said Neal Froneman, CEO of Sibanye Gold Ltd., which repelled an attack on its Cooke mine two weeks ago. “It eventually has a knock-on impact into society, it’s lawlessness, it’s anarchy.”

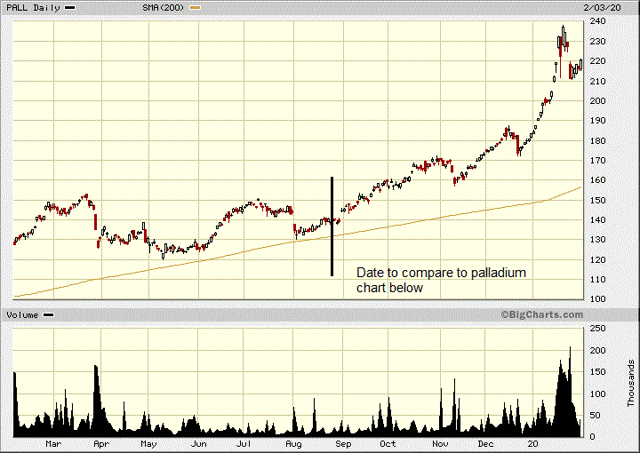

There is the Aberdeen Standard Physical Palladium ETF Trust (PALL). The investment objective of the Trust is for the Shares to reflect the performance of the price of palladium, less the expenses of the Trust’s operations. The ETF Trust physically holds palladium in JPMorgan vaults in London and Zurich. PALL tracks the movements in palladium spot prices fairly well and is the best direct exposure to palladium. Aberdeen purchased the fund effective October 1, 2018, from ETF Securities. The Aberdeen website is terrible, it just diverts you to something else they are trying to sell. You can find some more info at etf.com.

One disadvantage, as a Trust it will often trade at a discount to NAV, so short term may not always reflect palladium movements precisely.

The chart of PALL reveals quite a jump in volume on the last rally. I do not find this alarming, but shows it is really the first time the palladium market has caught retail interest.

If we compare to the short-term chart on palladium below, it is easy to see that PALL has tracked the palladium price very well. After a needed correction, the price jumped higher on Monday. This is probably a start to the next rally.

There is also Sprott Physical Platinum and Palladium Trust (SPPP), but it is split 50/50 between the two metals.

Canada is the third-largest producing country, so an obvious place to look. A lot of the palladium production comes from major miners in the Sudbury nickel/copper complex as a byproduct. Obviously, this is a good area to look and there was an excellent proxy for investors called North American Palladium that was operating the Lac Des Isles palladium mine. Unfortunately, for us, investors, it was bought out last year by SA producer Implats. The area had a number of discoveries back in the last bull market around the year 2000, and I visited a number of those projects back then. I believe the best one in this area is Canadian Palladium that acquired the East Bull project last year. There is also Palladium One that is not Canada but not in SA either.

Palladium One Mining (OTC:NKORF) – PGM project is in Finland.

Shares outstanding 111 million, 185 million fully diluted

Their LK project is located in north-central Finland, approximately 40 km north of the company’s exploration office in the town of Taivalkoski. The property is 160 km (by road) east-southeast of Rovaniemi and 190 km northeast of the port city of Oulu. Finland is a very stable jurisdiction and has a viable mining sector.

The company is run by CEO/President, Derrick Weyrauch, CPA, CA who is an experienced mining executive and corporate director. Mr. Weyrauch’s background includes finance, risk management, corporate restructuring and turnarounds, coupled with M&A strategy development, execution and post transaction integration. He is the co-founder of Magna Mining Corp. and is a former corporate director of a number of companies including Eco Oro Minerals Corp., Jaguar Mining Inc., and Banro Corp. and is a former CFO of Jaguar Mining Inc. and Andina Minerals Inc. Currently, he is a non-executive director and at Cabral Gold Inc.

The LK Project is 100% owned by Palladium One Mining Inc.

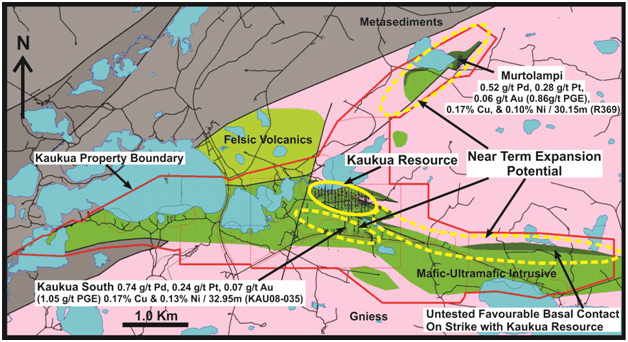

Palladium One released a mineral resource estimate for the Kaukua deposit within the 100-per-cent-owned Lantinen Koillismaa (LK) project.

Highlights:

- An optimized pit-constrained mineral resource, at a 0.3-g/t palladium cut-off;

- 635,600 PdEq (palladium equivalent) ounces of indicated resources grading 1.80 g/t PdEq contained in 11 million tonnes;

- 525,800 PdEq ounces of inferred resources grading 1.50 g/t PdEq contained in 11 million tonnes.

Neil Pettigrew, VP, exploration, commented:

Significant potential exists to expand the historic Haukiaho deposit along strike both to the east and west. For example, 1960s-era historic drilling by Outokumpu about two km east of the historic 2013 Haukiaho inferred resource returned up to 36.36 m grading 0.20 per cent Cu and 0.19 per cent Ni from 1.64 m to 38.00 m downhole in hole R692 (no PGE analysis was conducted). Reconnaissance prospecting by Palladium One in the vicinity of this historic drill hole returned up to 0.51 per cent Cu, 0.33 per cent Ni, 0.19 g/t Pt, 0.56 g/t Pd and 0.21 g/t Au (0.96 g/t PGE) (see press release dated Aug. 12, 2019). Palladium one recently applied for the Haukiaho East reservation (see press release date Sept. 5, 2019), which, if approved, the company would control about 24 km of the favourable Haukiaho basal contact.”

The company plans to conduct a 75-line-kilometre induced polarization (IP) geophysical program, along with a diamond drilling program of up to 5,000 metres, at the LK project. Both drilling and geophysics contractor are expected to be mandated soon.

The Tyko Ni-Cu-PGE project, i65km northeast of Marathon Ontario, Canada.

The Tyko project is an early stage, high sulphide tenor, nickel focused project with recent drill hole intercepts returning up to 1.06 Ni over 6.22 m including 4.71% Ni over 0.87m in hole TK-16-010 (see press release dated June 8, 2016). On January 21, 2019, Palladium One reported prospecting samples with assay results of up to 0.74% Ni, 4.09% Cu, and 2.51g/t PGE on the Tyko Nickel-Copper-PGE Property. This project has some palladium, but if it is developed to a resource, it will be more like the Sudbury copper and nickel mines with PGMs as a byproduct.

The company is well financed, closing a C$3,786,180 private placement at C$0.06 per unit issuing 63,102,999 units. Eric Sprott took down 20,000,000 units. While funding is required, this is quite a bit of dilution.

Currently, the stock is priced around $0.18 so all the warrants and options are well in the money. So is appropriate to use the fully diluted shares outstanding for valuation.

Market cap – $20 million. Market cap fully diluted Cdn $33.3 million

Subtracting $3.8 million financing from the market cap, it values their 635,600 PdEq indicated resource at C$25 per ounce and fully diluted at C$46 per ounce. This is a quite low valuation.

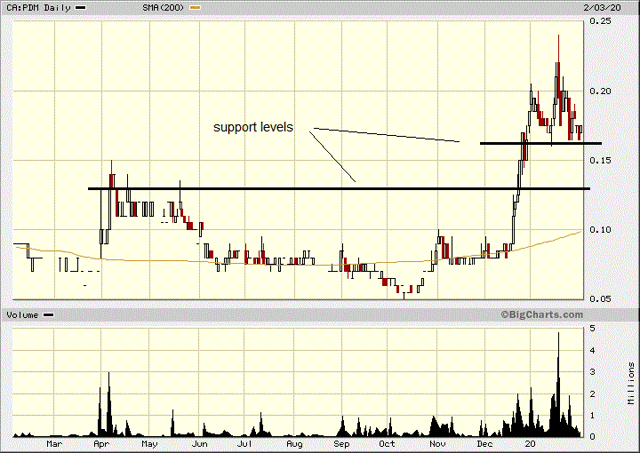

The stock mostly trades on the TSXV symbol (PDM), so I used the C$ chart. Support is around 16 cents and 12.5 cents. If 16 cents holds, the stock could begin a leg higher.

Canadian Palladium

Shares outstanding 100.3 million approx.

All warrants and options are at 30 cents and higher.

What I consider one of the most important highlights is the company is run by Wayne Tisdale. In the last 10 years, he has advanced three juniors and sold them for large profits for their shareholders. He helped start and finance the Rainy River project which was sold to NewGold in 2013 for $310 million. He developed US Cobalt and, in 2018, sold it to First Cobalt in a transaction worth $150 million to his shareholders’ delight. Going back further, he helped finance oil & gas company Ryland Oil that was bought out by Crescent Point in 2010 for a $121.8 million valuation. Mr. Tisdale has a keen eye to find projects that can quickly be advanced further to make them prime acquisition targets. Canadian Palladium only has a market value now of about C$20 million, and I have little doubt that Mr. Tisdale is going to do it again with Canadian Palladium.

Highlights:

- Company run by Wayne Tisdale

- Low market valuation – C$31 per ounce

- East Bull with 43-101, 523,000 inferred palladium equivalent resource

- East Bull can open to depth and along strike

- Widely spaced drilling only needs infill drilling to upgrade and expand resource

- Close to Sudbury complex where ore can be processed

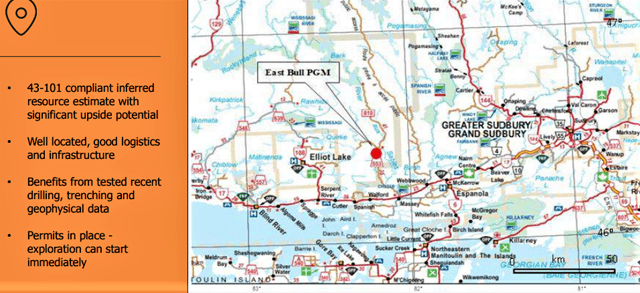

Projects – East Bull, Ontario Canada

East Bull was drilled by Freewest and Mustang Minerals back in the 2000 era and now has a 43-101, 523,000 ounces inferred palladium equivalent resource. A private company, Pavey Ark Minerals had the property and in 2017 they twinned old drill holes and completed the work to bring the project to 43-101 standards. Canadian Palladium (formerly 21C Metals) acquired a 100% option on the project last February.

This graphic from their presentation is a good summary and shows the location

In the 1999, 2000 period, Freewest drilled 27 holes for a total of 2,902 meters and carried out extensive surface trenching. Work by Mustang on the eastern part of the Property (claim 1227910) included 11 drill holes for a total of 1,766 meters. The work by Freewest and Mustang forms the majority of the data for the current resource estimate. Additionally, Pavey Ark reviewed and re-sampled drill core from the 27 BQ and NQ holes from the Freewest drilling program. Pavey Ark’s exploration results in 2017 included;

- hole EB17-01 that intersected 12.0 m at 2.87 g/t PGM+Au, 0.23% Cu and 0.13% Ni and

- hole EB17-03 that intersected 7.0 m of 3.21 g/t PGM+Au, 0.16% Cu and 0.07% Ni.

(Note: Au = gold, Cu = copper, and Ni = nickel.)

In 2019, BULL completed their initial exploration program at East Bull and reported results Sept. 17, 2019. These are highlights from the first sampling program on the East Bull palladium project and field program on the Agnew Lake project:

- Seventy-three grab samples were selected to help identify the palladium-bearing rock types of the mineralized trend. Grab samples are used to determine the presence mineralization and may not be indicative of the overall grade of the zone

- Sampling successfully defined locations for channel sampling and the higher grades could indicate potential zones within the mineralized zone for higher-grade starter pits

- Range of palladium assay sample results were 37 samples below 0.1 g/t palladium, 17 between 0.1 and 0.5 g/t with 14 above 1 g/t. Nine of these ran between 2 and 6.5 g/t

- Geological mapping and review of the Freewest diamond drilling in 2000, indicates the northeast-trending faults are composed of multiple intrusions of mafic to diabase dikes. Left lateral movement on the dikes is measured to be up to 100 metres

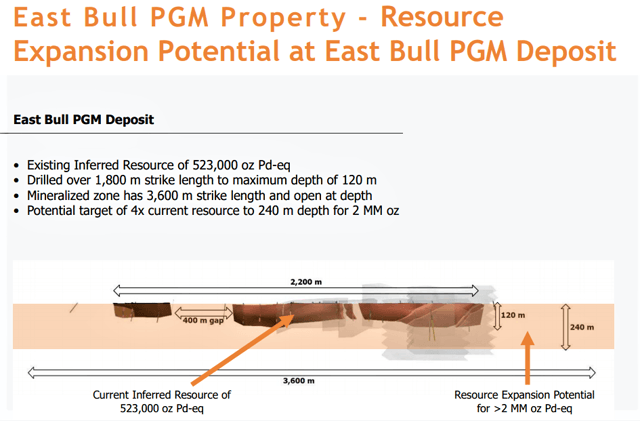

This graphic gives a good snapshot of the current resource and expansion potential. Mineralization starts at surface and the system appears to be about 30 meters wide. This would be an open-pit operation.

Agnew Lake property

It is located 80 kms. west of Sudbury, Ont., home of Glencore and Vale’s Canadian nickel-copper-platinum-group-elements mining and smelting operations. The Agnew Lake property comprises over 260 claims (about 6,000 hectares) and is part of the larger East Bull Lake-Agnew Lake mafic-ultramafic complex.

The Agnew Lake magmas have major element compositions that are very similar to the model parent liquids proposed for the mafic portions of the Stillwater and Bushveld complexes. The Agnew intrusion and the East Bull Lake intrusion are also considered to host significant PGE-Cu-Ni mineralization in marginal rock units (Peck & James, 1990; Peck et al., 1993a, 1993b, 1995; Vogel et al., 1997).

Financial/Summary

Last financial statements show just over $400,000 cash. The company just closed a $4 million financing at 12 cents per share. Eric Sprott bought 12.5 million shares of that financing.

Wayne Tisdale has been successful in financing and increasing the value of properties and dealing them off for large profits. I believe he will do it again and also has a loyal following of shareholders from his past success. BULL just acquired the property last year and there has been little exploration and no drilling so it has been under the radar until the recent financing. The discovery is on the surface, so will be cheap to mine and is close to the Sudbury complex where refiners can recover PGMs. There is a couple other palladium exploration plays in Canada, but they are mostly old stale stories and I believe none have the short-term potential that the East Bull project has.

The current market cap is $20.1 Million less the $4 million financing gives an enterprise value of C$31 per ounce on their 523,000-ounce Pd-eq inferred resource. Part of the reason for the low value is the resource is only inferred. If drilling success starts to prove larger potential and the resource moves up to the measured and indicated category it could easily increase the value potential.

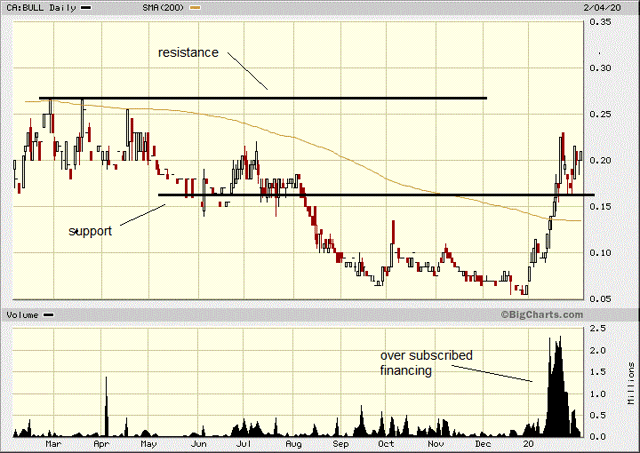

Only exploration news last year was sample results that came out last September just when the junior market started heading south. The stock made a decent move higher than just drifted lower until a typical year-end bottom. The stock took off when it hit 12 cents on good volume. This is when they began marketing a financing that was way oversubscribed in one day. Probably spill over buying drove the stock up to the 23-cent level. The stock then came back to support around 16 cents and bounced off higher. Drill news will likely cause the next move higher with the old highs around 27 cents last year as the first major resistance.

Conclusion

A recent update on palladium by TD Securities highlights tightening emission controls and South Africa as I have, but most interesting is the lack of speculative trading positions. TD comments positions held by traders are below average. This rally has room to move and if excessive speculation builds it could go way higher.

Regardless of whether palladium is $1,200 or $2,400 per ounce, palladium discoveries and deposits will be worth premium valuations, especially in stable jurisdictions. The potential for discoveries in South Africa is very good but the political risks are rising. Ivanhoe Mines (OTCQX:IVPAF), Eastplats, and Platinum Group Metals (PLG) have projects in SA, and if I had to pick one there, it would be Platinum Group Metals because they have the most leverage to platinum and palladium prices.

The best direct related investment to palladium is the PALL ETF, but it does not offer any leverage. There are not any 2 times or 3 times palladium ETFs. This leaves the best leverage to junior palladium companies and there are few. I prefer those outside of SA like Canadian Palladium and Palladium One. I prefer Canadian Palladium because of the CEO’s track record, their resource is on surface, near PGM smelters and likely cheaper exploration costs in Canada vs Finland. For diversification, owning more than one palladium play is not a bad idea.

Disclosure: I am/we are long DCNNF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Canadian Palladium is a paid advertiser at affiliate playstocks.net

SOURCE: https://seekingalpha.com/article/4322038-palladium-is-soaring-and-offers-investment-opportunities

Tags: clean energy, CSE, palladium, PGM, PGM Demand, stocks, tsx