SPONSOR: Labrador Gold – Two successful gold explorers lead the way in the Labrador gold rush targeting the under-explored gold potential of the province. Exploration has already outlined district scale gold on two projects, including a 40km strike length of the Florence Lake greenstone belt, one of two greenstone belts covered by the Hopedale Project. Recently acquired 14km of the potential extension of the new discovery by New Found Gold’s Queensway project to the south. Click Here for More Info

- Small gold bars and coins are in high demand from consumers

- The size of different products is a key reason for the crunch

Surging demand and disruptions from the coronavirus pandemic have created a shortage of the small gold bars most popular with consumers.

When people are worried about the future they turn to gold to protect their savings. That’s rarely been more true than today.

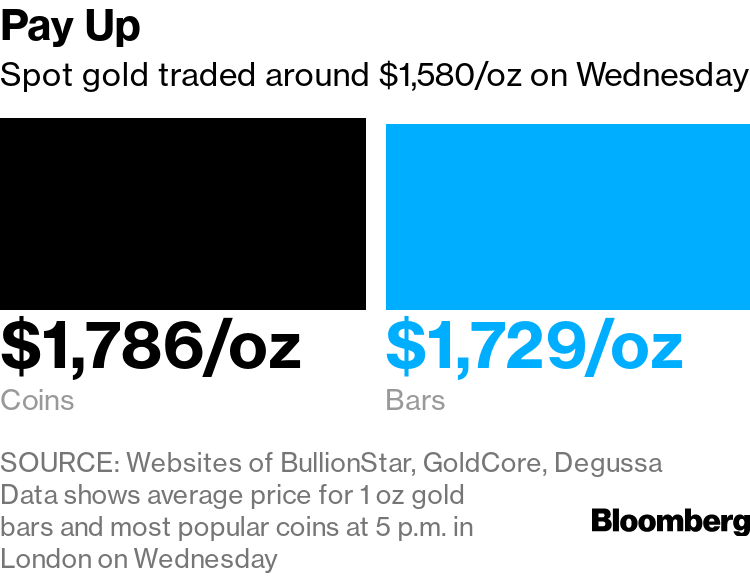

Surging demand and disruptions from the coronavirus pandemic have created a shortage of the small gold bars most popular with consumers. Those who do manage to get their hands on metal have to pay up –- well above the per-ounce prices being quoted on financial markets in London and New York.

Some dealers are desperately contacting clients to see if anyone is willing to sell their gold bars and coins, and offering a rare premium over spot prices. Others have given up trying to trade altogether.

“People want to buy, not to sell gold,†said Mark O’Byrne, the founder of GoldCore, a dealer based in Dublin. “We have a buyers’ waiting list and we emailed our clients seeing who wished to sell their gold. At this time there is roughly only one or two sellers for every 99 buyers.â€

Size is a key reason for the crunch. While there’s plenty of gold in a big trading hub like London, banks and other institutional investors there typically use large bars of 400 ounces. That’s not practical for a regular person who may not want to cough up more than $600,000 for a single bar. Instead, retail investors prefer kilobars (about 32 ounces), 1-ounce bars and coins, or something even smaller.

Those smaller items are getting hard to find for several reasons. First, of course, demand has exploded. But there’s also been pressure on supply, as global travel shuts down and some refineries and mints have stopped operating or capped production because of local lockdowns.

Premiums in the retail market “have exploded,†said Markus Krall, chief executive of German precious-metals retailer Degussa. The average price of products in shops is somewhere between 10% and 15% over spot prices, which he’s never seen before, Krall said. Demand, too, is at the highest level he’s experienced.

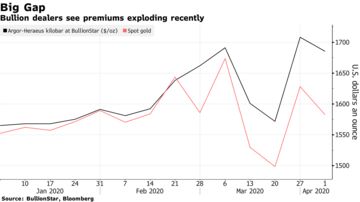

Certain products also command more of a premium than others. Kilobars manufactured by Argor-Heraeus SA, one of the big Swiss refiners whose plant has been closed since last week due to the health crisis, were selling for over 6% above spot, said Ronan Manly, an analyst at Singapore dealer BullionStar.

“We are seeing an unprecedented situation where huge customer demand and the disconnect between physical prices and spot prices is driving buy premiums high,†he said. Spot prices coming from London or New York “are completely detached from the reality on the ground.â€

Source: https://www.bloomberg.com/amp/news/articles/2020-04-02/want-a-gold-bar-under-your-mattress-get-in-line-and-pay-up

Tags: #Ashuanipi, #Discovery, #Drilling, #Greenstone, #Hopedale, #LAB, #Labrador, #LabradorGold, #Newfoundland, #NVO, #Plethora, #Queensway, NewFoundGold