sponsor: Durango owns 100% interest in the Trove claims, in the Windfall Lake area between Val d’Or and Chibougamau, Quebec., which are surrounded by Osisko Mining Inc. The property is compelling due to the coincidence of gold found in tills, coinciding with magnetic highs, several Induced Polarization anomalies and two faults crosscutting the property. Durango is undergoing a final review process for the proposed 3,000m drill program in 2020. Click Here For More Info

Crescat November Research Letter:

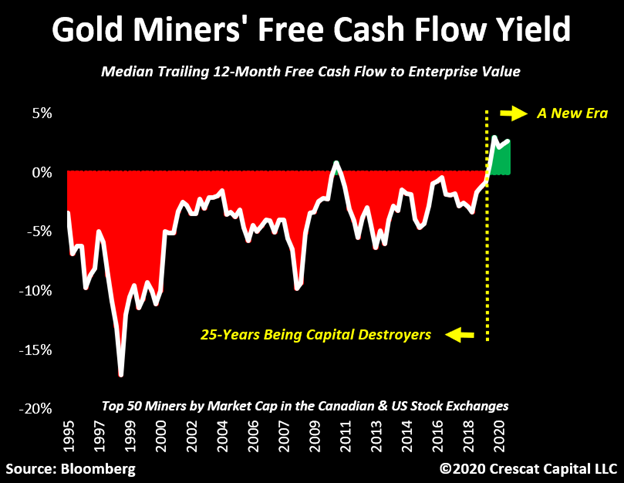

Gold & Silver Miners Turn Over a New Leaf:

- Top 50 largest gold and silver miners have had five straight quarters of positive free cash flow for the first time in the last three decades.

- Gold and silver mining companies are the real beneficiaries of today’s macro environment with strong balance sheets, high growth, and still incredible undervaluation.

One of the few areas of the equity market that is meaningfully improving fundamentally is the precious metals mining industry. With gold and silver prices at their current levels, these companies are set to massively expand their margins. This is indeed a new phenomenon for the miners. After 25 years of constantly losing money and regrettably creating a long-standing reputation of being capital destroyers, this industry is becoming one of the most disciplined and profitable businesses in the global economy today. In fact, the median stock among top 50 largest gold and silver miners has had five straight quarters of positive free cash flow for the first time in the last three decades. We believe this is only the beginning. These stocks are becoming new cash flow machines with the strong support of precious metals prices moving higher. Gold and silver mining companies are the real beneficiaries of today’s macro environment with strong balance sheets, high growth, and still incredible undervaluation.

Risk Parity Exhaustion

Among all the demand drivers for gold, we view the lack of competing cheap assets being a major one. For the first time in history, junk bonds and stocks are record overvalued in tandem. We have only seen the exact opposite of this. That was in the Global Financial Crisis when US equities and corporate bonds both hit rock bottom. This time, we are on the other side of the coin. Both sides of the so-called risk parity strategy, stocks and bonds, are at extreme valuations. In a world of near zero to negative yields and frothy valuations across almost every risky asset, it will become imperative for investors to seek out undervalued assets that are true beneficiaries of the current macro environment. In our view, precious metals are poised to become the new core must-have asset for capital allocators. Gold and silver are risk-off alternatives to bonds in the portfolios of prudently minded investors in today’s market. At the same time, attractively priced, high-growth gold and silver mining companies serve to ignite the animal spirits of traders and investors looking for a risk-on alternative to overvalued, low-growth stocks at large.

source: https://www.crescat.net/crescat-november-research-letter/

Tags: #BTR, #DGO, #Discovery, #Drilling, #Gold, #OSK, #Quebec, #silver, Abitibi, EastBarry, Exploration, Osisko, Trove