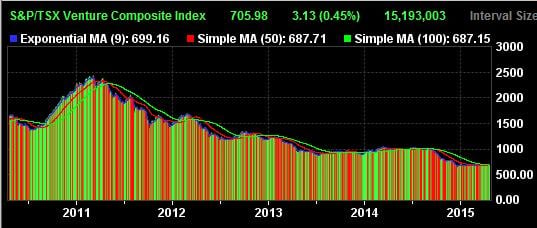

It is no secret that Canadian small-cap companies have taken a massive beating in the last 4 years, falling from 2,500 to 650 or ~ 75%. Â That is a brutal melt down and here is a visual:

Nobody escaped unscathed. Â If you were lucky, you survived – barely. Â The rest just died. Â AGORACOM survived largely because we saw the oversupply and called it as far back as 2008 when I posted the following right here on this same blog”

Our industry, however, didn’t learn our lesson and chose to keep the fly by nights going in the name and pursuit of greed.  Unfortunately, Mr. Market doesn’t like an oversupply of non-performing assets, so he chose to teach us the lesson by turning fly by nights into zombies.  For the record, I want to thank Tony Simon for quantifying the term … but have to give credit to our very own Chief Market Commentator, Allan Bary Labouchan, for first applying the term Zombies to the TSX Venture Walking Dead … watch this clip.

THAT WAS THE BAD NEWS … HERE IS THE GOOD NEWS … I’M NOW CALLING A MELT UP

I’m calling it, right here, right now … the Canadian Small Cap Market is now entering a Melt UP Phase that will last for a minimum of 4 years. My call is based on the following:

- The Zombies may still be walking around but we all know who they are and they no longer pose a risk.

- Investors have ended the “mourning” phase and are now seeking new investments to build their future with. Â This is supported by our traffic metrics clearly demonstrating investors are spending more time researching even while the TSXV bottomed out in 2014.

- The Buzz at PDAC was much more focused on making real deals and moves between the strong companies that survived the melt down.

- The survivors are trading at ridiculously cheap prices.

- The TSX Venture Exchange is starting to see healthy diversification via “real” companies from the tech and medical space. Â I emphasize REAL because these companies have real products, customers and business plans.

More than just lip service, here is my video call. Â If your small cap company is ready to take advantage of the multi-year melt up, be sure to get in contact with us to discuss our CASHLESS online programs!