As many of you know, we are very bullish on the long-term future of Chinese small cap and mid cap companies for two reasons:

1] The obvious reason – China is the fastest growing economy on the planet and nothing is going to slow down its ascent over the next 50 years and beyond. Investing in growth companies there just makes too much sense.

2] Great Results and Valuations – Many Small Cap Chinese Companies are listing in the US (OTCBB, NYSE Alternext and NASDAQ) with great financial results. Unlike many dubious US Small Cap Companies, Chinese Companies don’t seem to believe in losing money or failing to execute in a business plan. As such, 7-digit revenues and profits are very common.

From a valuation point of view, many Chinese companies became a victim of their own success in Q4 2008 and Q1 2009. Why? When the world needed to start liquidating, one of the first places they looked were China where most investors had significant gains to sell into. This resulted in the proverbial baby being thrown out with the bathwater and some great valuations.

TODAY’S FEATURED COMPANY

Acorn is a leading integrated multi-platform marketing company in China, operating one of China’s largest TV direct sales businesses in terms of revenues and TV air time and a nationwide off-TV distribution network.

On June 24th, the Company announced that it has reached an agreement to sell 33% equity interests of Shanghai Yimeng Software Technology Co., Ltd., a company engaged in the development and marketing of CPS stock tracking software, to Mr. Zeng Shan, the CEO of Yimeng

Check out the full details below!

Read Full Press Release

China Stocks TV Segment

HIGHLIGHTS

- Acorn will receive approximately $7.5 million in dividends and $15.5 million for sale of 33% equity interests of Yimeng, which is valued, post-dividend, at approximately $47.0 million.

- The Company will continue to hold 18% equity interests of Yimeng after the sale as part of Acorn’s long- term investments.

- The Company originally acquired 51% equity interests of Yimeng for a cash consideration of approximately $160,000 in December 2005.

MY COMMENTS:

As always, this is my view in a snapshot. It is intended to give you a running start into your research. Now, you have to do your own due diligence to make sure the valuation is not impaired by other factors including balance sheet items, lawsuits or any other negative events.

If you have any comments, I’d love to see them below.

YOUR RESEARCH STARTING POINTS FOR CHINESE SMALL CAP AND MID CAP COMPANIES

We’ve provided investors with two great starting points to research great Chinese small cap and mid cap companies.

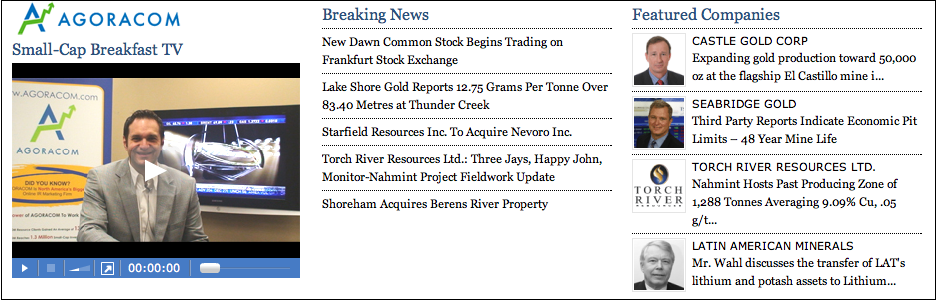

1. ChinaSecurities.com – ChinaSecurities.com tracks 250 of the best small cap and mid cap companies trading on North American exchanges. It provides you with the best of the best in two ways. First, the front page lists the best news of the day coming out of the space. It does so by giving you a text view of the best press releases by industry and via Chinese Stocks TV, a 5-minute broadcast every morning just after the open. Chinse Stocks TV is archived, so you can catch up on shows you missed.

Second, if you want to research each of the 250 companies to find candidates for your portfolio, it has a very intuitive directory that lets you quickly review each company on the master list, or parse it out by industry and exchange if you have a particular sector of interest. Cool stuff.

2. Right here on AGORACOM, you can refer to our China category for other featured Chinese Small-Cap Companies. As always, we will disclose any IR relationship with any public company. Given the sheer number of great Chinese Small-Cap Companies out there, you can expect us NOT to have an IR relationship with most of these companies.

Regards,

George