PlantX Life Inc. (VEGA: CSE) (PLTXF: OTCQB) announces massive partnerships With Alicia Silverstone and Venus Williams. Did we mention that Russell Peters attended the AGM?

PlantX Life Inc. (VEGA: CSE) (PLTXF: OTCQB) announces massive partnerships With Alicia Silverstone and Venus Williams. Did we mention that Russell Peters attended the AGM?

Combination of Loop technologies with Maitri platform has potential to create new paradigm in $120 Billion PPE market.

VANCOUVER, BC , March 1, 2021 – Loop Insights Inc. (TSXV: MTRX) (OTCQB: RACMF) (the “Company” or “Loop”), a provider of contactless solutions and artificial intelligence (“AI”) to drive real-time insights, enhanced customer engagement, and automated venue tracing to the brick and mortar space, is pleased to announce the signing of a letter of intent (LOI) for the grant of a non-exclusive license to Maitri Health Technologies Corp. (CSE: MTEC) for various aspects of Loop’s technology in return for CDN$2,000,000 in cash and common shares as well as a revenue-sharing arrangement.

Maitri Health Technologies is focused on modernizing healthcare systems for a post-pandemic world. Global events in 2020 identified the need for long-term security in both healthcare and the workplace. Maitri is a global platform for healthcare supply security providing a reliable source of certified PPE (personal protective equipment) and testing solutions through an onshore manufacturing model. This model has led to the creation of innovative and industry-leading products integrated with technology to help track, trace, and enable safer workplaces and communities. Maitri’s vision for the future is for safe workplaces and institutions to enable economies to operate uninterrupted.

The global market for PPE is expected to exceed USD$123 Billion by 2027 according to Grandview Research . The global workplace safety market is expected to grow to USD$19.9 Billion by 2025 according to Research and Markets .

The combination of Loop’s technologies with Maitri’s unique products has the potential to create a comprehensive offering for PPE and technology that will provide the foundation for safer, more protected workplaces and communities.

Loop Insights CEO Rob Anson stated: “COVID-19 created an immediate need for PPE that also immediately became a highly disorganized and fragmented market of middlemen and brokers with often questionable sources. Maitri’s ability to establish secure access and trusted distribution to key PPE products through a platform positions them to quickly become a strong force in the industry. This licensing arrangement will provide the ability to add venue, business and building protection to their offering, leading to brand new opportunities and revenue models.”

LICENSING ARRANGEMENT TO COMBINE PPE, ARTIFICIAL INTELLIGENCE AND PROPTECH IN FIRST-EVER AND FULLY SCALABLE OFFERING

Maitri’s PPE line of products combined with Loop Insights technology represents the convergence of a powerful PPE, AI, and Proptech offering that enables operators, businesses and building owners to reopen and protect all constituents with a documented process from verified PPE to venue management and artificial intelligence-driven marketing opportunities. This combined protocol enables physical buildings to fully reopen, generate revenue, and remain viable assets under end-to-end protection.

As a result, Loop Insights gains access to another major industry component that is essential to the safe re-opening of the global economy and society.

“Our relationship with Loop technology will create the opportunity to deliver a more complete safety protocol along with our existing products and offerings,” said Andrew Morton , CEO of Maitri. “We’re well-positioned to play a significant role supporting a path to global economic recovery.”

TERMS OF THE LOI

Loop will license the following technology:

In exchange for the license, Loop will receive a total value of $2,000,000 in a combination of both:

Both parties have agreed to a 30-day closing period for a definitive agreement, the terms of which are subject to the approval by the Board of Directors of both companies.

This Press Release Is Available On The Loop Insights Verified Forum On AGORACOM For Shareholder Discussion And Management Engagement https://agoracom.com/ir/LoopInsights/forums/discussion

About Maitri Health Technologies

Maitri Health Technologies Corp. (CSE: MTEC, FRA: D84) is a global platform for healthcare supply security. Our mission is to enhance safety and quality of life, and keep organizations and economies running. Maitri provides a reliable source of innovative, certified personal protective equipment and testing solutions through an onshore manufacturing model. Our stable, scalable supply chain is integrated with unique digital technology to deliver a comprehensive healthcare supply platform. For more information: https://maitrihealth.ca/ or [email protected]

About Loop Insights

Loop Insights Inc. is a Vancouver -based Internet of Things (“IoT”) technology company that delivers transformative artificial intelligence (“AI”) automated marketing, contact tracing, and contactless solutions to the brick and mortar space. Its unique IoT device, Fobi, enables data connectivity across online and on-premise platforms to provide real-time, detailed insights and automated, personalized engagement. Its ability to integrate seamlessly into existing infrastructure, and customize campaigns according to each vertical, creates a highly scalable solution for its prospective global clients that span industries. Loop Insights operates in the telecom, casino gaming, sports and entertainment, hospitality, and retail industries, in Canada , the US, the UK, Latin America , Australia , Japan , and Indonesia . Loop’s products and services are backed by Amazon’s Partner Network.

Read More: https://agoracom.com/ir/LoopInsights/forums/discussion/topics/756287-loop-insights-signs-letter-of-intent-for-2-000-000-licensing-deal-with-maitri-health-technologies-to-combine-ppe-artificial-intelligence/messages/2305880#message

Liquid Avatar name and symbol change better reflects Company’s corporate branding

TORONTO, ON / March 1, 2021 / KABN Systems NA Holdings Corp. (CSE:KABN)(“KABN” or the “Company“) is pleased to announce that it has changed its name from KABN Systems NA Holdings Corp. to Liquid Avatar Technologies Inc. (www.liquidavatartechnologies.com) and its ticker symbol from KABN to LQID. Subject to approval by the Canadian Securities Exchange (the “CSE”), the Company expects the name and symbol change to take effect for trading purposes on March 3, 2021 when its common shares will begin trading on the CSE under the new name, CUSIP number and new ticker symbol.

On February 18, 2021, the Company launched the first phase of its flagship product, the Liquid Avatar (www.liquidavatar.com) app in the Apple Store and Google Play.

Like search, online communications and browser usage, digital identity is addressable to up to 100% of the online market and is a very early-stage market opportunity, with the potential to reach up to 400 Million people in North America and over 5 Billion people online globally.

According to Statista.com, over 79% of video game users in the US are over the age of 18 with a surprising 41% over the age of 34, showing that video gaming and character creation is widespread through all age categories. Using Liquid Avatar, users are able to select from 1000’s of combinations of facial features to create their perfect digital, “cartoon-like” representations of themselves – all at no cost. Future releases of Liquid Avatar will allow users to upload their own digital icon images and create even more realistic versions of themselves as the Company explores new technologies that allow 3D animation and facial embedding on video characters.

Read More: https://agoracom.com/ir/KABN/forums/discussion/topics/756296-kabn-systems-na-holdings-corp-changes-its-name-to-liquid-avatar-technologies-inc-with-new-symbol-lqid/messages/2305893#message

TORONTO, ON / March 1, 2021 / Novamind Inc. (CSE:NM)(OTC PINK:NVMDF) (“Novamind” or “the Company”), a leading mental health company specialized in psychedelic medicine, today reported its fiscal second quarter results for the three months ended December 31, 2020 (“Fiscal Q2 2021″). The Company’s fiscal year-end is June 30th. All results are reported under International Financial Reporting Standards (“IFRS”) and in Canadian dollars, unless otherwise specified.

Fiscal Q2 2021 Highlights and Subsequent Developments

Financing and Public Listing

Novamind successfully closed an oversubscribed $10,000,000 financing on November 23rd, 2020. The funds were made available to the Company upon the completion of its reverse takeover (“RTO”) transaction and conditional listing approval from the Canadian Securities Exchange (“CSE”). The company ended the quarter with a cash balance of $10,868,742. With its strong cash position, Novamind is well-positioned to execute on its growth strategy to expand its network of mental health clinics, retreats and clinical research sites.

On January 5th, 2021, Novamind began trading on the CSE under the stock symbol “NM”. Less than two months after going public on the CSE, Novamind achieved the milestone of being included in the underlying index of the Horizons Psychedelic Stock Index ETF (NEO: PSYK) through a “Fast Entry” category, further increasing its profile with retail and institutional investors in the psychedelic medicine sector.

The Company announced on February 19th, 2021, that its common shares commenced trading under the symbol “NVMDF” on the OTC Market. In the near future, Novamind intends to apply to list its common shares on the OTCQB Market, an established marketplace in the United States for promising, innovative companies.

Operational Highlights

On January 28th, 2021, Novamind announced that it had reached two significant milestones at its Cedar Psychiatry mental health clinics: administering over 5,000 ketamine treatments since its opening in 2016, and administering over 2,000 Spravato™ treatments since the product became available in 2019. These milestones position Novamind as one of North America’s top providers of ketamine-assisted psychotherapy and Spravato™.

On January 13th, 2021, the Company announced the expansion and optimization of its Layton, Utah clinic. The redesigned Layton Clinic now offers improved treatment rooms to accommodate a higher number of ketamine and Spravato™ treatments. The Layton Clinic expansion comes in response to a significant increase in demand for ketamine therapies across Novamind’s mental health clinics. In 2020 alone, the Cedar Psychiatry clinic network facilitated over 20,000 client visits, an increase of over 100 percent compared to the same period in 2019.

On January 19th, 2021, Novamind announced the expansion of its leadership team with the appointment of Pierre Bou-Mansour, P.Eng., to the role of Chief Operating Officer. Mr. Bou-Mansour assumes the responsibility for ensuring operational excellence as Novamind develops its network of clinics, retreats, and research sites. An accomplished senior executive and leader, he brings a wealth of experience managing large and complex healthcare organizations. Prior to joining Novamind, Pierre served as the Chief Operating Officer of LifeLabs, a diagnostic laboratory services company he helped to scale into an industry leader with 5,700 employees and 370 patient access sites in Canada. Most recently, he served as the Chief Laboratory Operations Officer of Public Health Ontario, serving Canada’s largest province with over 14 million residents. In this role, Bou-Mansour successfully led the expansion of Public Health Ontario’s testing capacity for the COVID-19 response.

Strategic Investment in Bionomics

On February 11th, 2021, the Company announced that it had made a strategic investment of AU$827,486 (approximately CAN$810,000), in Bionomics Limited (“Bionomics”) (ASX: BNO, OTCQB: BNOEF, Germany: AU000000BNO5), a biopharmaceutical company dedicated to developing better treatments for central nervous system disorders. In addition, Cedar Clinical Research, a wholly owned subsidiary of Novamind, will be evaluated by Bionomics as a clinical research site to conduct Bionomics’ phase IIb clinical trial examining BNC210, a drug that has received Fast Track Designation from the U.S. Food and Drug Administration for the treatment of post-traumatic stress disorder (PTSD).

Impact of COVID-19

Novamind has not been significantly affected by the COVID-19 pandemic. As reported across multiple media outlets, the COVID-19 pandemic has resulted in a significant increase in the incidence of mental health problems, in particular anxiety and depression, conditions that are commonly treated by Novamind. The Company’s Cedar Psychiatry network of clinics continues to experience steady demand for mental health services, and this demand is anticipated to continue despite COVID-related restrictions.

Financial Highlights and Selected Consolidated Financial Information

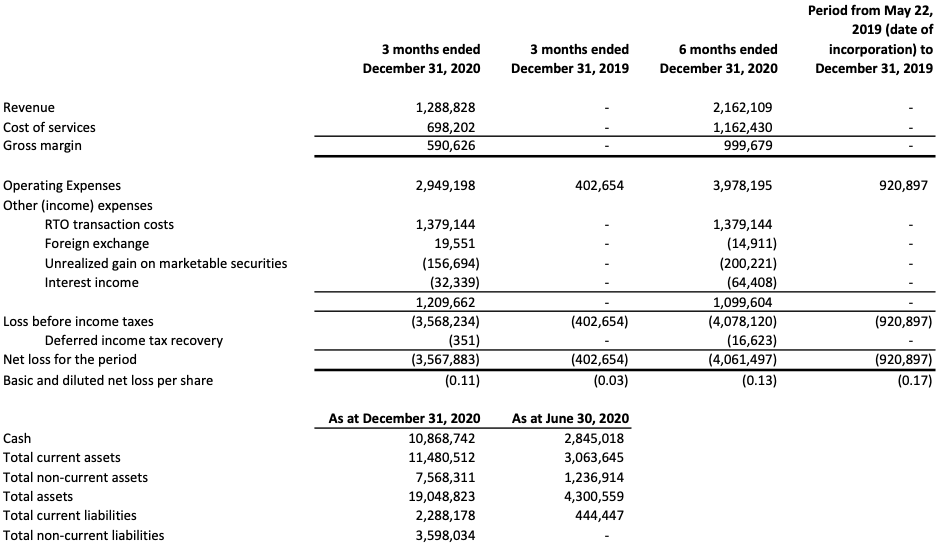

In Fiscal Q2 2021, Novamind reported revenue of $1,288,828 primarily composed of patient services revenue from its network of four Cedar Psychiatry outpatient mental health clinics in Utah. This represents a 47 percent increase over the previous quarter ended September 30th, 2020.

The Company reported a net loss of $3,567,883 for the three months ended December 31st, 2020, as compared to a net loss of $493,614 for the prior quarter ended September 30th, 2020. The net loss for the second fiscal quarter was primarily due to expenses related to the Company’s listing on the CSE, and funding of capacity expansion at its Cedar Psychiatry clinics. This includes consulting expenses of $416,268, professional fees of $450,419, salaries and wages of $791,078, office and general expenses of $87,368, advertising and promotion expenses of $236,650, and stock-based compensation of $664,814. Additionally, there was $1,379,144 in RTO transaction costs in the quarter.

The following table presents selected financial information from the Company’s unaudited condensed interim financial statements for the three and six months ended December 31st, 2020, and periods ended December 31st, 2019.

The following information should be read in conjunction with the financial statements and management’s discussion and analysis, which are available under the Company’s SEDAR profile at www.sedar.com.

About Novamind

Novamind is a leading mental health company enabling safe access to psychedelic medicine through a network of clinics, retreats, and clinical research sites. Novamind provides ketamine-assisted psychotherapy and other novel treatments through its network of Cedar Psychiatry clinics and operates Cedar Clinical Research, a contract research organization specialized in clinical trials and evidence-based research for psychedelic medicine. Both Cedar Psychiatry and Cedar Clinical Research are wholly owned subsidiaries of Novamind. For more information on how Novamind is enhancing mental wellness and guiding people through their entire healing journey, visit novamind.ca.

Contact Information

Novamind

Yaron Conforti, CEO and Director

Telephone: +1 (647) 953 9512

Bill Mitoulas, Investor Relations

Email: [email protected]

Forward-Looking Statements

This news release contains forward-looking statements. All statements other than statements of historical fact included in this release are forward-looking statements that involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company’s expectations including the risks detailed from time to time in the Company’s public disclosure. The reader is cautioned not to place undue reliance on any forward-looking information. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release and the Company will update or revise publicly any of the included forward-looking statements as expressly required by applicable laws.

SOURCE: Novamind Inc.

PlantX Life Inc. (VEGA: CSE) (PLTXF: OTCQB) announces massive partnerships With Alicia Silverstone and Venus Williams. Did we mention that Russell Peters attended the AGM?

FEATURES February 24, 2021

Yaron Conforti spoke to CSE TV about how Novamind is creating access points to alternative mental health treatments.

Novamind to Present at Benzinga Conference

February 23, 2021

Novamind Fast Tracked for Inclusion in Horizons Psychedelic ETF

February 22, 2021

Follow @novamind_inc on Instagram

TORONTO, Feb. 26, 2021 — ThreeD Capital Inc. (“ThreeD” or the “Company”) (CSE:IDK / OTCQB:IDKFF) a Canadian based venture capital firm that invests in disruptive companies and promising junior resources companies, is pleased to announce that it has acquired ownership and control of an aggregate of 8,889,500 common shares (the “Subject Shares”) and 1,000,000 common share purchase warrants (the “Subject Warrants” and together with the Subject Shares, the “Subject Units”) of Windfall Geotek Inc. (“Windfall”) through a series of transactions ending on February 19, 2021. The Subject Shares represented approximately 10.0% of all issued and outstanding common shares of Windfall as of February 26, 2021 immediately following the transaction described above (or approximately 11.0% on a partially diluted basis, assuming exercise of the Subject Warrants only).

Immediately before the transactions herein, ThreeD did not hold any securities of Windfall.

The Subject Units were acquired through a series of transactions. 1,000,000 Subject Shares and 1,000,000 Subject Warrants were acquired in a private placement and not through the facilities of any stock exchange for aggregate consideration payable of $60,000. The remaining Subject Shares were acquired in the open market through the facilities of the Canadian Securities Exchange for aggregate consideration payable of $1,972,691, or $0.25 per Subject Share. The holdings of securities of Windfall by ThreeD are managed for investment purposes, and ThreeD could increase or decrease their investments in Windfall at any time, or continue to maintain their current investment position, depending on market conditions or any other relevant factor.

The trade was effected in reliance upon the exemption contained in Section 2.3 of National Instrument 45-106 on the basis that ThreeD is an “accredited investor” as defined herein.

Read More: https://agoracom.com/ir/threedcapital/forums/discussion/topics/756207-threed-capital-inc-acquires-securities-of-windfall-geotek-inc/messages/2305710#message

PlantX Life Inc. (VEGA: CSE) (PLTXF: OTCQB) announces massive partnerships With Alicia Silverstone and Venus Williams. Did we mention that Russell Peters attended the AGM?

The highly-anticipated championship fight, with the WBA (Super), WBC, and The Ring super middleweight titles all on the line, is being broadcast to over 200 countries.

“WBC FAN PASS” ALLOWS WBC TO ENGAGE WORLDWIDE FANBASE, INCLUDING OVER 2 MILLION SOCIAL MEDIA FOLLOWERS AND OVER 10 MILLION COMBINED FOLLOWERS ON FIGHT NIGHT

WBC President Maurico Sulaiman stated: “This premier fight featuring Saul “Canelo” Álvarez and Avni Yildirim provides the perfect opportunity for the WBC to leverage Loop’s Engagement platform to connect in real-time with our worldwide fanbase. Loop’s impressive capabilities will allow the WBC to deliver the right experience at the right time, all while retaining critical information as we continue to grow our fan base throughout 2021, the year of boxing.”

Loop Insights’ automated engagement platform will revolutionize the fan onboarding experience for the WBC, enabling the seamless acquisition and activation of fans through the company’s Wallet pass technology. Click the link below to download your own personalized WBC Fan pass for this weekend’s event: https://goloop.ai/WBC-FanPass-IR

Sit back and watch this powerful interview.