SPONSOR: ThreeD Capital Inc. (IDK:CSE) Led by legendary financier, Sheldon Inwentash, ThreeD is a Canadian-based venture capital firm that only invests in best of breed small-cap companies which are both defensible and mass scalable. More than just lip service, Inwentash has financed many of Canada’s biggest small-cap exits. Click Here For More Information.

Crypto Markets Hit New 2019 Top as Bitcoin Cranks Higher to $6.3k

By: Martin Young

Market Wrap

- End of the week has seen crypto markets hit another new high for 2019.

- Bitcoin is pushing things higher as it eats away at the altcoins and itself posts new highs for the year.

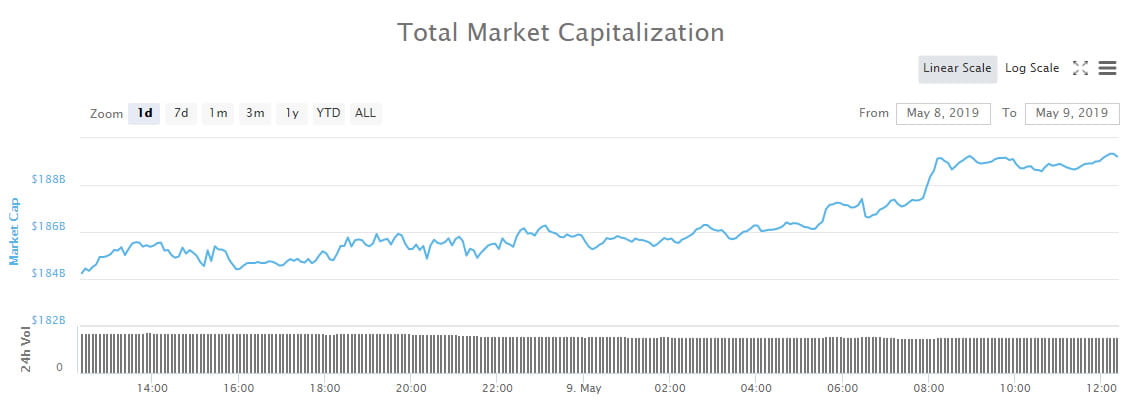

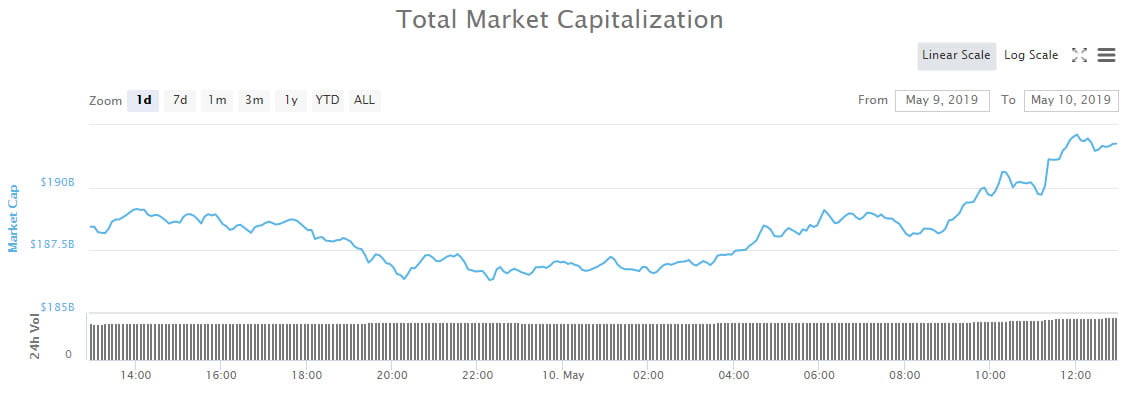

- Total market capitalization just passed $190 billion for the first time since November 2018.

The end of the week has seen crypto markets hit another new high for 2019. Bitcoin is pushing things higher as it eats away at the altcoins and itself posts new highs for the year. Total market capitalization just passed $190 billion for the first time since November 2018.

A new yearly high of just below $6,300 was made by Bitcoin a couple of hours ago. It has not dropped below $6k since breaching the psychological barrier in early trading yesterday and has pushed on a further 3 percent today. The big move has taken BTC volume up to $18 billion and market cap over $110 billion. Its dominance is now at a 17 month high of 58 percent, a level not seen since the big surge at the end of 2017.

The big move by BTC has pulled Ethereum up a little as it approaches $175. On the downside ETH market share has been eaten away to under ten percent as it remains sluggish.

The top ten is mostly red at the moment with only Litecoin making any positive momentum as it reaches $77 with 2.5 percent added on the day. Binance Coin is getting dumped dropping 8 percent back to $19 and XRP and Stellar continue to get eroded losing another couple of percent today.

There is greater pain in the top twenty as altcoins get assaulted by their big brother. Cosmos has been smashed 8 percent to fall below $4 and Tron and Maker have both lost over 4 percent over the past 24 hours. The rest are losing a couple of percent each as Bitcoin continues to consume them.

FOMO: Arcblock Still Pumping

Yesterday’s fomo driven pump has rolled into another day as ABT surges a further 40 percent lifting its position to 76th. South Koreans are all over this one as Bithumb dominates the trade volume in KRW. Social media tipping based altcoin ReddCoin is also flying at the moment with a gain of 18 percent on the back of Facebook’s rumored foray into crypto. Aurora is back again with another pump today of 15 percent which will dump tomorrow.

Speaking of dumps, WAX is in bad shape as it drops 9 percent as the top one hundred’s biggest loser. BNB and Cosmos are not far behind dumping 8 percent each.

Total market capitalization 24 hours. Coinmarketcap.com

Total crypto market capitalization has reached a new high for the year at $192 billion. The $4 billion, or two percent, gain on the day is largely due to Bitcoin which is a steamroller at the moment. Total daily volume is at its highest level for the week at $54 billion as markets slowly grind towards $200 billion.

Market Wrap is a section that takes a daily look at the top cryptocurrencies during the current trading session and analyses the best-performing ones, looking for trends and possible fundamentals.

Source: https://www.newsbtc.com/2019/05/10/crypto-markets-hit-new-2019-top-as-bitcoin-cranks-higher/