SPONSOR: ThreeD Capital Inc. (IDK:CSE) Led by legendary financier, Sheldon Inwentash, ThreeD is a Canadian-based venture capital firm that only invests in best of breed small-cap companies which are both defensible and mass scalable. More than just lip service, Inwentash has financed many of Canada’s biggest small-cap exits. Click Here For More Information.

Zero-Commission Trading Is Coming to Crypto

- ShapeShift exchange debuts zero fees following user defections

- Firms are slashing fees as race for market share intensifies

By Olga Kharif

Zero-fee trading first came to exchanged-traded funds and then to online stock and option transactions. Now the strategy is spreading into the cryptocurrency sphere.

Seen as the most profitable sector of digital-asset world, trading platforms are feeling the pressure as industry heavyweights such as Binance Holdings Ltd. and BitMex grab market share with both trading volume and coin prices sagging. ShapeShift, which has operated an exchange since 2014, said Wednesday it’s begun offering free “perpetual†trades.

“Free trading has become a feature of all fintech direct trading offerings, from Robinhood to SoFi and even JPMorgan,†said Lex Sokolin, global financial technology co-head at ConsenSys, which offers blockchain technology. “So it’s not surprising that in a digital race to acquire the most users, execution prices are starting to collapse.â€

The practice turned out to be a catalyst for Charles Schwab Corp., which recently reported it opened 142,000 new trading accounts in October, a 31% jump from September, after the brokerage offered zero fees. Fresh income is being generated from interest earned on client cash holdings. Firms in the crypto world are taking notice.

“We’ve definitely seen how people often need very simple messages,†Erik Voorhees, the Denver-based chief executive of ShapeShift, said in a phone interview. “Everyone understands free.â€

ShapeShift lost about 90% of its trading volume a year ago when it began checking user identifications to comply with regulatory guidelines, Voorhees said.

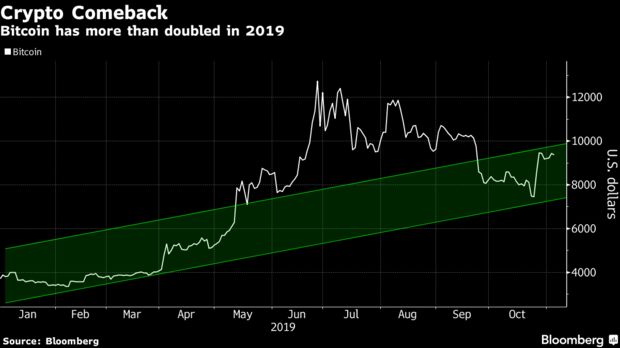

Daily-trading volume in crypto overall is about half of what it was in late October, and it’s been sluggish for most of the past few months, according to data compiler CoinMarketCap.com. The percentage of exchanges that are offering no-fee trading has increased to about 10% from 8% in June, data from CryptoCompare, which tracks exchanges.

To execute free transactions, traders will have to use so-called Fox tokens that ShapeShift is rolling out. Every user ShapeShift.com will get 100 free tokens, and the exchange may sell additional ones, Voorhees said. Each token — which are deposited in a user’s crypto wallet and are never spent — provides $10 of free trading volume on a rolling-30-day basis. So the more Fox tokens customers hold, the more free trades they can execute. Voorhees estimates that 90% of the exchange’s users will be able to do all their trades for free.

“We’d rather make a smaller amount of revenue from a larger pool of customers, and get those customers off centralized custodial exchanges,†Voorhees said. “It’s a risk we’re taking, but we think it’s worth it.â€

Other, mostly smaller, exchanges are offering zero fees as part of short- and long-term promotions. Liquid.com is waiving costs for traders who have less than $25 million per month in transactions. Zebpay introduced zero-trading fees in February. HitBTC lowered its fees in August. Malta-based Binance — often the largest spot trading exchange — lets users lower their trading fees by investing in its own cryptocurrency, Binance Coin.

“The end result of price wars tends to be consolidation and the starving of smaller players,†Sokolin said. “Already we see this with the dominance of Binance.â€

Source: https://www.bloomberg.com/news/articles/2019-11-20/zero-commission-trading-is-coming-to-crypto-as-boom-times-fade