SPONSOR: ThreeD Capital Inc. (IDK:CSE) Led by legendary financier, Sheldon Inwentash, ThreeD is a Canadian-based venture capital firm that only invests in best of breed small-cap companies which are both defensible and mass scalable. More than just lip service, Inwentash has financed many of Canada’s biggest small-cap exits. Click Here For More Information.

Understanding blockchain technology and its implications on the future of transactions

Blockchain technology will disrupt the way we write and enforce contracts, execute transactions and maintain records.

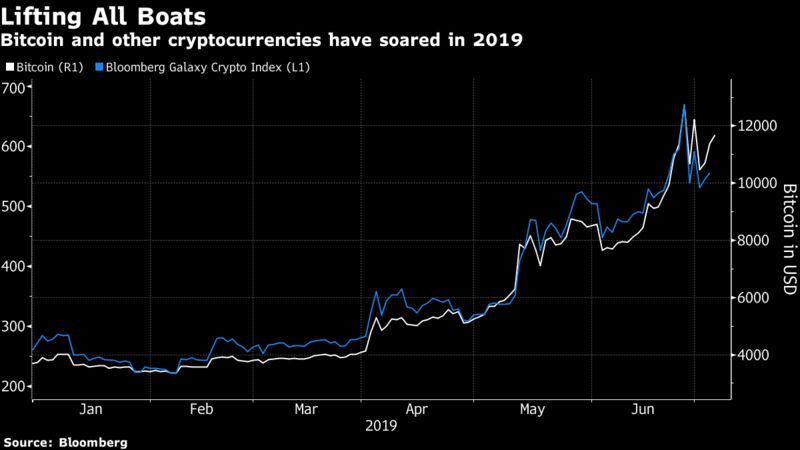

- Since blockchain technology is at the heart of Bitcoin and other virtual currencies, it can at the very least be expected to power even more consequential mediums of exchange in the future.

Shaan Ray Jul 22, 2019

Blockchain technology is transformative, and several commentators expect that it will have a massive economic impact similar to the one the Internet has had in the past few decades.

Blockchain could be the future of the financial industry.

Since blockchain technology is at the heart of Bitcoin and other virtual currencies, it can at the very least be expected to power even more consequential mediums of exchange in the future. However, virtual currencies are merely the first use case of blockchain technology.

Blockchain fundamentals

The blockchain is an open and distributed ledger. It uses an append-only data structure, meaning new transactions and data can be added on to a blockchain, but past data cannot be erased.

This results in a verifiable and permanent record of data and transactions between two or more parties. This has the potential to increase transparency and accountability, and positively enhance our social and economic systems. A blockchain is built by running software and linking several nodes together.

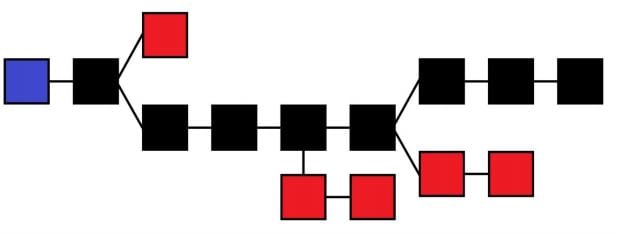

The main chain (black) consists of the longest series of blocks from the genesis block (blue) to

the current block. Orphan blocks (red) exist outside of the main chain.

A blockchain is not one global entity — there are several blockchains. Imagine a network of connected computers inside a highly secure office, which are connected to each other, but not to the internet. A blockchain is similar to this: it can have numerous connected nodes, but remain totally separate and unique from other blockchains.

Institutions and banks can build internal blockchains with their own features for various organizational purposes. A consensus mechanism and a reward system are required to maintain the integrity and functionality of a blockchain.

In the Bitcoin blockchain, consensus is achieved by ‘mining’, and the reward system is a protocol awarding a miner some amount of Bitcoin upon successfully mining a block. Mining is undertaken by powerful computers solving complex mathematical puzzles. Once a transaction is verified and accepted as true by the entire network, miners start working on the next block. Thus, a blockchain keeps growing (linking each new block to the one before it).

Implications for transactions

Blockchain technology will disrupt the way we write and enforce contracts, execute transactions and maintain records. Keeping records of transactions is a core function of all businesses. These records are meant to track past performance and help with forecasting and planning for the future.

Most organizations’ records take a lot of time and effort to create, and often the creation and storage processes are prone to errors. Currently, transactions can be executed immediately, but settlement can take anywhere from several hours to several days. For example, someone selling stock in a corporation on a stock exchange can sell immediately, but settlement can take a few days.

Similarly, a deal to purchase a house or car can be negotiated and signed quickly, but the registration process (verifying and registering the change in property ownership) often takes days and may involve lawyers and government employees. In each of these examples, each party maintains its own ledger, and cannot access the ledgers of the other parties involved. On the blockchain, the process of transaction verification and recording is immediate and permanent.

The ledger is distributed across several nodes, meaning the data is replicated and stored instantaneously on each node across the system. When a transaction is recorded in the blockchain, details of the transaction such as price, asset, and ownership, are recorded, verified and settled within seconds across all nodes. A verified change registered on any one ledger is also simultaneously registered on all other copies of the ledger. Since each transaction is transparently and permanently recorded across all ledgers, open for anyone to see, there is no need for third-party verification.

From virtual currencies to enterprise

Use The blockchain underlying Bitcoin is currently the largest and best-known blockchain. Ethereum is a separate blockchain: while it supports the Ether currency, it also acts as a distributed computing platform that features smart contract functionality. Therefore, despite having a virtual currency element, it has many more uses than Bitcoin. For example, companies in various industries raising funds through ICOs use Ethereum for their projects.

The Hyperledger Project, by the Linux Foundation, aims to bring together a number of independent efforts to develop open protocols and standards in blockchain technology for enterprise use.

Here for the long term

Blockchain technology will disrupt the way we write Blockchain technology, but is still in an early, formative stage, and cryptocurrencies are only its first major use case.

Beyond cryptocurrency, blockchain technology will change how we transact, and how we record and verify transactions. This will revolutionise contracts and reduce friction in the exchange of assets.

Over the next few decades, blockchain technology will percolate through our organizations and institutions, and shape how we transact with one another. Just as the Internet continues to power emergent technologies, we can expect to see new use cases of blockchain technology across all industries.

Shaan Ray (MBA) is the head of Denver Hill, a group that uses emerging technologies like blockchain, artificial intelligence, additive manufacturing and the industrial internet to create new products and processes.

Source: https://www.firstpost.com/tech/news-analysis/understanding-blockchain-technology-and-its-implications-on-the-future-of-transactions-7033731.html