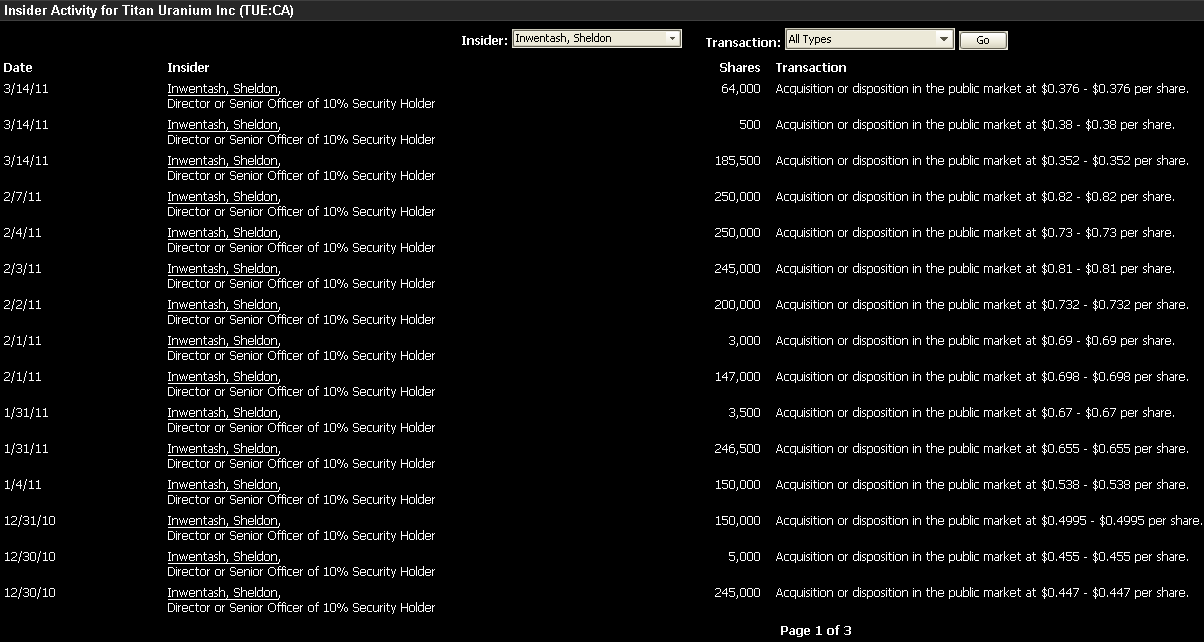

I picked up 30,000 shares of Titan Uranium today for a couple of reasons … here is my biggest reason … and why I will probably add more. Â Sometimes, when someone with better access to information and analysis then you have puts their money where their mouth is, you just follow along.

As always, do your own DD and remember I may be in for the day or for the year. Â Right now, all other things being equal, my first target is low 40’s … but that can change at anytime and for any reason.

CLICK ON IMAGE TO DOWNLOAD A LARGER VERSION