Nemis credited the company’s retail shareholders, many of whom use the small-cap

investor relations website Agoracom, for strengthening management’s position.

“Without the Agoracom support, we never would have come to a balance with Rosseau

and never been able to negotiate the kind of agreement that we did negotiate and that

was my main concern.”

Richard Nemis, Chairman Emeritus, Noront Resources

Annual General Meeting

October 28, 2008

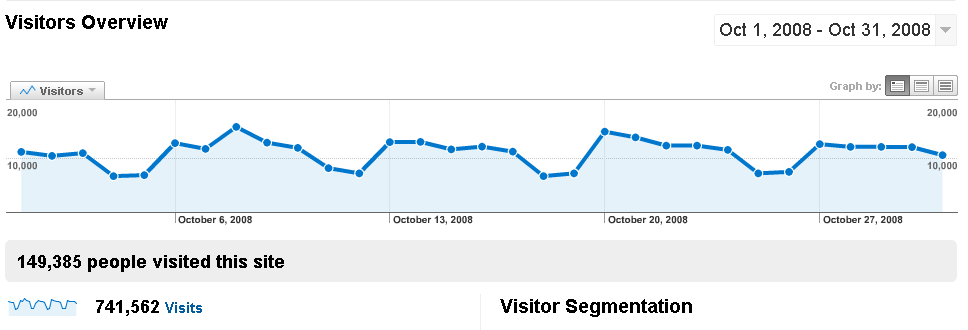

On October 9th, the most recent and biggest battle for a Canadian junior resource company – Noront Resources – commenced. As the company’s investor relations firm, we went to work protecting the interests of management and the board – but we weren’t alone. The AGORACOM Noront Shareholder Community was bigger, more motivated and ultimately more effective than the AGORACOM Aurelian warriors – and that was one hell of a crew. Here is the tale of the tape over just 19 days. The figures are quite simply massive and unprecedented.

PAGE VIEWS:Â Â Â Â Â Â Â Â Â Â Â Â 2,232,789

UNIQUE VISITORS:Â Â Â Â 41,709

PAGES PER VISIT:Â Â Â Â Â Â 58.90

AVG TIME PER VISIT:Â 22:09

TOP 10 COUNTRIES:Â Â Canada, USA, Netherlands, Germany, Belgium, Austria, United Kingdom, Peru, Switzerland

On October 27th, after a 19-day e-mail, web, telephone, letter writing and media campaign that the dissident shareholder group never could have foreseen, the two sides agreed to a jointly determined single slate of directors for election at Noront’s annual and special meeting.

Much like the Democratic and Republican political conventions, once the nominees have been finalized, both sides agree to lay down their arms and unite behind the new leadership. True, it will take many investors some time to completely trust and support the new board but that is to be expected following any such battle.

For our part, AGORACOM unequivocally supports the new board and will continue to do its part to advance the best interests of the company and its shareholders.

On a broader scale, however, something has permanently changed the stock market landscape. It’s big and notice of the change was served the following day.

On October 28th, the AGORACOM Noront Community finished the lesson first started by the AGORACOM Aurelian Community, which forced Kinross Gold to extend it’s “friendly offer” 3 times before finally taking control of Aurelian Resources. Specifically, Bay Street no longer has unfettered control. The boys in the towers can no longer count on making deals to the detriment of retail investors over scotch. Main Street now has Web 2.0 muscle and will use it to amalgamate and protect its interests.

CONCLUSION

Words can not express how proud I am of every AGORACOM Noront member/shareholder. You saved the day. You are pioneers that shook the small-cap world and returned it to its rightful owner – the retail investor. Above all, you are a courageous, intelligent, cooperative, selfless and noble group. Be proud and take a moment to fully savor your accomplishment.

Tomorrow, let’s get back to work. Noront Resources will not be the last company to go through this process. This is especially true given current market conditions. Spread the word by sending this message to every investor you know, with the goal of having a fully functioning HUB (client or non-client), for every great small-cap company. Investor communities are never going to be the same.

Finally, I’ll save the last word for Chairman Emeritus, Richard Nemis. On behalf of everyone at AGORACOM and the entire AGORACOM Noront Community, thank-you. For everything. Anytime, anywhere, just pick up the phone. You have an army at your service.

With great respect,

George, Paul and the AGORACOM Team