SPONSOR: ThreeD Capital Inc. (IDK:CSE) Led by legendary financier, Sheldon Inwentash, ThreeD is a Canadian-based venture capital firm that only invests in best of breed small-cap companies which are both defensible and mass scalable. More than just lip service, Inwentash has financed many of Canada’s biggest small-cap exits. Click Here For More Information.

As Facebook Struggles For Blockchain Support, A Truly Decentralized Challenger Emerges

- So, what is Celo? In a similar fashion to Libra, Celo is at its core a stablecoin platform

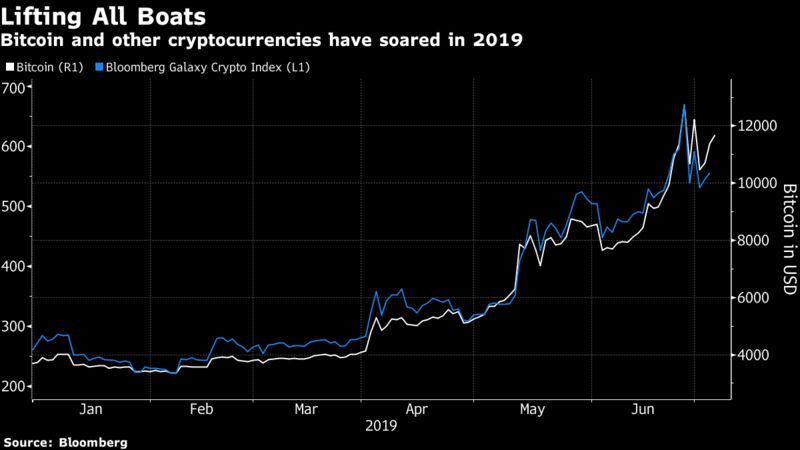

- This means that the key value proposition of the assets running on top of the platform is that they are immune to the wide swings in volatility that have plagued leading crypto assets in recent years

- Creates an opportunity for companies and projects like Celo, which are building pure blockchain-based financial services aimed at linking the nearly 2 billion people in the world that do not have access to bank accounts or the ability to verify their identity

As Facebook Blockchain Lead David Marcus tries to simultaneously use his testimony in front of U.S. lawmakers to restore trust in the company, and convince them that Facebook will not always be the driving force of its Libra project, it is easy to see why some of its key blockchain competitors are enthusiastic about the company’s entrance in the space.

The prevailing belief is that at some point the inherent contractions in Facebook’s blockchain strategy and the Libra project are going to become too much to overcome. Of course, this assumes that the project launches at all, which is not certain given the regulatory scrutiny it faces around the world.

This creates an opportunity for companies and projects like Celo, which are building pure blockchain-based financial services aimed at linking the nearly 2 billion people in the world that do not have access to bank accounts or the ability to verify their identity.

To the point, it is interesting that some of Libra’s first members, including venerated venture capital firm Andreessen Horowitz and crypto-unicorn Coinbase, have invested in Celo. Some of Celo’s other high-profile investors include LinkedIn founder Reid Hoffman and Twitter/Square CEO Jack Dorsey.

Understanding Celo

So, what is Celo? In a similar fashion to Libra, Celo is at its core a stablecoin platform. This means that the key value proposition of the assets running on top of the platform is that they are immune to the wide swings in volatility that have plagued leading crypto assets in recent years. Many are designed to mirror the price movements of traditional currency, and most have names that reflect their fiat brethren, such as the Gemini Dollar. This is a critical need for the industry, as no asset will be able to serve as a currency if it does not maintain a consistent price.

A man walks past signs advertising money transfer services and loans outside a business in Mexico City, Tuesday, April 5, 2016. (AP Photo/Rebecca Blackwell) ASSOCIATED PRESS

However, rather than being a centralized issuer that supports the price pegs with fiat held in banks, Celo has built a full-stack platform (meaning it developed the underlying blockchain and applications that run on top), that can offer an unlimited number of stablecoins all backed by cryptoassets held in reserve.

Furthermore, Celo is what is known as an algorithmic-based stablecoin provider. This distinction means that rather than being a centralized entity that controls issuances and redemptions, the company employs a smart-contract based stability protocol that automatically expands or contracts the supply of its collateral reserves in a fashion similar to how the Federal Reserve adjusts the U.S. monetary supply. In this vein, Celo co-founder Rene Reinsberg told me that the company actually “Maintains overcollaterization via a multi-asset crypto reserve composed of Celo’s native asset, Celo Gold, and a basket of other crypto assets, such as bitcoin.†This overcollateralization is important, and common in crypto lending and stablecoin platforms, because it serves as a buffer against potential volatility.

Additionally, a key differentiator for Celo from similar projects is that for the first time its blockchain platform allows users to send/receive money to a person’s phone number, IP address, email, as well as other identifiers. This feature will be critical to the long-term success for the network because it eliminates the need for counterparties in a transaction to share their public keys with each other prior to a transaction.

And now today, Celo is open-sourcing its entire codebase and design after two years of development. Additionally, the company is launching the first prototype of its platform, named the Alfajores Testnet, and Celo Wallet, an Android app that will allow users to manage their accounts and send/receive payments on the testnet.

This announcement and product is intended to be just the first of what will be a wide range of financial services applications designed to connect the world.

A Bright Outlook But Significant Question Remain

With all of that said, the company’s near and long-term success will depend on its ability to navigate and address some key hurdles. Three in particular immediately come to mind:

Stability of the Network. There are currently no algorithmic/smart-contract based stablecoins in circulation today that have seen widespread adoption. There are multiple reasons for this. First, it is simpler to issue stablecoins on a 1:1 basis for fiat kept in reserves. Second, it is nearly-impossible to design a complex system that can account for and overcome any threat or challenge. It is likely that at some point the future the network’s governance structure will be challenged or that a critical flaw will be discovered in the underlying code. The platform’s ability to rebound from these challenges without compromising its decentralized nature will be a key determinant of its future.

Ability to Adapt to Highly Volatile Fiat. A key differentiator between Celo and other stablecoin issuers is that anyone that participates in its governance function can propose a new currency. The intention is that the platform will support a wide range of global, national, and local currencies. Given that it is first targeting users in the developing world, where the currencies are notoriously volatile, there is a chance that the system could be strained as it seeks to maintain constant pegs across the network. It is worth noting that the company has given great thought and care to ensure that it is anti-fragile, and part of this strategy involves using a diverse basket of collateral to support all assets on the network.

Regulation. If the Libra hearings in front of Congress proved nothing else, lawmakers are very concerned about crypto being misappropriated for illicit uses. All issuers will need to comply with existing AML/KYC laws. I asked Rene about this challenge and whether or not their ability to comply will be hindered by the firms ability to onboard users with little more than a phone number or some other numerical identifier. His response was, “Yes, we’ve had conversations with regulators both in the US and around the world. We think regulation is critical for this space, particularly when it comes to protecting consumers. We will absolutely comply with US laws and laws around the world. We’re looking forward to sharing more on this at a later stage, closer to mainnet launchâ€

Conclusion

There is a saying “nothing worth having comes easyâ€, and that certainly applies to Celo and its diligent approach to development. Additionally, the irony of its launch’s juxtaposition with the Libra hearings underscores the need for a decentralized approach to connecting the world.

Source: https://www.forbes.com/sites/stevenehrlich/2019/07/17/as-facebook-struggles-for-blockchain-support-a-truly-decentralized-challenger-emerges/#3e22e26319eb