SPONSOR: ThreeD Capital Inc. (IDK:CSE) Led by legendary financier, Sheldon Inwentash, ThreeD is a Canadian-based venture capital firm that only invests in best of breed small-cap companies which are both defensible and mass scalable. More than just lip service, Inwentash has financed many of Canada’s biggest small-cap exits. Click Here For More Information.

From Online Gambling to Pot, Crypto Commerce Takes Off This Year

- Bitcoin still accounted for about 90% of commerce transactions

- Nearly $6 million in transactions done daily: Chainalysis

By Olga Kharif

After being given up for dead, cryptocurrency-based commerce — albeit still tiny — has started growing again.

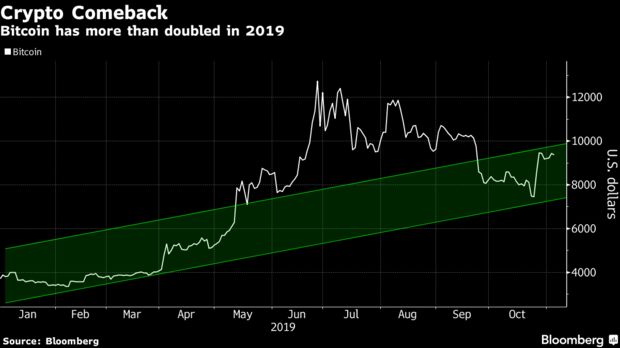

The amount of digital money sent to 16 merchant service providers such as BitPay rose 65% between January and July, according to data researcher Chainalysis. The price of Bitcoin, which accounted for 89% of all such transactions, had more than doubled over the seven months, to about $10,000. Typically, steep run-ups in the cryptocurrency’s price push people to spend less, and instead to hold or to speculate.

The resurgence is in contrast to last year, when Chainalysis found that Bitcoin-based commerce was in decline. This time around, the researcher looked not just at Bitcoin but also at Tether, Litecoin and Bitcoin Cash, which are used to fund everything from online gambling to purchases at pot shops.

“It suggests there’s more overall trust in crypto,†Kim Grauer, senior economist at New York-based Chainalysis, said in a phone interview.

In one of the biggest efforts for mainstream use, Intercontinental Exchange Inc. plans to begin testing its consumer app for digital assets with Starbucks Inc. in the first half of 2020. Processor BitPay and others are adding support for new coins, also boosting commerce. The company, which says it processes more than $1 billion annually, anticipates continued growth as new cryptocurrencies are added to the mix including Bitcoin Cash Ether and XRP, spokesperson Jan Jahosky said in an email.

The overall amount of crypto used in commerce remains tiny: It was $5.5 million on average per day in July, up from only about $3 million in January. Starbucks alone books about $70 million in sales daily.

Inconvenience has been a major barrier. Transaction confirmation on the Bitcoin network can take an hour — making it hard for someone to just walk in a store, buy a cup of coffee and leave. Many businesses still don’t accept the coins. And many consumers are still leery to spend them anyway, due to most cryptocurrencies’ wild volatility.

Increased use of Tether — a so-called stablecoin because its price doesn’t typically fluctuate much — gave crypto commerce a boost, with the token’s use in commerce increasing five-fold between January and July, according to the researcher. In those seven months, Tether accounted for 9% of all commerce, Chainalysis said.

“There’s still a lot of growth in Bitcoin,†Grauer said. “But if you look at Tether, especially in the second half of the year, Tether took off.â€

Source: https://www.bloomberg.com/news/articles/2019-11-06/crypto-commerce-jumps-65-as-tether-s-use-takes-off-this-year