SPONSOR: New Age Metals Inc. The company owns one of North America’s largest primary platinum group metals deposits in Sudbury, Canada. The company has an updated NI 43-101 Mineral Resource Estimate of 2,867,000 PdEq Measured and Indicated Ounces, with an additional 1,059,000 PdEq Ounces Inferred. Learn More.

Palladium Weekly: Uptrend Set To Prevail This Year

- We continue to believe that palladium benefits from the tightest fundamental backdrop, with the market likely to post a meaningful deficit in 2020 despite a contraction in automotive demand.

- The negative seasonality in May-June could lead to some palladium price weakness, which we would view as a buying opportunity.

Thesis

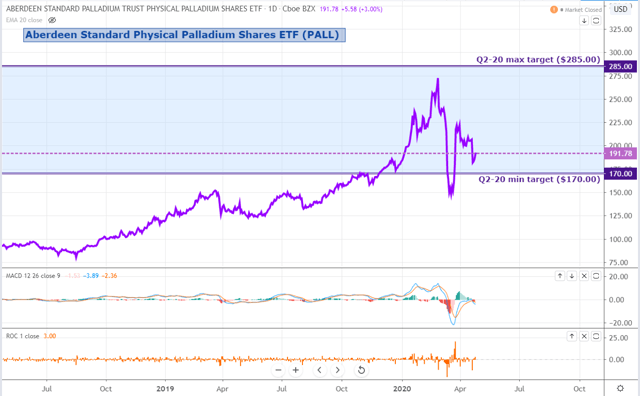

Welcome to Orchid’s Palladium Weekly report, in which we discuss palladium prices through the lenses of the Aberdeen Standard Physical Palladium Shares ETF (PALL).

PALL has come under downward pressure since the start of April, despite a strong performance across the rest of the precious metals space.

The recent underperformance of palladium is driven by three main factors:

- Less exposure to South African PGM production disruptions

- More sensitivity to the recession in the automotive sector

- Less safe-haven demand

However, we continue to believe that palladium benefits from the tightest fundamental backdrop, with the market likely to post a meaningful deficit in 2020 despite a contraction in automotive demand for PGMs.

As a result, we expect the uptrend in PALL to prevail this year and next.

For Q2, we see PALL trading between $170 and $285 per share, implying a risk/reward skewed to the upside.

Source: Trading View, Orchid Research

About PALL

For investors seeking exposure to the fluctuations of palladium prices, PALL is an interesting investment vehicle because it seeks to track spot palladium prices by physically holding palladium bars, which are located in JPM vaults in London and Zurich. The vaults are inspected twice a year, including once randomly.

The Fund summary is as follows:

PALL seeks to reflect the performance of the price of physical palladium, less the Trust’s expenses.

Its expense ratio is 0.60%. In other words, a long position in PALL of $10,000 held over 12 months would cost the investor $60.

Liquidity conditions are poorer than that for platinum. PALL shows an average daily volume of $3 million and an average spread (over the past two months) of 0.33%.

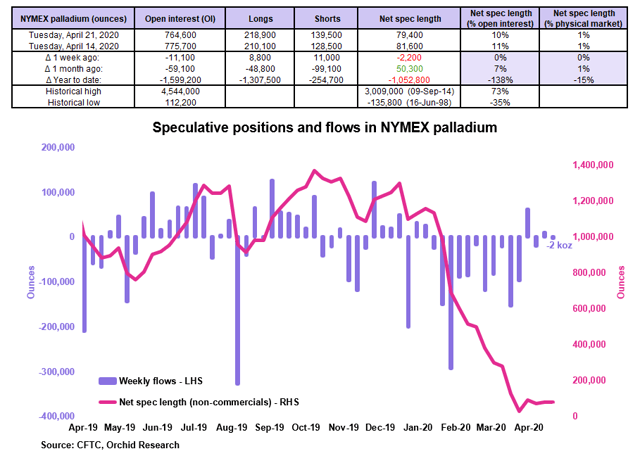

Speculative positioning

Source: CFTC, Orchid Research

The speculative community slashed by the equivalent of ~2 koz its net long position in NYMEX palladium in the week to April 21, according to the CFTC. The NYMEX palladium price sold off by 6.3% over the corresponding period, suggesting the presence of additional selling pressure stemming from the OTC market and the physical market.

Since the start of the year, the speculative community has sold the equivalent of 1.053 moz of net long positions in NYMEX palladium, representing around 15% of annual supply. Despite this, the NYMEX palladium price is still up nearly 6% YTD. This highlights the fundamental strength in the physical market.

Because palladium’s spec positioning is very light (the net spec length is at just 10% of open interest), there is plenty of room for speculative buying pressure in case of a positive swing in sentiment among the speculative community.

Implications for PALL: The current spec positioning in NYMEX palladium is a potential bullish force for palladium prices due to the ample dry powder available to deploy among the speculative community. A renewed wave of spec buying in NYMEX palladium would push the NYMEX palladium price much higher, thereby boosting PALL in the process.

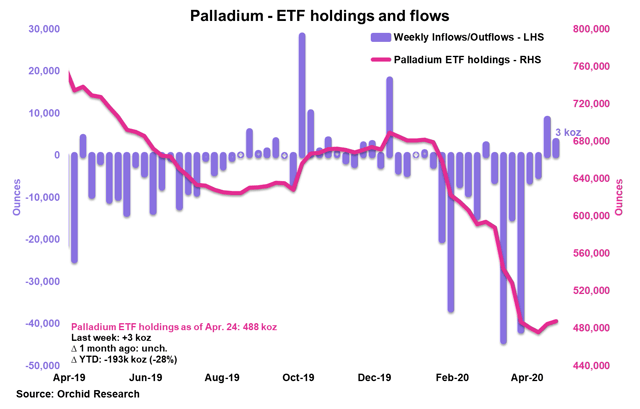

Investment positioning

Source: Orchid Research

ETF investors bought around 3 koz of palladium in the week to April 24, marking the 2nd week of net buying.

Given the weakness in automotive demand for palladium due to the COVID-19 crisis, the re-emergence of palladium ETF buying could help underpin the uptrend in the NYMEX palladium price. That said, we contend that it is too early to assert that a sustained positive change in investor sentiment toward palladium has occurred this month.

ETF investors have sold roughly 193 koz since the start of the year, marking a 28% decline in palladium ETF holdings.

Once again, despite the contraction in ETF demand for palladium, the NYMEX palladium price is up on the year. This shows the extent to which the physical palladium market is tight.

Implications for PALL: A resumption of ETF inflows in palladium would be bullish for the NYMEX palladium price and thus PALL.

Automotive demand

Last week, we discussed the supply side of the palladium market. This week, we discuss the outlook for automotive demand for palladium.

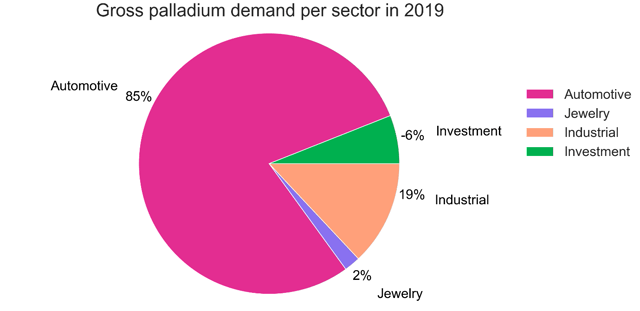

Source: Johnson Matthey

Palladium demand from the automotive industry represents around 85% of gross palladium demand, according to Johnson Matthey.

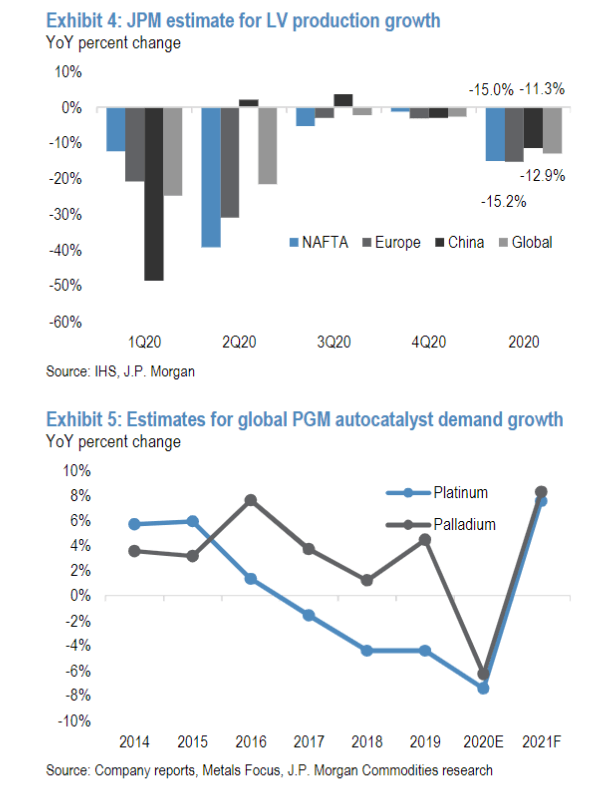

JP Morgan predicts a contraction of 13% in global light vehicle production this year, including a contraction of 25% YoY in the first quarter. In Q1, JP Morgan estimates that Chinese production contracted by 50% YoY while production dropped by 17% YoY both in North America and Europe.

This would translate into a decline of roughly 7% in automotive demand for palladium this year.

Source: JPM

Implications for PALL: The contraction in automotive demand for palladium should be largely offset by the contraction in palladium mine supply in 2020. As such, the palladium market is likely to remain in a meaningful deficit this year and post an even deeper deficit next year. As the fundamental tightness in the physical palladium market is set to prevail, we believe that the uptrend in PALL is intact for this year and next.

Closing thoughts

We expect the uptrend in PALL to prevail in 2020 and next year, principally because the palladium market is expected to post a meaningful deficit in spite of the recession in the automotive industry.

The extremely low level of visible inventories is likely to intensify the positive impact on palladium prices.

Given the negative seasonality in May-June, we stand ready to buy the dips in case of a retest of the recent lows.

For Q2, we see PALL trading between $170 and $285 per share, implying a risk/reward skewed to the upside.

Source: https://seekingalpha.com/article/4340578-palladium-weekly-uptrend-set-to-prevail-this-year