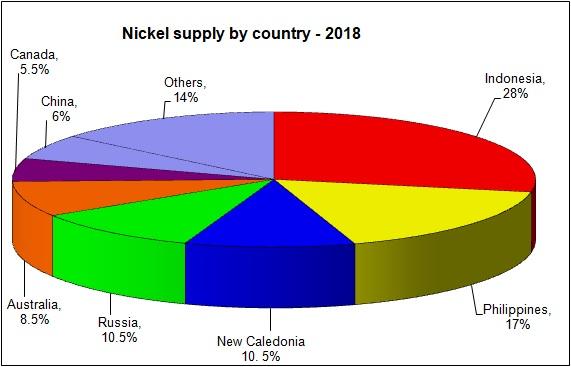

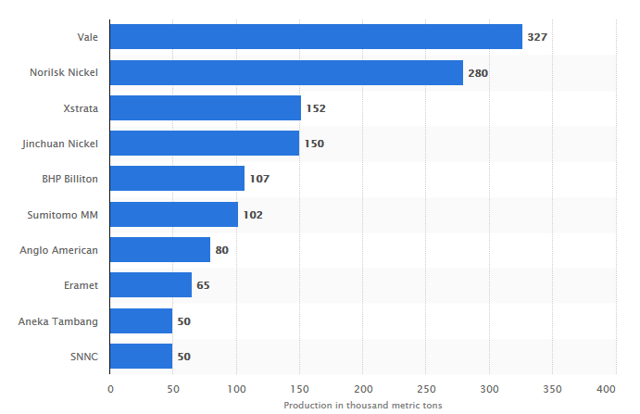

SPONSOR: Tartisan Nickel (TN:CSE) Kenbridge Property has a measured and indicated resource of 7.14 million tonnes at 0.62% nickel, 0.33% copper. Tartisan also has interests in Peru, including a 20 percent equity stake in Eloro Resources and 2 percent NSR in their La Victoria property. Click her for more information

The battery decade: How energy storage could revolutionize industries in the next 10 years

By: Pippa Stevens

- Over the last decade a surge in lithium-ion battery production has led to an 85% decline in prices, making electric vehicles and energy storage commercially viable for the first time in history.

- Batteries hold the key to transitioning away from fossil fuel dependence, and are set to play a greater role in the coming decade.

- UBS estimates that over the next ten years the energy storage market in the United States could grow to as much as $426 billion, and there are many ways to buy into the surge, including chemical companies, battery cell makers, car companies, solar companies and utility companies.

- “Capturing the massive economic opportunity underlying the shift to controls and battery-based energy systems requires that planners, policymakers, regulators, and investors take an ecosystem approach to developing these markets,†sustainability-focused research firm Rocky Mountain Institute said recently.

What a difference a decade can make. In 2010, batteries powered our phones and computers. By the end of the decade, they are starting to power our cars and houses too.

Over the last ten years, a surge in lithium-ion battery production drove down prices to the point that — for the first time in history — electric vehicles became commercially viable from the standpoint of both cost and performance. The next step, and what will define the next decade, is utility-scale storage.

As the immediacy of the climate crisis becomes ever more apparent, batteries hold the key to transitioning to a renewable-fueled world. Solar and wind are playing a greater role in power generation, but without effective energy storage techniques, natural gas and coal are needed for times when the sun isn’t shining or the wind isn’t howling. And so large scale storage is instrumental if society is to shift away from a world dependent on fossil-fuel.

watch now VIDEO08:13 The battery industry is exploding — here’s how it’s changing our world

UBS estimates that over the next decade energy storage costs will fall between 66% and 80%, and that the market will grow to as much as $426 billion worldwide. Along the way entire ecosystems will grow and develop to support a new age of battery-powered electricity, and the effects will be felt throughout society.

Changing electrical grid

If electric vehicles grow faster than expected, peak oil demand could be reached sooner than expected, for instance, while more green-generated power will alter the makeup of the electricity grid.

In a recent note to clients, Cowen analysts said that the grid will “see more changes over the next ten years than it has in the prior 100.â€

The growing energy storage market offers no shortage of investing opportunities, especially as government subsidies and regulations assist the move towards clean energy. But like other highly competitive markets — such as the semiconductor space in the 1990s — the battery space hasn’t always provided the best return for investors. A number of battery companies have gone bankrupt, underlining the fact that a society-altering product might not reward shareholders.

“Eventually this will come down to some industry leaders who make some money,†JMP Securities’ Joe Osha said. “I think all these companies are going to do a good job of delivering declining prices for [electric vehicle] manufacturers over the course of the next 5-10 years. I am not so sure that they are going to generate great stockholder returns in the process.â€

That said, while it might be tricky to invest in pure-play battery companies, there are opportunities to target companies that stand to benefit from the shift to a low-carbon world. For example, Sunrun is the largest residential solar company in the United States, while NextEra Energy is one of the country’s largest renewable power companies and is currently building out its utility-scale storage.

As scientists alter the chemical makeup of batteries and companies make bets on what could be the next breakthrough technology, Dan Goldman, founder at clean tech-focused venture capital firm Clean Energy Ventures, said that areas like innovative battery management systems are a good bet for investors since they can work with any battery technology.

“Capturing the massive economic opportunity underlying the shift to controls and battery-based energy systems†requires that not only planners, policymakers and regulators but investors “take an ecosystem approach to developing these markets,†researchers from Rocky Mountain Institute wrote in Breakthrough Batteries: Powering the Era of Clean Electrification.

Batteries: the new star of science

Battery technology in its simplest form dates back more than two centuries. The word itself is an umbrella term since batteries come in all shapes and sizes: lead-acid, nickel-iron, nickel-cadmium, nickel-metal hydride, etc.

Lithium-ion batteries — which itself can be a catchall term — were first developed in the 1970s, and first commercialized by Sony in 1991 for the company’s handheld video recorder. They’re now found in everything from iPhones to medical devices to planes to the international space station.

Read full article here: https://www.cnbc.com/2019/12/30/battery-developments-in-the-last-decade-created-a-seismic-shift-that-will-play-out-in-the-next-10-years.html