SPONSOR: Tartisan Nickel (TN:CSE) Kenbridge Property has a measured and indicated resource of 7.14 million tonnes at 0.62% nickel, 0.33% copper. Tartisan also has interests in Peru, including a 20 percent equity stake in Eloro Resources and 2 percent NSR in their La Victoria property. Click her for more information

Fact Sheet

—————————-

Battery Metals Face Looming Supply Crunch

By Mining.com – Jul 25, 2019

- Growing global demand for batteries that power electric vehicles (EVs) and high tech devices is set to cause a supply crunch of lithium, cobalt and nickel by the mid-2020s, global consultancy Wood Mackenzie predicts.

The firm’s latest research shows that sales of passenger EVs, including hybrid electric vehicles (HEV), jumped by more than 24% last year. And while HEVs had the smallest growth, they made up over 60% of EV sales.

WoodMac expects global sales of EVs to account for 7% of all passenger car demand by 2025, 14% by 2030 and 38% by 2040.

“Battery pack sizes continue to trend larger through the medium term, resulting in overall greater battery demand. We have seen the first announcements of the commercialization of NMC 811 cells in EVs,†says Gavin Montgomery, WoodMac research director.

Not surprisingly, Montgomery notes, China was the first market mover, but a number of other nations and companies are moving towards mass production of 811 cells before the end the year.

South Korea’s SK Innovation is already in talks to set up separate battery-making joint ventures with Volkswagen AG and Chinese partners, as part of the petrochemicals producer’s aggressive plans to tap into the EV market.

“While still conservative on mass-market uptake for [811 cells], we are more optimistic in regards to adoption. As such, we expect to see an increased nickel demand at the expense of cobalt, and to a lesser extent, lithium,†the analyst says.

Most carmakers, including Volkswagen, Ford Motor, Toyota and BMW have already stated they would go completely electric by 2050. Related: Another Surprising Industry Falls Victim To Ongoing Trade War Chaos

WoodMac warns that, unless battery technology is developed, tested, commercialized, manufactured and integrated into EVs and their supply chains faster than ever before, it will be impossible for many EV targets and ICE (Internal Combustion Engines) bans to be achieved. “This will pose issues for current EV adoption rate projections,†Montgomery says.

Lithium prices to fall further

Over the past year, spot prices for lithium carbonate have fallen by just under $7,000 a tonne, affecting top producers and juniors alike.

“This is in an environment where the major brine producers in South America have failed to ramp up capacity. Clearly, the first responders to the lithium boom– Australian hard rock mines – have the capability to quickly deliver the required tonnages. Meanwhile, the bottleneck in Chinese conversion capacity that was supporting prices is giving way as China emerges as a net exporter of lithium chemicals to the region.

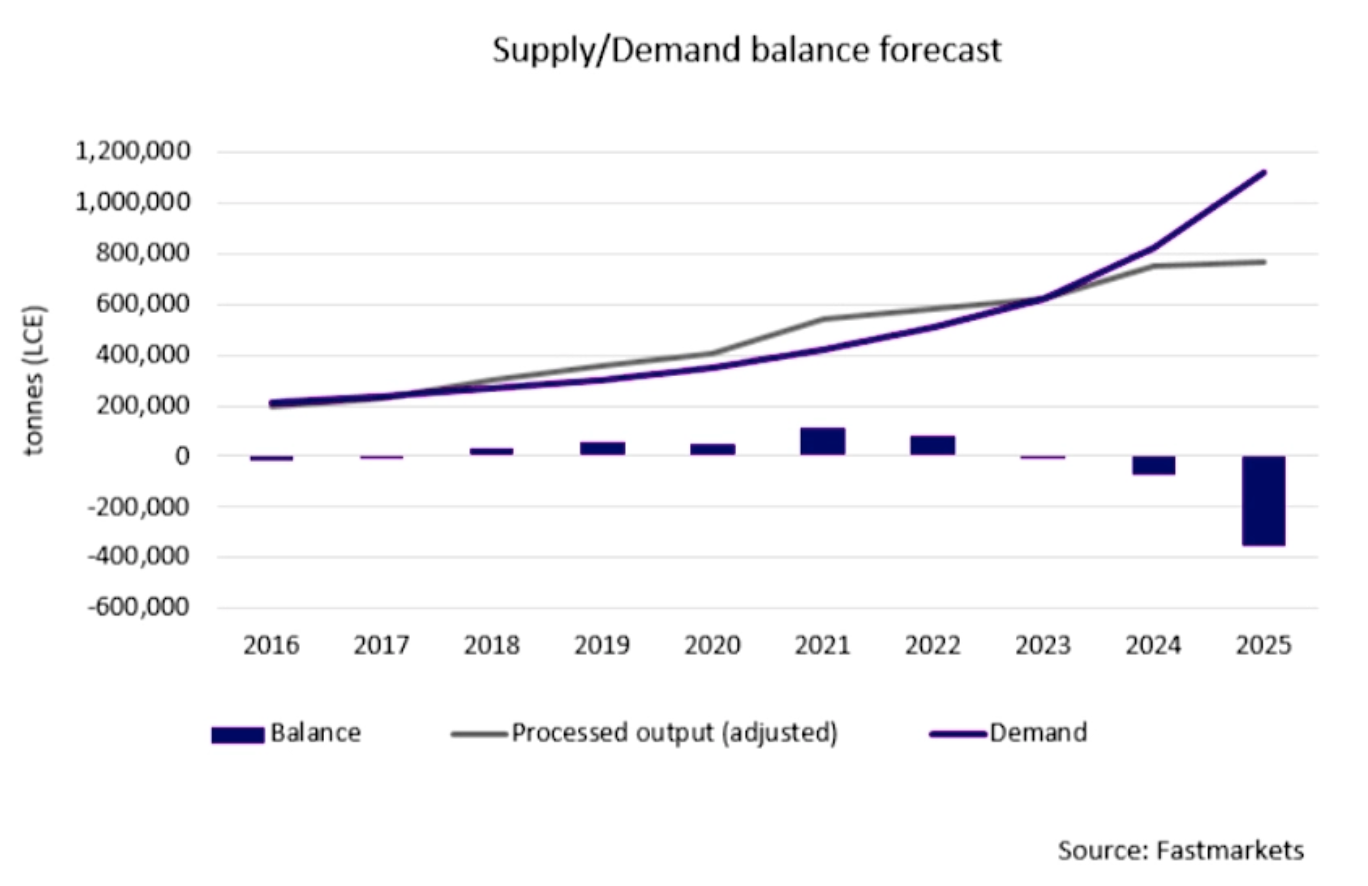

(Click to enlarge)

Expected strong lithium demand will not be able to offset a decline in prices, even though the need for the commodity from battery makers alone will jump 650% by 2027.

“It has only taken a few years for the battery sector to become the largest demand driver for lithium. Lithium’s use in every lithium-ion battery type means it will have double-digit annual growth, making up over 80% of total lithium demand by 2030,†Montgomery adds. The study also reveals that the cobalt market will see an oversupply of intermediate products such as hydroxide until at least 2024.

The firm also suggests that investment in new nickel projects are needed now as mines can take up to 10 years to develop.

By Mining.com

Source: https://safehaven.com/commodities/industrial-metals/Battery-Metals-Face-Looming-Supply-Crunch.html