(NAM:TSXV)

A Green Metals Company

- New Age Metals has two divisions which focus on the exploration and development of green metals: Platinum Group Metals and Lithium

i.) PGM Division: focus on development of the 100% owned River Valley PGM Project.

ii.) Lithium Canada: focus on exploration of hard rock lithium, in Manitoba, Canada.

- Eric Sprott is a strategic shareholder and has an 18.56% ownership of the Company’s current issued and outstanding shares on a post conversion beneficial ownership basis

PGM DIVISION – River Valley PGM Project near Sudbury, ON

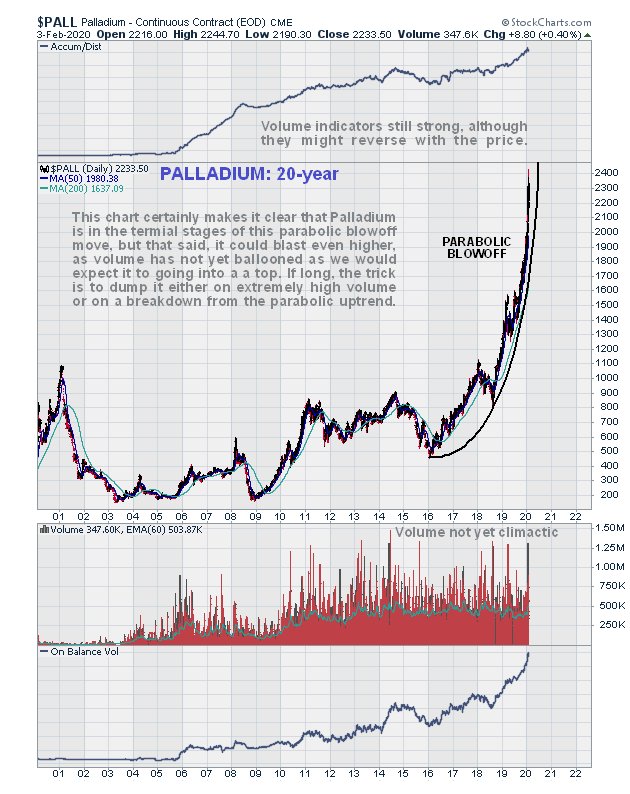

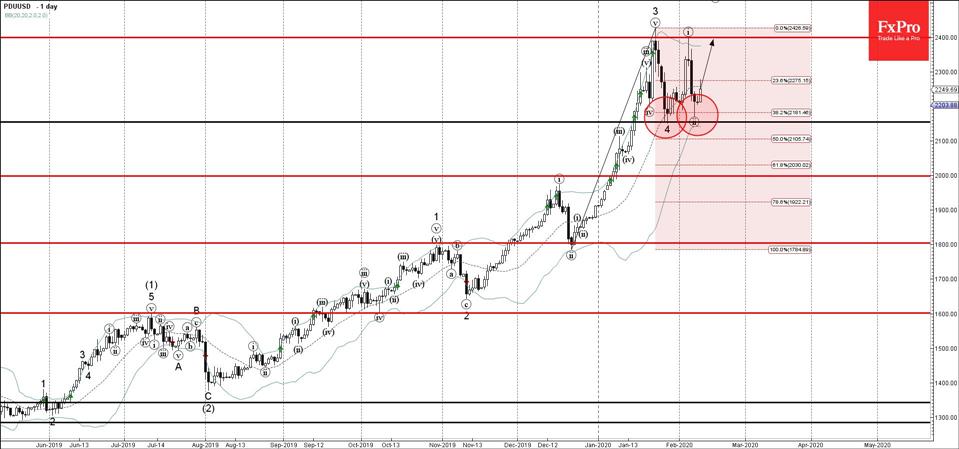

- Largest 100% owned undeveloped primary PGM project in North America, Palladium is the main payable metal accounting for 65% of revenue stream based on 2019 PEA.

- 1:0.4 (Pd:Pt).

- Excellent infrastructure and within 100 kilometers of the Sudbury Metallurgical Complex.

- NI 43-101 Mineral Resource Estimation Q1 2019.

- PEA Q3 2019.

- 2020 plan to follow up on PEA recommendations.

Preliminary Economic Assessment demonstrates positive economics for a large-scale open pit mining operation.

PEA Highlights (CDN$):

- Life of mine (LOM) of 14 years, with 6 million tonnes annually of potential process plant feed at an average grade of 0.88 g/t Palladium Equivalent (PdEq) and process recovery rate of 80%, resulting in an annual average payable PdEq production of 119,000 ounces.

- Pre-Production capital requirements: $495 M.

- Undiscounted cash flow before income and mining taxes of $586M.

- Undiscounted cash flow after income and mining taxes of $384M.

- Average unit operating cost of $19.50/tonne over the life-of-mine.

- Potential for up to 325 jobs at the peak of production.

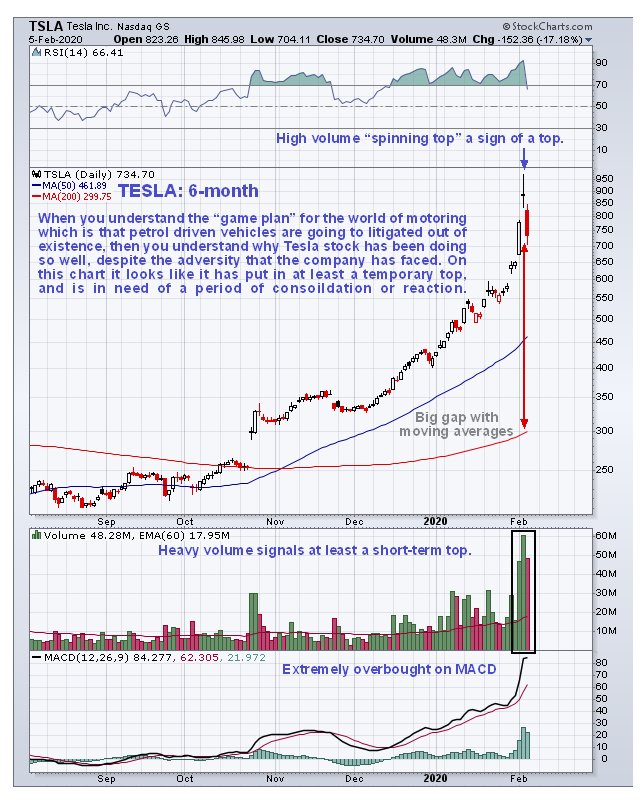

- Using March 11, 2020 spot Palladium price (US$2,275/oz) River Valley Project After-tax IRR is 30% and After-tax NPV (5%) is $C858M.

Figure 1: River Valley Project site map including results from the 2019 Mineral Resource Estimate by zone.2020 River Valley Project Exploration & Development Plan

Management has developed a three-phase exploration and development plan for the balance of 2020.

- Phase One will focus on drilling to expand the boundaries of the Pine Zone discovery and to generate rhodium data for future mineral resource estimations.

- Phase Two will involve drill testing further geophysical targets in the Northern area of the project, identified in the 2017/2018 induced polarization surveys. The target areas to be drill tested in this program are outlined in Figure 1.

- Finally, Phase 3 will be focused on metallurgy – with the primary objective being to improve process recoveries of platinum metals, particularly palladium and including rhodium. We plan to start Phase 1 in early Q2-2020.

- Note that each phase is contingent on success from the previous phase.

PGM DIVISION – Genesis PGM-Cu-Ni Project in Alaska

On April 18, 2018 New Age Metals acquired the Genesis Platinum Group Metals Project.

Figure 3: Genesis Project location map. The road accessible Genesis PGM-Cu-Ni Project adjacent to Richardson Highway and 138 kv electric lines. The project is 460 road kilometers to Fairbanks, Alaska and 120 road kilometers to the all-weather port city of Valdez

- The Genesis project’s PGM-Cu-Ni mineralization is hosted in the Tonsina mafic-ultramafic complex, an undrilled, virtually unexplored layered mafic-ultramafic complex. Recent petrology indicates the Genesis mineralization is similar to the Stillwater and Great Dyke complexes.

- Known PGM mineralization covers a distance of 9 km across the prospect.

- The Genesis PGM-Cu-Ni Project is an under explored, highly prospective multi-prospect drill ready property that warrants follow-up drilling, additional surface mapping, sampling to expand the known footprint of mineralization and to determine the ultimate size and grade of the layered mineralization outlined to date.

- The stable land status, ease of access and superb infrastructure make this project prospective for year-around exploration, development and production.

- Summer 2019 exploration efforts doubled the strike length of prospective mineralization at our road accessible Genesis PGM-Ni-Cu Project in Alaska.

- Currently, New Age is seeking an Option/Joint Venture Partner to assist in the exploration and development of this project.

- Drill ready PGM-Ni-Cu reef style target with 2.4 grams/ton Palladium (Pd), 2.4 grams/ton Platinum (Pt), 0.96% Nickel (Ni), and 0.58% Copper (Cu).

- Reef mineralization is open to the west, east, north, and at depth

- Mineralized reef identified in outcrop for 2000 m along strike and a 40 m true thickness

- Separate style of chromite mineralization contains Platinum Group Metals (PGM) up to 2.5 g/t Pd and 2.8 g/t Pt.

- No historic drilling has been done on the project.

- Project is within 3 km of a paved highway and electric transmission line.

New Age Metals is the largest mineral claim holder in the prolific, Winnipeg River – Cat Lake Pegmatite Field. All of the claims are held by Lithium Canada Development, a 100% owned Lithium Division of New Age Metals. The company presently has eight Lithium Projects in the region which are along strike of the Tanco Pegmatite and the claims encompass several pegmatite groups.

Situated around the Tanco Mine which in 2019 was acquired by Chinese miner Sinomine, the projects are located 140 kilometres northeast of Winnipeg, Manitoba.

- Three of the projects are considered drill ready. Lithium One, Lithium Two and Lithman West

- Active exploration of the claim holdings is ongoing.

- New Age Metals has signed an exploration agreement with the Sagkeeng First Nation in regards to the exploration and development of any of the company’s claims that are located on traditional Sagkeeng territories.

- The Tanco Mine was one of North America’s only producers of Tantalum, Cesium and Lithium minerals (Spodumene), with the mine opening in 1969. Owned by the Cabot Corporation as of 1993 until 2019, when Chinese miner Sinomine purchased from Cabot for US$130M.

- Presently the Tanco Mine produces Cesium Formate, a completion fluid for the petroleum industry.

- Management is actively seeking a qualified and dedicated Option Joint Venture Partner to assist in the exploration and development of these highly prospective projects.