Empower intends to acquire Kai Medical Laboratory, a state-of-the-art diagnostics laboratory located in the medical district of Dallas, TX to advance COVID-19 national testing programs

- Entered into a non-binding term sheet to acquire the business of Kai Medical Laboratory, LLC, by way of a share or asset acquisition, subject to due diligence and customary closing conditions

- Kai Medical Laboratory is a high-complexity CLIA and COLA accredited Laboratory that provides reliable and accurate testing solutions to hospitals, medical clinics, pharmacies, and employer groups

- Kai Medical Laboratory offers a wide array of testing services ranging from hematology to hormone testing, endocrinology, toxicology, and immunology

VANCOUVER, BC / September 1, 2020 / EMPOWER CLINICS INC. (CSE:CBDT) (Frankfurt:8EC) (OTCQB:EPWCF) (“Empower” or the “Company“) today announces it has entered into a non-binding term sheet to acquire the business of Kai Medical Laboratory, LLC (“Kai Medical Laboratory“), by way of a share or asset acquisition, subject to due diligence and customary closing conditions.

Kai Medical Laboratory is a high-complexity CLIA and COLA accredited Laboratory that provides reliable and accurate testing solutions to hospitals, medical clinics, pharmacies, and employer groups. Kai Medical Laboratory offers a wide array of testing services ranging from hematology to hormone testing, endocrinology, toxicology, and immunology. These tests are done under the supervision of its well-qualified and highly experienced scientists, medical professionals, and pharmacists. https://www.kaimedicallaboratory.com

Kai Medical Laboratory has taken an active role in COVID-19 testing, battling the pandemic through RT-PCR testing and serology testing. While the RT-PCR test identifies if a patient has an active virus, the serology or antibody test detects if a patient has previously been exposed to the virus. Both of these test results are vital to managing outbreaks and the potential spread of coronavirus.

To further assist with COVID-19 testing, Kai Medical Laboratory has also developed two key programs in Texas and Arizona. The first program is a direct-to-consumer program that leverages the ability of various healthcare providers to order and administer both the RT-PCR test and the Antibody test. This increases the ability of the general population to be tested, in certain circumstances. The second is an Employer COVID-19 Compliance Program (ECCP) for business owners and employer groups to enable them to test and monitor their employees.

Texas program https://www.testtexasnow.com

Arizona program https://www.covidtest2u.com

Currently the lab has the capacity to complete in excess of 2,000 RT-PCR tests in one eight-hour shift by utilizing its Thermo Fisher QuantStudio 12k Flex testing machine. The lab also utilizes a Roche Cobas 6000 for COVID-19 Antibody testing, ensuring that Kai Medical Laboratory has the capability and capacity to serve a broad range of clients and test methods.

“Adding Kai Medical Laboratory to the Empower Clinics family enables us to dramatically expand COVID-19 testing capability and deliver phase four of our national rollout plan” said Steven McAuley, Empower’s Chairman & CEO. “Kai Medical has a newly built high-complexity lab offering a wide array of testing services, that together we will leverage to serve the massive demand for national COVID testing in the U.S. Further, as flu season arrives and a potential second-wave of COVID takes hold, the technical infrastructure of Kai Medical allows Empower to capture testing demand and the additional growth revenues associated with it.”

The driving force behind Kai Medical Laboratory’s remarkable growth and success is Yoshi Tyler. Yoshi has a passion for being an entrepreneur, and overtime, she found her true calling in healthcare. Driven by this interest, she pursued her career in the healthcare industry for more than two decades. She helmed leadership positions at a Fortune 500 pharmaceutical company for over thirteen years. These leadership experiences provided her with in-depth knowledge and industry insights that helped her to lead Kai Medical Laboratory towards growth.

The Kai Medical Laboratory team includes key roles including Principal Scientist, Director of Operations, Molecular Scientist, Quality Assurance, Lab Director and other critical roles.

“Kai Medical Laboratory is inspired by science and built on integrity. Our mission is to change healthcare through science & innovative quality care by providing value-added services, accuracy, and consistency. Our unwavering commitment to quality compliance and scientific innovation elevates Kai Medical Laboratory to a new standard in healthcare,” says Yoshi Tyler, the owner, and CEO of the company.

The proposed acquisition includes an 8,000 sq. ft. medical laboratory including covered drive up testing center, with premium testing and laboratory equipment, cash and current assets with a value in excess of $1,750,000.00 USD and a corporate office, both located in the heart of the medical district in Dallas, TX. Under the proposed terms Empower will assume a $1,200,000.00 USD Small Business Administration (SBA) equipment loan, a $150,000.00 SBA Economic Injury Disaster Loan and short-term liabilities of up to $250,000.00 at closing. In addition, Empower will issue 1,000,000 Company stock options to the Vendors, subject to the terms and conditions as set out in the Company Stock Option Plan.

Market Leading Technology Kai Medical Laboratory utilizes state-of-the-art instrumentation, preeminent testing methodologies, and laboratory services enabling high-complexity accredited laboratory testing solutions, providing some of the following key instrument testing capabilities:

- Thermo Fisher – QuantStudio 12K Flex

- COVID-19 testing

- Cannabis Testing

- Clinical Genomics

- Roche Cobas 6000

- COVID-19 Antibody testing

- Clinical Chemistry/Endocrinology

- AB SCIEX 6500+ – Liquid Chromatography Mass Spectrometry

- Clinical Chemistry/Endocrinology

- Agriculture/Cannabis testing

- AB SCIEX 4500 – Liquid Chromatography Mass Spectrometry

- Urine Toxicology

- Cannabis testing

- SYSMEX XN-550

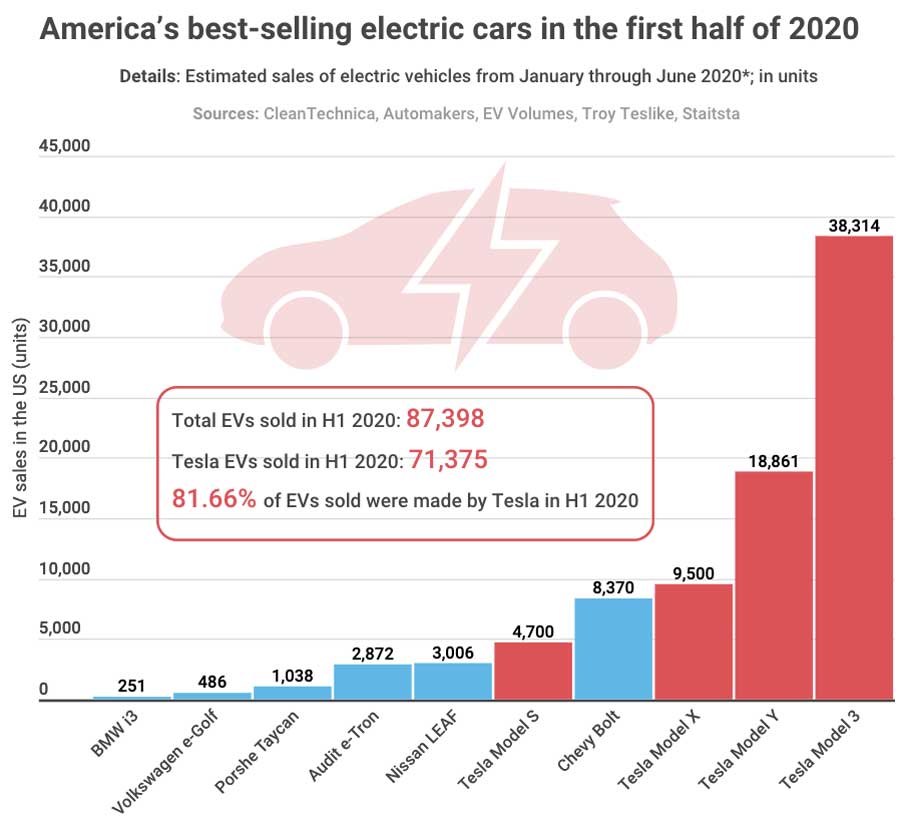

USA COVID-19 Data as at August 31, 2020

TOTAL CASES: 5,972,356

TOTAL DEATHS: 182,622

CASES IN LAST 7 DAYS: 289,865

ARIZONA as at August 31, 2020

CONFIRMED CASES: 199,984

PROBABLE CASES: 1,713

TOTAL CASES: 201,661

CASES IN LAST 7 DAYS: 3,558

CASES/100K: 1,769

DEATHS/100K: 70

TEXAS as at August 31, 2020

TOTAL CASES: 610,354

CASES IN LAST 7 DAYS: 32,817

CASES/100K: 2,126

DEATHS/100K: 46

(CLIA) The Clinical Laboratory Improvement Amendments regulate laboratory testing and require clinical laboratories to be certified by the Center for Medicare and Medicaid Services (CMS) before they can accept human samples for diagnostic testing.

(COLA) is the premier clinical laboratory accreditation, education and consultation organization. An independent accreditor whose practical, educational standards have a positive and immediate impact on patient care. http://www.cola.org

The transaction is expected to be structured on a tax efficient basis, and otherwise in accordance with the requirements of requisite securities laws and the policies of the CSE. Empower has agreed to enter into employment agreements with Yoshi Tyler and Michael Haines, each having an initial term of two years.

Completion of the transaction will be subject to various conditions, including entry into a definitive agreement, completion of due diligence, and receipt of all required shareholder, manager, third party and regulatory approvals, including approval of the CSE. Closing of the transaction is expected to occur prior to October 15, 2020.

ABOUT EMPOWER

Empower is a vertically integrated health & wellness company with a network of corporate and franchised health & wellness clinics in the U.S. The Company is focused on helping patients improve and protect their health, through innovative physician recommended treatment options. The Company has launched Dosed Wellness Ltd. to connect its significant data, to the potential of the efficacy of alternative treatment options related to hemp-derived cannabidiol (CBD) therapies, psilocybin and other psychedelic plant-based treatment options. The Company provides COVID-19 testing services to consumers and businesses as part of a four-phased nationwide testing initiative.

ABOUT KAI MEDICAL LABORATORY

Our mission is to change healthcare through science & innovative quality care by providing value added services, accuracy, and consistency. Our unwavering commitment to quality compliance and scientific innovation elevates Kai Medical Laboratory to a new standard in patient care. Kai Medical Laboratory is located in the Dallas Medical District in close proximity to some of the largest healthcare groups in the U.S. including Parkland Hospital, UT Southwestern, Children’s Medical Center, Baylor Scott & White Health (Dallas), Tenet Healthcare (Dallas), CHRISTUS Healthcare (Dallas).

ON BEHALF OF THE BOARD OF DIRECTORS:

Steven McAuley

Chief Executive Officer

CONTACTS:

Investors: Dustin Klein

Director

[email protected]

720-352-1398

Investors: Steven McAuley

CEO

[email protected]

604-789-2146

DISCLAIMER FOR FORWARD-LOOKING STATEMENTS

This news release contains certain “forward-looking statements” or “forward-looking information” (collectively “forward looking statements”) within the meaning of applicable Canadian securities laws. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release.Forward-looking statements can frequently be identified by words such as “plans”, “continues”, “expects”, “projects”, “intends”, “believes”, “anticipates”, “estimates”, “may”, “will”, “potential”, “proposed” and other similar words, or information that certain events or conditions “may” or “will” occur. Forward-looking statements in this news release include, but are not limited to, statements regarding: the expected benefits to the Company and its shareholders as a result of the proposed acquisition of Sun Valley; the proposed transaction terms; the expected number of clinics and patients following the closing; the future potential success of Sun Valley’s franchise model; the anticipated date of closing of the acquisition and the occurrence thereof; and that the Company will be positioned to be a market-leading service provider for complex patient requirements in 2019 and beyond. Such statements are only projections, are based on assumptions known to management at this time, and are subject to risks and uncertainties that may cause actual results, performance or developments to differ materially from those contained in the forward-looking statements, including: that the Kai Medical Laboratory acquisition may not be completed on the terms expected or at all; that the Company’s products may not work as expected; that the Company may not be able to expand COVID-19 testing; that legislative changes may have an adverse affect on the Company’s business and product development; that the Company may not be able to obtain adequate financing to pursue its business plan; general business, economic, competitive, political and social uncertainties; failure to obtain any necessary approvals in connection with the proposed transaction; and other factors beyond the Company’s control. No assurance can be given that any of the events anticipated by the forward-looking statements will occur or, if they do occur, what benefits the Company will obtain from them. Readers are cautioned not to place undue reliance on the forward-looking statements in this release, which are qualified in their entirety by these cautionary statements. The Company is under no obligation, and expressly disclaims any intention or obligation, to update or revise any forward-looking statements in this release, whether as a result of new information, future events or otherwise, except as expressly required by applicable laws.

SOURCE: Empower Clinics Inc.