AGORACOM Chief Commentator, Peter Grandich, believes we are in a secular bear market – but doesn’t believe it will resume until the Dow gets to at least 10,500.

My friend and Top 10 Financial Blogger Barry Ritholtz also believes we are in a secular bear market but sees the current rallying continuing until as high as 11,500. In a must read post, he discusses the key factors that have been contributing to, and may continue adding to, the ongoing rally. More than just lip service, I’ve provided 2 of his great data pieces to look atbelow .

At the same point, it should also be pointed out that both are bullish on gold. Peter’s position is no secret – but Barry’s confirmation lends significant further support to gold bulls. Specifically, Barry stated:

As I mentioned in an article this summer, you can look for a close of GLD over $100

and spot Gold over 1032 highs to get long or add to your position (Ideally,a close over 1050).

As we know, Gold smashed through both $1,032 and $1,050.

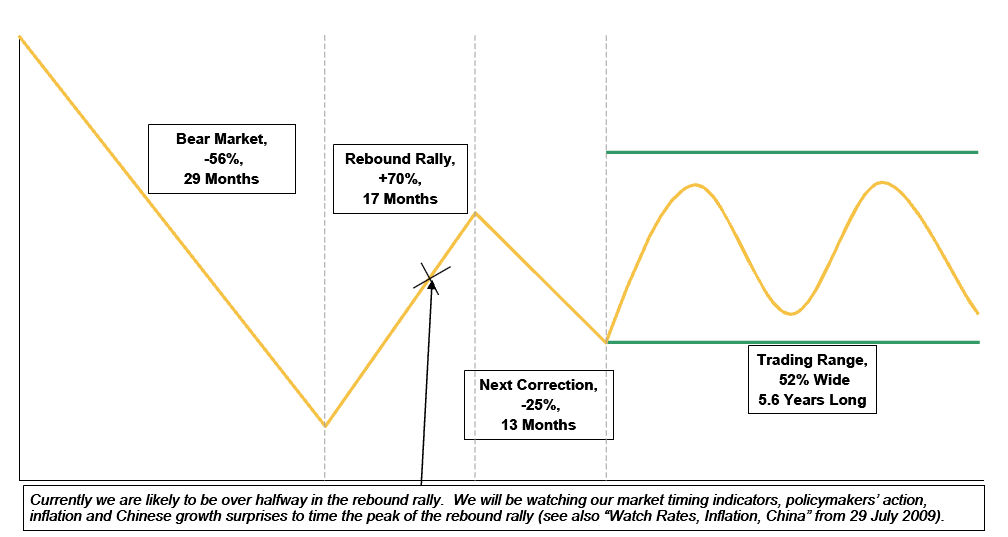

1]Â Composite Of 29 Secular Bear Markets

I love this data because it is a compilation of 29 secular bear markets, as opposed to those that try and simply compare today’s markets to the Crash of 1929 – 1932. Barry’s notes in the graph make his point very clear. “X” marks the spot that we are currently at: (click on it to see a larger version if necessary):

2]Â 11,500 As The Typical Recessionary Sell Off Point

Barry demonstrates that 11,500 was the level we should have reached for a typical recessionary sell off – and that the next 5,000 points was the “end of the world” panic sell-off. As such, we should get back to 11, 500 before real resistance starts to settle in. Again, click on the chart for a larger image:

OK, then. See you all at 11,500.

Regards,

George