By Dr. Allen Alper

on 4/5/2015

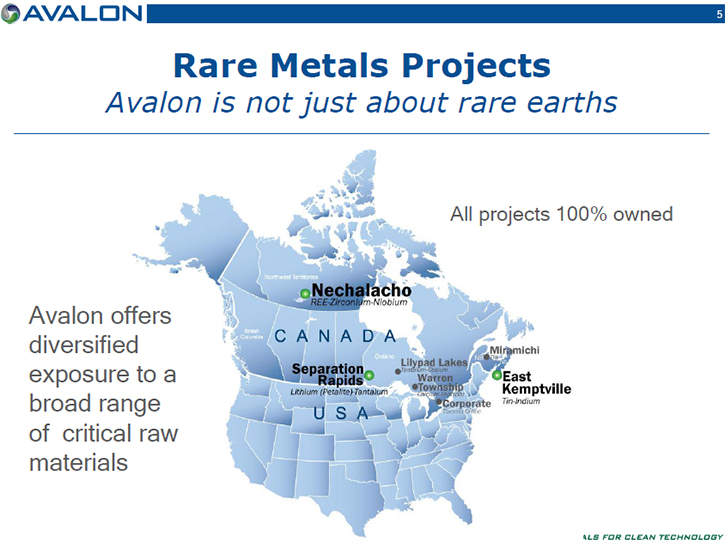

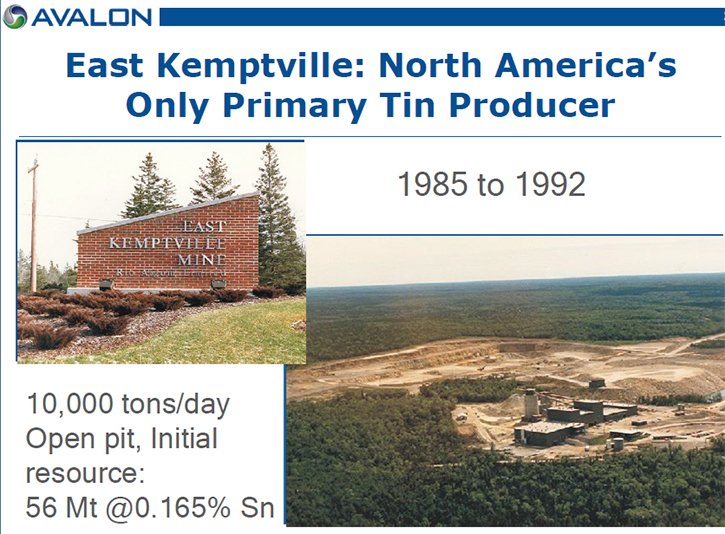

Avalon Rare Metals (TSX and NYSE MKT: AVL) is currently pursuing three advanced projects that consist of critical raw materials such as heavy rare earths, tin and lithium at several different locations in Canada. Their Nechalacho Project contains exceptional heavy rare earth enrichment. Their East Kemptville Project was North America’s only primary tin producer with a significant unmined resource awaiting renewed production. Separation Rapids is the largest undeveloped petalite deposit in the world, a unique high-purity lithium mineral used in glass-ceramics.Â

Don Bubar, President and CEO of Avalon Rare Metals (TSX and NYSE MKT: AVL), took a few minutes to speak with Metals News while visiting the PDAC 2015. He said, “We have a number of things going on. As you know, we have been known mainly as a rare earth story for the last six or seven years. The rare earth market has gone quiet since the big spike we saw in prices in 2010 and 2011. It has also gone quiet in terms of investor interest in Avalon. But we are well positioned to ‘hit the pause button’ until investor interest returns because we have completed our feasibility study and all of the related work at the Nechalacho project site in the Northwest Territories.â€Â

The pause at Nechalacho allows the company to focus on its two other advanced projects. Said Bubar, “We wanted to redirect our energies to where there is more interest in the underlying commodities and we have two other such projects in our portfolio – our Separation Rapids lithium project in Ontario and our East Kemptville tin project in Nova Scotia. Both of these are advanced projects and both tin and lithium are seeing more market interest than the rare earths are at the present time. So we are diverting our attention to those projects for the time being until we see some renewed interest in rare earths.â€Â

Nechalacho is still a critical part of the company’s long term plan. Mr. Bubar said, “For Nechalacho, it has always been about the heavy rare earth enrichment of the deposit. As all of your readers know, the more advanced projects like those in California and Australia are dominantly light rare earth deposits. The need in the market for additional supply outside China is for the heavy rare earths, which Nechalacho has always been in a position to offer with its relatively high grade resource. We remain the most advanced heavy rare earth development project outside of China.â€Â

Â

Â

The other projects on which Avalon is focused expose them to the tin and lithium markets which are seeing increasing demand and prices. Said Bubar, “In terms of the other projects, East Kemptville was a producing tin mine in the late 1980’s. It was North America’s only primary tin producer and it only closed down in 1992 because of a collapse in tin prices at the time which was related to the international tin cartel being disbanded, but most of the reserves they identified originally were never mined. Since then, there has been a fundamental change in the tin market. Now the demand is mainly related to a new use in lead-free solders, primarily for electronics applications and now accounts for over 50% of global demand. We have seen steadily rising prices over the last ten years or so and all the analysts are projecting that there is likely to be a deficit in the tin market over the next few years as in the face of diminishing supplies. Lots of people are aware of that. The advantage that East Kemptville has is that, as a brownfields site, it offers a potentially shorter timeline to production. Most of the work to be done is around managing the existing environmental liability that is related to the past operation, then pumping out the pit and building a new mill. If all goes well, we could be in production there in as little as three years which is relatively fast given the timelines that are typically associated with bringing a new greenfields project online. We just published a new economic study – we called it a conceptual redevelopment study – to confirm that there is a sufficiently strong business case to move forward with further work there. The study produced a Capex estimate of about $200 million Canadian.â€Â

Â

Â

The project also benefits from excellent infrastructure. Said Bubar, “There is a paved road and grid electrical power to the site. There is a community about 50 kilometers away that would welcome some new jobs in this economically- depressed part of the province. The study estimated it would generate 187 full-time jobs. Because we haven’t done quite enough metallurgical work to produce a NI 43-101 compliant PEA, investors will have to wait for the next iteration in order to see the details of the economic model. But we did disclose that the project can generate a healthy operating margin with annual revenues forecast to be double annual operating costs. â€Â

Mr. Bubar said, “Our next steps are doing definition drilling on the deposit to bring more of the resource from the inferred category to the indicated category and to recover a bulk sample for metallurgical testing and flow-sheet design. There is also lots of room to expand the resource. Right now, our mineral tenure there is held under a special license which is up for renewal right now. Then we have to work through the process to secure full surface tenure from the surface rights owners before we can move into feasibility study work. We anticipate that will happen in 2015. Basically, this is an asset that we have had in the background for ten years, but have not had the opportunity to move forward until now.â€Â

As the company adds new projects, Avalon still wants to remain on the rare earth stage. Said Bubar, “Avalon still trades primarily as a rare earth company. As we move East Kemptville forward and tin gets more recognition in the marketplace we should see East Kemptville start to contribute to our market valuation.Â

Separation Rapids was our original rare metals project, we acquired in 1996 not long after I started running Avalon.Â

Â

Â

We have held onto it because you have to be opportunistic about bringing industrial minerals projects like these into production. We now see the market is looking for new supply sources of petalite for glasses and ceramics. That is an ideal situation for us as we are the only potential new supplier of size at the moment. The lithium chemical market is also evolving very quickly because of growing demand for rechargeable batteries. The next step is for us to do more sampling for process development work and prove that we can produce high purity lithium minerals and chemicals for these markets.Â

Over the 20 years I have been running this Company, We have always offered exposure to a broad range of rare metals and minerals, being ready to supply new demand as it arises. We think this diversification of rare metals assets is a good reason to invest in Avalon.â€Â

130 Adelaide St. W, Suite 1901

Toronto, ON M5H 3P5

Tel: (416) 364-4938

Fax: (416) 364-5162

[email protected]

Source: metalsnews.com

Tags: #mining, #smallcapstocks, HREE, REE, tsx