- Announced that further to its news releases dated April 18, 2016 and May 4, 2016 the Company is increasing its previously announced placement from $750,000 to $1,500,000 by way of combined flow-through (“FT”) and non flow-through units.

- Company closed a 1st tranche of this financing raising $461,490

Vancouver, Canada / June 13, 2016 – Pacific North West Capital Corp. (“PFN” and the “Company”) (TSX.V: PFN; Frankfurt: P7J.F; OTCQB: PAWEF) announces that further to its news releases dated April 18, 2016 and May 4, 2016 the Company is increasing its previously announced placement from $750,000 to $1,500,000 by way of combined flow-through (“FT”) and non flow-through (“NFT”) units. The Company closed a 1st tranche of this financing raising $461,490.

Each FT unit will consist of one common share at a price of $0.065 per FT unit and one non flow-through non-transferable share purchase warrant (“Warrant”). Each Warrant will entitle the holder thereof to purchase one additional common share of the Company at an exercise price of $0.10 per share during the first year and $0.20 per share during the second year, for a period of two years from closing,

Each NFT unit will consist of one common share at a price of $0.055 per NFT unit and one non-transferable share purchase warrant (“Warrant”). Each Warrant will entitle the holder thereof to purchase one additional common share of the Company at an exercise price of $0.10 per share during the first year and $0.20 per share during the second year, for a period of two years from closing.

Finder’s fees may be paid in connection with the private placement.

The proceeds of the private placement will be used for the acquisition and exploration of Lithium projects in PFN’s newly formed subsidiary, Lithium Canada Inc., for funding advanced exploration on the company’s 100% owned River Valley PGM project near Sudbury, Ontario, one of the largest undeveloped primary PGM resources in Canada, and for general working capital.

About the Company’s Platinum Group Metals Division

Achievements to date and future plans for River Valley are outlined below as follows:

- 1.PFN currently has 100% ownership in the River Valley Project, subject to a 3% NSR, with options to buy down

- 2.Completed exploration and development programs on the River Valley property include more than 600 holes drilled since year 2000 and several mineral resource estimates and metallurgical studies;

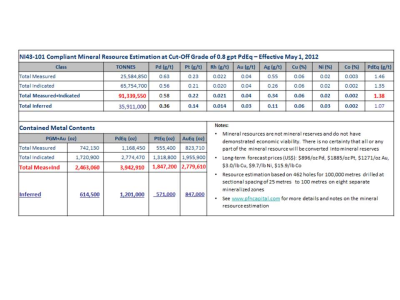

- 3.Results for the current (2012) mineral resource estimate are below;

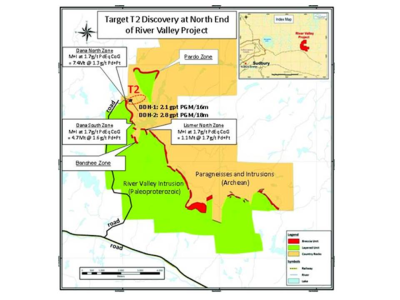

- 4.2015 drill program confirms new high grade T2 discovery

- 5.Exploration and development plans outlined for 2016

- 6.Ongoing strategic partner search for River Valley project

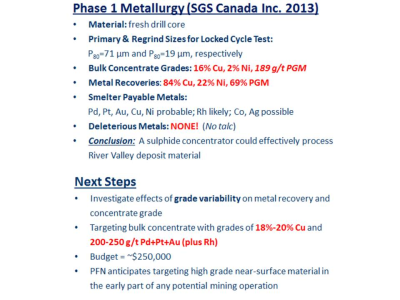

- 7.Results for the most recent Metallurgical Testwork Study are summarized below:

– Prepared by Tetra Tech (Wardrop)

– High Confidence: Measured plus Indicated = 72% of total

– Reported on PdEq basis: Pd=40% & Pt=20% of the payable metals

– Pd to Pt ratio = 2.5:1; Cu to Ni ratio = 3:1

– High Grade potential, particularly in the north part of River Valley deposit

– Resources under evaluation for development potential as open pit mining operation

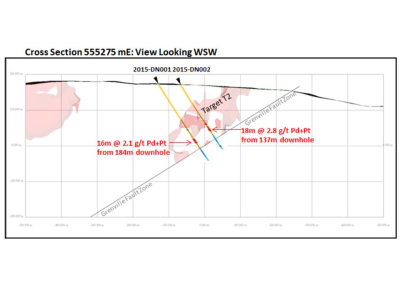

- 8.Results for the 2015 discovery drill program on the T2 target are as follows:

-Drill hole intercepts much higher than the average grade of current mineral resource estimate

-Possible new mineralized zone at the north end of the River Valley deposit

-Show potential to take the River Valley PGM Project in a new direction

-More drilling required

- 9. Exploration and Development Plans for 2016

- ??Mineral prospecting and geological mapping on surface

- ??Drill programs targeted to add more higher grade

- ??Geological interpretation and 2D/3D modelling of all drill and surface results

- ??Application to the OPA’s Junior Exploration Assistance Program (JEAP) for 33% refund of all exploration expenditures up to $300,000.

- ??Strategic Partner Search for River Valley

QUALIFIED PERSON

The contents contained herein that relates to Exploration Results or Mineral Resources is based on information compiled, reviewed or prepared by Dr. Bill Stone, Principal Consulting Geoscientist for Pacific Northwest Capital. Dr. Stone is the Qualified Person as defined by National Instrument 43-101 and has reviewed and approved the technical content.

On behalf of the Board of Directors

” Harry Barr ”

Harry Barr

Chairman and CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward Looking Statements. This release contains forward-looking statements that involve risks and uncertainties. These statements may differ materially from actual future events or results and are based on current expectations or beliefs. For this purpose, statements of historical fact may be deemed to be forward-looking statements. In addition, forward-looking statements include statements in which the Company uses words such as “continue”, “efforts”, “expect”, “believe”, “anticipate”, “confident”, “intend”, “strategy”, “plan”, “will”, “estimate”, “project”, “goal”, “target”, “prospects”, “optimistic” or similar expressions. These statements by their nature involve risks and uncertainties, and actual results may differ materially depending on a variety of important factors, including, among others, the Company’s ability and continuation of efforts to timely and completely make available adequate current public information, additional or different regulatory and legal requirements and restrictions that may be imposed, and other factors as may be discussed in the documents filed by the Company on SEDAR (www.sedar.com), including the most recent reports that identify important risk factors that could cause actual results to differ from those contained in the forward-looking statements. The Company does not undertake any obligation to review or confirm analysts’ expectations or estimates or to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Investors should not place undue reliance on forward-looking statements.

Tags: #mining, #smallcapstocks, $TSXV, lithium, PGM