- Signed a non-binding Letter of Intent (“LOI”) with Azincourt Energy Corp (TSX-V: AAZ)

- Azincourt to acquire up to a 60% interest with the potential to 100%, in Lithium Canada Development (LCD)

New Age Metals Inc. (TSX.V: NAM; OTCQB: PAWEF; FSE: P7J.F) is pleased to announce that it has signed a non-binding Letter of Intent (“LOI”) with Azincourt Energy Corp (“Azincourt”) (TSX-V: AAZ). The LOI allows for Azincourt (NR – Dec 11th, 2017) to acquire up to a 60% interest with the potential to 100%, in Lithium Canada Development (LCD) and/or its equal interest in the individual projects. New Age Metals retains the option of entering into a joint-venture agreement with Azincourt for the remaining 40%.

“We are pleased to partner with Azincourt Energy on our Lithium properties. This agreement accomplishes another milestone in 2017 for New Age Metals, which was to find a joint-venture partner for our Lithium Division. When completed, this option joint venture allows management to focus on the continued development of our 100% owned River Valley Project, which is Canada’s largest undeveloped primary PGM Deposit” Harry Barr, Chairman/CEO.

Terms of the LOI/Agreement

Under the terms of the LOI, Azincourt has paid NAM $10,000 and further agrees to pay $200,000 to New Age Metals (NAM) in exchange for a 60% ownership stake of NAMs 100% owned subsidiary Lithium Canada Developments (LCD). This payment of $200,000 will be made by Azincourt in four equal payments over the next 18 months. In addition to this cash payment Azincourt will issue up to 1,000,000 shares to NAM, staged in four equal installments, by the third anniversary of the signing of the definitive agreement. Azincourt has further committed to work expenditures totaling $2.85 million over 3 years, broken down as follows: $500,000 year one, $600,000 year two, $1million year three plus an additional $750,000 to reach the 60% threshold.Upon completion of all stock, property expenditures and cash payments AAZ will also issue a 2% net smelter royalty on all five of the projects to NAM.

Under terms of the non-binding LOI the Company must complete its due diligence and enter into a definitive agreement no later than January 15, 2018.

To earn 100%, Azincourt must meet additional requirements. Within 90 days of Azincourt earning its 60% in LCD or the projects, NAM has to the option to enter into a joint venture on a 60% AAZ/40% NAM basis using a standard Canadian Junior Mining joint venture agreement.

In the event NAM does not elect to enter into the above-mentioned option, then Azincourt must issue an additional 1,000,000 shares to NAM within 15 days of NAM electing not to participate in the Joint Venture. Azincourt must also expend an additional $1 million dollars by Oct 30, 2022 (for a total of $3.85 million), on any of the projects it elects to so long as all projects are in good standing. In the event the Company does not make the $1 million expenditure AAZ percentage will remain at 60%.

All securities issued in connection with the property option will be subject to a four-month-and one-day statutory hold period. The property option remains subject to a number of conditions, including negotiation of definitive agreements, approval of the TSX Venture Exchange, and such other conditions as are customary in transactions of this nature.

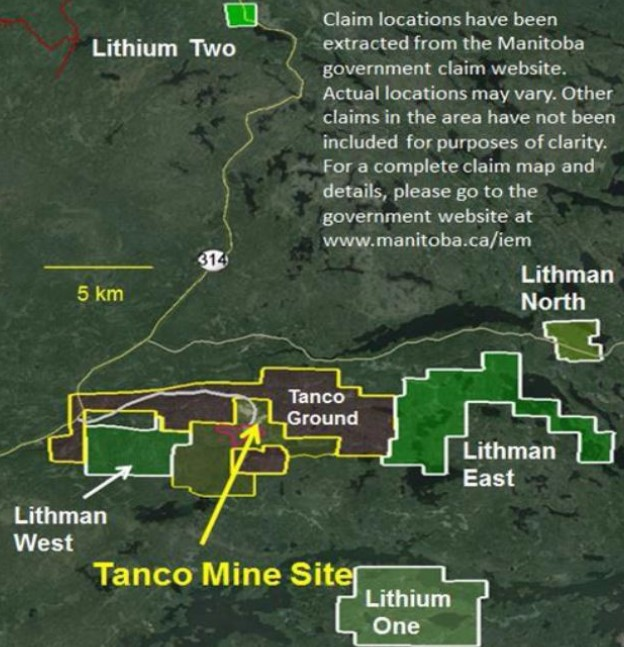

The agreement covers the Lithium One, Lithium Two, Lithman West, Lithman East and Lithman North projects. The land package included in this agreement represents the largest mineral claim holding for Lithium Projects in the Winnipeg River Pegmatite Field with over 6000 hectares of ground. This represents approximately 64 square kilometres of mineral claim coverage.

Figure 1: Projects Location Map

The Winnipeg River Pegmatite Field is host to numerous Lithium-rich Pegmatites in addition to the world-class Tanco Pegmatite, a highly fractionated lithium-cesium-tantalum (LCT) type pegmatite that has been mined at the Tanco Mine as an underground operation since 1969 for Tantalum, Spodumene (a lithium mineral) and cesium (Cs).

Three of the five projects are drill ready:

Lithium Two Project

-Field work in 2016 confirmed that the Eagle and FD5 Pegmatites contained spodumene at surface

-Highest grade surface samples from the Eagle Pegmatite returned 3.04% Li2O and 2.08% Li2O from the FD5

-The Eagle Pegmatite is ~1100 meters in length and up to 12 meters wide

-Historic drilling from 1947 defined 545,000 tonnes of 1.4% Li2O, drilled to a depth of 60 meters (non-compliant 43-101)

-Pegmatite is open to depth

-Adjacent to Quantum Minerals Corp (TSX.V: QMC) Cat Lake Lithium Project (aka Irgon Lithium Mine)

-Several drill ready targets

Lithium One Project

-Field work in 2016 sampled several historical Pegmatites

-Highest grade surface assay results were 4.33% Li2O and 0.04% Ta2O5 from the Silverleaf Pegmatite

-Several of the other Pegmatites in the project area yielded Lithium values from Lepidolite and Spodumene

-Approximately 40 Pegmatites are estimated to exist north of Greer Lake with around 100 to the south of the lake

-The Silverleaf Pegmatite was excavated for Spodumene in the 1920’s, with surface exposure of 80 m X 45 m

-Several drill ready targets

Lithman West Project

-Historical rock and soil geochemical anomalies

-Anomalies have not been drill tested

-Drill ready

The Lithman West and East projects are adjacent to the Tanco Mine Mineral Leases.

The additional projects contained in this agreement, Lithman East (adjacent to Tanco) and Lithman North, represent prospective exploration areas that require additional ground work to determine drill targets.

About Azincourt Energy Corp

Azincourt Energy Corp. is a Canadian-based resource company specializing in the strategic acquisition, exploration and development of alternative energy/fuel projects, focusing on uranium, lithium, cobalt, and other critical energy & fuel elements.

ABOUT NAM’S PGM DIVISION

NAM’s flagship project is its 100% owned River Valley PGM Project (NAM Website – River Valley Project) in the Sudbury Mining District of Northern Ontario (100 km east of Sudbury, Ontario). Presently the River Valley Project is Canada’s largest undeveloped primary PGM deposit with Measured + Indicated resources of 91 million tonnes @ 0.58 g/t Palladium, 0.22 g/t Platinum, 0.04 g/t Gold, at a cut-off grade of 0.8 g/t PdEq for 2,463,000 ounces PGM plus Gold.This equates to 3,942,910 PdEq ounces. The River Valley PGM-Copper-Nickel Sulphide mineralized zones remains open to expansion. The company has recently completed a drill program on the Pine and T3 Zones.

In 2016, the Company acquired the River Valley extension property from Mustang Minerals which added approximately 4 kilometres to the project’s mineralized strike length to the southern portion of the intrusion.

ABOUT NAM’S LITHIUM DIVISION

The Company has five pegmatite hosted Lithium Projects in the Winnipeg River Pegmatite Field, located in SE Manitoba. Three of the projects are drill ready. This Pegmatite Field hosts the world class Tanco Pegmatite that has been mined for Tantalum, Cesium and Spodumene (one of the primary Lithium ore minerals) in varying capacities, since 1969. NAM’s Lithium Projects are strategically situated in this prolific Pegmatite Field. Presently, NAM is one of the largest mineral claim holders of Lithium Projects in the Winnipeg River Pegmatite Field and is seeking JV partners to further develop the company’s Li division.

QUALIFIED PERSON

The contents contained herein that relate to Exploration Results or Mineral Resources is based on information compiled, reviewed or prepared by Carey Galeschuk, a consulting geoscientist for New Age Metals. Mr. Galeschuk is the Qualified Person as defined by National Instrument 43-101 and has reviewed and approved the technical content of this news release.

On behalf of the Board of Directors

“Harry Barr”

Harry G. Barr

Chairman and CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Tags: #mining, #smallcapstocks, $TSXV, $WG$XTM.ca $WM.ca, CSE, palladium, PGM, Platinum