Sponsor: Loncor is a Canadian gold exploration company focused on two projects in the DRC – the Ngayu and North Kivu projects. Both projects have historic gold production. Exploration at the Ngayu project is currently being undertaken by Loncor’s joint venture partner Barrick Gold (Congo) SARL (“Barrickâ€). The Ngayu project is 200 kilometres southwest of the Kibali gold mine, which is operated by Barrick and in 2018 produced approximately 800,000 ounces of gold. As per the joint venture agreement signed in January 2016, Barrick manages and funds exploration at the Ngayu project until the completion of a pre-feasibility study on any gold discovery meeting the investment criteria of Barrick. Subject to the DRC’s free carried interest requirements, Barrick would earn 65% of any discovery with Loncor holding the balance of 35%. Loncor will be required, from that point forward, to fund its pro-rata share in respect of the discovery in order to maintain its 35% interest or be diluted. Click Here for More Info

The first thing is gold

It’s true that gold has made a significant upward move from $1,300 per ounce in May to currently around $1,500 per ounce with at least some of that move being attributable to bullish market fundamentals. Yet, we can also count on a lot more whipsaw action as gold continues to be ping-ponged about from geopolitical headline to geopolitical headline.

The devaluation of fiat currencies in the face of rising and unsustainable debt loads across all developed economies will be the true driver of the long-term bull market that’s beginning to take form now.

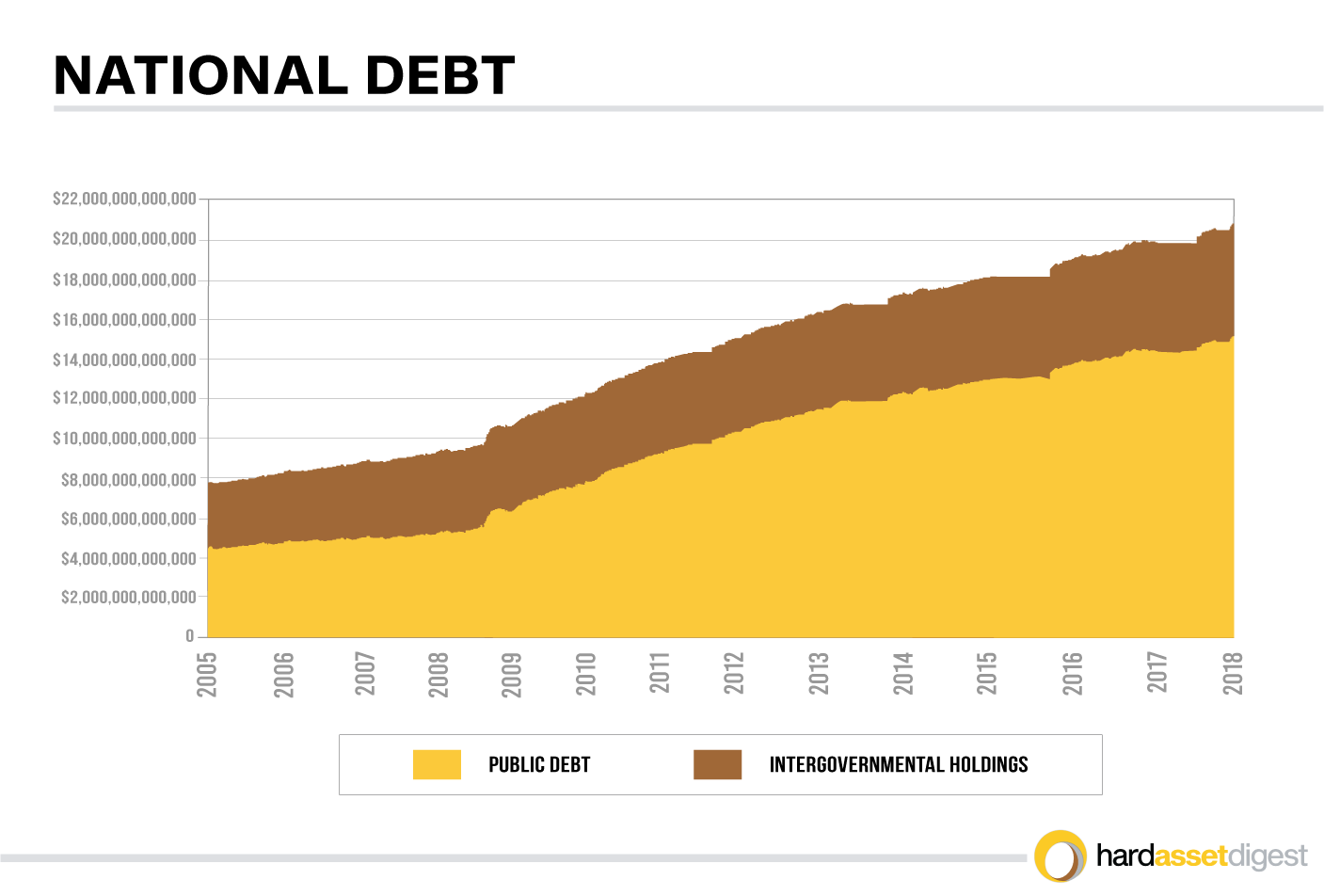

US government spending is so wildly out of control, and has been for more than a decade, that the federal debt will become unmanageable in the very near future.

Not that long ago, economists didn’t really have to think in terms of “Trillions of Dollars.†Yet today, we’ve grown accustomed to the fact… however dire it may be…that our federal debt is ballooning at a rate of nearly $1.5 Trillion each and every year. It’s simply not sustainable.

At this rate, it will only be a few years until America can no longer afford to service its federal debt — no matter where interest rates go.

Add to that the fact that we’re seeing this exact pattern of excessive money printing combined with unsustainable debt accumulation emerge across all developed economies.

The end result can be only one thing: A devaluation of all fiat currencies.

This doomed race to the bottom will leave gold, along with silver, standing alone as the only real store of value.

The EU is nearing recession

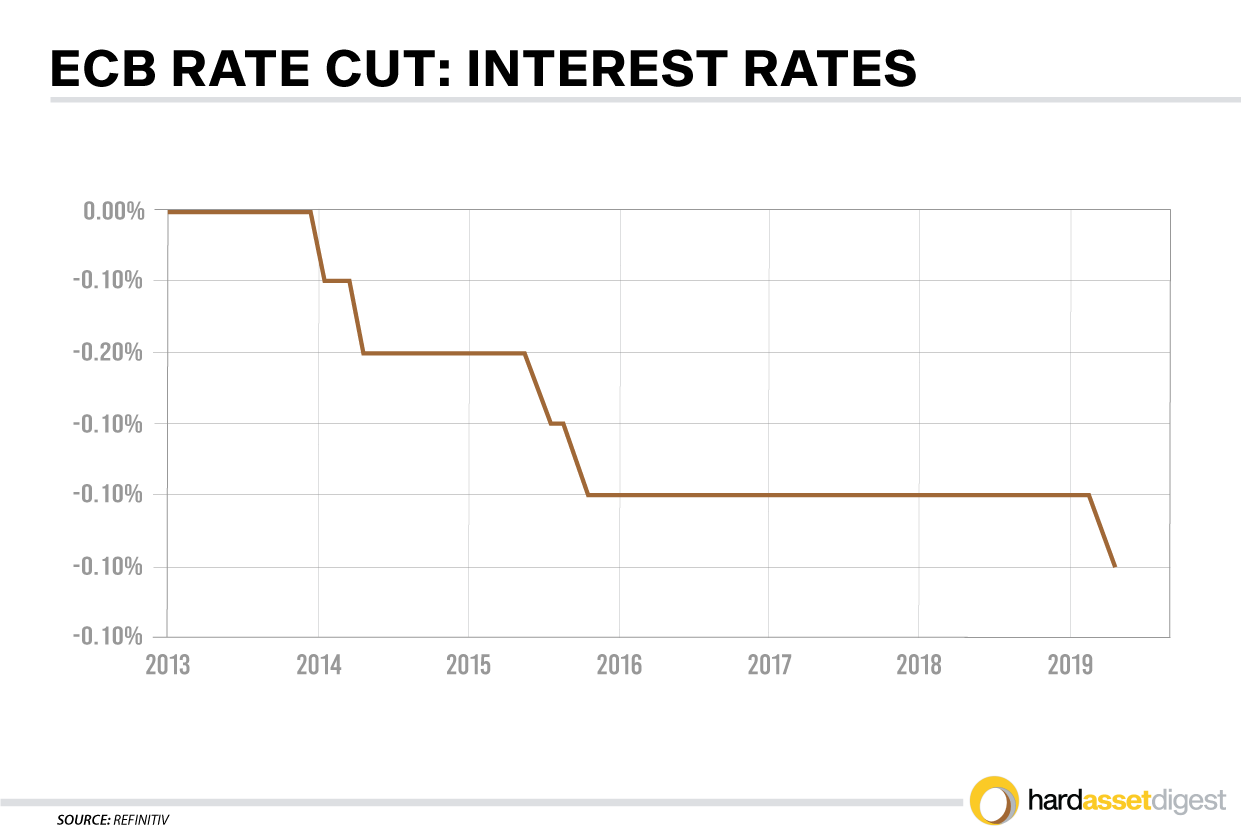

The Eurozone continues to experiment with negative interest rates in an attempt to spur economic growth by encouraging bank lending and also by boosting exports. Yet, the bottom line is that banks simply cannot make money in a negative deposit rate environment.

As much as banks may continue to try and sway lenders to do something more useful with their money than simply parking it with the European Central Bank, it’s doubtful such an ill-devised monetary policy can stave off recession.

Thus far, growth has remained anemic, raising the specter of a recession hitting the Eurozone sometime next year.

US/China Trade War: A trickle down effect across Europe’s largest economies

Germany, Europe’s largest economy, is suffering its worst manufacturing downturn in almost seven years as the US/China trade war spills over into european economies.

It’ll be interesting to see if Germany resorts to injecting fiscal stimulus (aka, the printing of even more money!) to boost its sagging export-reliant economy. Growth forecasts for 2020 have already fallen below the key 1% threshold.

Britain, Europe’s second largest economy, remains mired in its self-induced Brexit maelstrom, which certainly isn’t helping things from an economic standpoint.

In what looks to be a warning sign of impending stagnation, the British economy took its first step backward (in Q2) in more than 7 years. Amid all the turmoil, it seems increasingly doubtful Britain will be exiting the EU on October 31st, with or without a deal, as the Brexit cloud continues to darken.

New reports are also revealing weakness in Europe’s third largest economy, France. In fact, the export sectors of both France and Germany – which includes their high-profile automobile industries – are being hit hard by flagging demand from China.

The luster is coming off the Chinese economy

While growth in China held steady at 6.4% in Q1 this year, it proceeded to slip to 6.2% in Q2. Economic numbers over the last few months reveal that the worst may not yet be over for China with analysts projecting weakening third quarter data.

A recent survey by China Beige Book reveals slowing growth and soaring debt levels for the world’s second largest economy.

Here at home, the trade war continues to stoke recession fears

US gross domestic product grew at a 2% annual pace from April to June, which was in-line with expectations. Yet, how long can that last?

Tags: #Africa, #Barrick, #Congo, #leadership, #Loncor, #NewmontGold, #Ngayu, #NGT, #ResoluteMining, #Resources, gold, teck