The gold silver ratio has been rising for nine years.

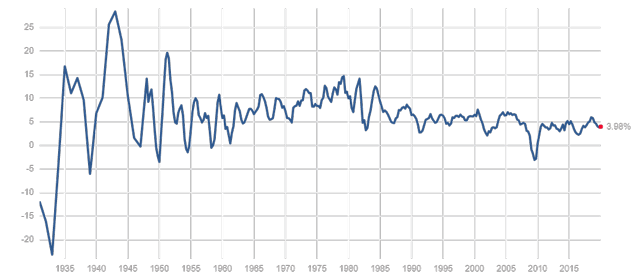

There are many commentators suggesting that the gold silver ratio is nearing a top at present. Here and here are good examples. I am not of that opinion and consider that it will keep climbing for the next 10 years at least. Below is a chart of the gold silver ratio (Source)

As you can see, the chart shows that the gold silver ratio hit a high of 125.89 on the 18th March 2020 and has since declined back to 111.81 (16/4/20). It is likely over time to retest and break the recent highs and then keep on climbing.

The analysis

To understand why the ratio is going to keep on climbing, we need to look at how gold and silver are used.

Silver

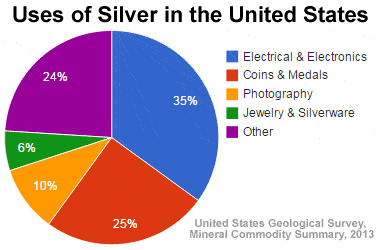

Below is the breakdown of the percentage usage of silver in the US:

As you can see, 45% is used in photography and electrics. The other category (24%) is a mix of energy use, brazing and soldering, chemical production, mirror production and medicine (see link above). In total therefore 69% is used in industry. Only 31% is used in jewelry and coins (silver kept in circulation).

Gold

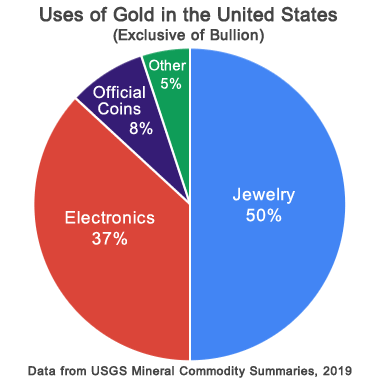

Below is a breakdown of the percentage uses of gold in the US:

Industrial use of gold is only 37%, but 58% is used in coins and jewelry (gold kept in circulation).

Conclusion

As silver is 69% used in industry and gold only 35%, silver is much more sensitive to the strength of the economy than gold is. The last economic cycle in the US was the weakest in modern economic history. Real potential GDP was 1.6% from 2008 to 2018 (Source). This is the lowest 10-year rate since before the Second World War. The gold silver ratio is therefore doing exactly what you would expect it to do in a weak economic backdrop. It is steadily rising. If the economy remains weak after the present recession, I would expect that the gold silver ratio will continue to rise. So will it remain weak?

Here is a link to the latest Hoisington Investment Management March report. Their conclusion is that growth and inflation will remain weak, despite the massive money printing and stimulus presently being rolled out by the US government and Federal Reserve. I heartily agree with this analysis. Below is a long-term chart of US GDP:

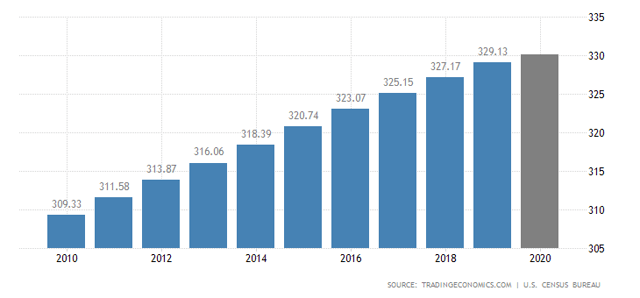

Growth peaked during the second world war and has been steadily falling since then. Since the war, average growth is falling at .7 of a percent every 10 years. As the US government and Federal Reserve are insistent on bailing out all industries and companies, productivity will remain low. This is because the weak companies will not be eliminated, allowing a re-allocation of the capital from the weak to the strong. Below is the population growth of the US economy for the last decade:

The 2019 growth rate was .6 of 1%. With slow population growth and slow productivity growth, the growth rate of the US economy must remain weak. GDP growth is the product of the change in population growth and the change in productivity growth. If both are weak, GDP must remain weak.

Implications

For investment (not trading) purposes, it is clear that if the gold silver ratio keeps climbing, gold will outperform silver on a long-term basis. If you like precious metals to diversify your portfolio, you should buy gold and not silver. It may well be that the gold silver ratio trades lower in the short term and is a good trade, but it is not the way to go if you are an investor. It is also clear that gold miners will outperform silver miners. I presently have no exposure to any silver mining stocks (although some of my gold miners produce silver as a byproduct). Don’t be fooled into thinking that just because the gold silver ratio has hit a high and is now falling that it will mean revert. We are in a low growth environment for the foreseeable future and the ratio will behave accordingly!

SOURCE: https://seekingalpha.com/article/4338404-gold-silver-ratio-will-keep-on-climbing

Tags: #AFF, #AffinityMetals, #BCMining, #Canada, #Discovery, #Drilling, #GoldStandard, #Incrementum, #InGoldWeTrust, gold