- Peak Value of 4.0g/t Au in Auger

- Within Broad 240m Wide Zone of Bedrock Gold Anomalism

New Discovery with Potential Strike Length of 1,800m

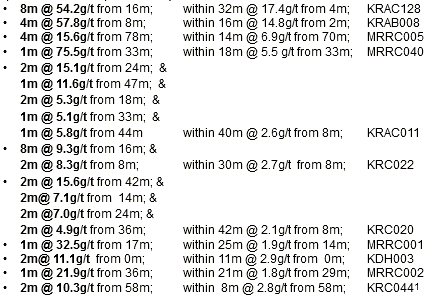

VANCOUVER, BC , Dec. 18, 2020 – Tajiri Resources Corp. (the “Company”) (TSXV: TAJ) is excited to announce preliminary, yet outstanding results from a small, single line twelve hole, 25m spaced auger programme sampling the top 2 metres of saprolite at the Epeius Project. The program, tested the extrapolated strike extensions of known gold mineralisation currently undergoing resource definition drilling by Troy Resources Limited (ASX:TRY or ‘Troy’) at their Goldstar Prospect where initial drill and trench results reported to date demonstrate the potential for several sub parallel zones with highlights that include : RC drilling: 6m @ 10.0g/t from 66m ; 17m @ 2.2g/t from 3m ; 16m @ 1.0 g/t from 31m , 16m @ 1.7g/t from 59m Trenches horizontal at surface : 13m @ 3.3g/t; 8m @ 3.0g/t, 7m @ 2.9g/t; 10m @ 1.0g/t; & 11m @ 1.5g/t.

The auger results reported today indicate potential for a significant zone of gold mineralisation, within a small portion of the Epeius Project, over a potential 1,800 metres of strike length (see Figure 2 ). The zone of potential extends 1,150 metres from the Project’s southern boundary which is contiguous with the Goldstar Prospect, through the auger holes and onward for 650m to the Project’s northern boundary,where weaker but persistent soil gold anomalism has been encountered by Troy.

The zone of gold anomalism outlined by the auger holes is ~230m wide @ >40ppb and includes the following higher gold in saprolite values of: 4,034 (4.03g/t), 702, 251, 276 & 113 ppb Au. Auger Holes were drilled at depths between 4 to 7 metres and the last two metres where saprock textures were visible was sampled and assayed by 1kg, 24 hour cyanide leach with an accelerant. The values are therefore in-situ bedrock values and the width of the zone of gold anomalism which topographically lies at the uppermost of a ridge that has not been substantially effected by mechanical lateral dispersion – more typical of gold in soil anomalies.

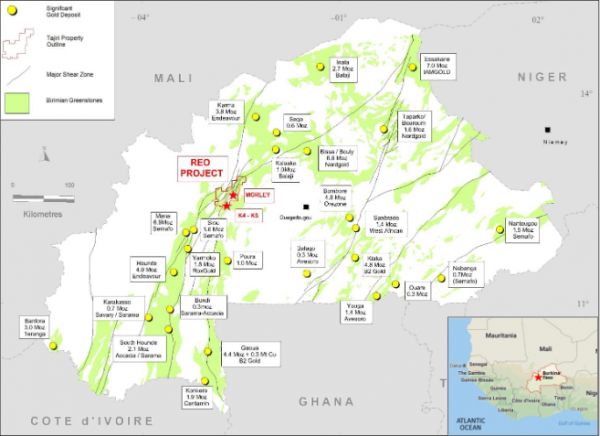

Mineralisation in this part of the Epeius Project is hosted by early Proterozoic greenstones of the Barama Mazaruni Supergroup and is associated with a NNW trending zone of regional shearing (the Gem Creek Corridor), which extends for at least 20km strike and which for most its known strike approximately follows the contact of a geochemically distinct basalt which displays high magnesium and chrome contents. This basalt has been identified by Troy as the same unit which hosts the Smarts and Hicks deposits (15.5Mt @ 2.3g/t of NI43-101 compliant M+I+I resources reported pre-mining 9 th September 2014 ) nine kilometres to the south.

Significantly, of the 1,150 metres of strike potential between the Company’s line of auger holes and Troy’s resource drilling the projected mineralisation is completely covered by alluvium for 600m of strike and partially covered for 400m of strike. As such the company’s auger holes were located in the first area on strike from Troy’s Goldstar Prospect where a transect of the full width of the mineralised trend projecting from Goldstar could be tested. Furthermore, all creeks in near vicinity of the auger holes have been worked repeatedly and extensively by artisanal miners and the area where the potential mineralisation is completely covered for 550m of strike, immediately adjacent to Goldstar, is the upstream starting point for a prodigious area of artisanal alluvial mining varying between 200 and 800 metres width and extending downstream along the flats of the West Kaburi and Kaburi Rivers for 15,000 metres. As such the scale of alluvial workings suggest that the Goldstar Prospect and its indicated strike extensions through the Epeius Project is a bedrock gold source of considerable, but yet to be determined size.

When received, the Company considered the auger results worthy of immediate follow-up and consequently an excavator commenced trenching at Epeius, December 3 rd 2020, along the line of auger holes and south over a strike of ~400m along strike, across projected areas of mineralisation where not covered by alluvium. To date approximately 600 linear metres has been excavated in seven trenches to a depth of ~ 4m to in situ saprolite exhibiting bedrock and mappable textures.

First assay results from the trench programme are expected within two weeks but examination of the trenches confirms several potentially mineralised zones similar to gold mineralisation described by Troy resources at Goldstar. These include possible gold mineralisation at the contacts between the high MgO basalt with small felsic intrusive bodies of (2- 15m width) and with small dolerite bodies of (4- 12m width) within the High MgO basalt. Potential gold mineralisation appears as both stock works and shallow dipping vein sets within the felsic intrusive bodies and dolerites and as highly oxidised, iron oxide rich “black coated” often boudinage quartz veins within highly strained MgO basalt. In particular, the peak 4.0g/t value from auger drilling corresponds with a 4- 12m wide dolerite which exhibits a well-developed stockwork of 1-30cm wide quartz-carbonate veins and the next highest value of 0.7g/t was located within a fine grained felsic intrusive of approximately 8m width which exhibited well developed NW striking, flat to 20 dipping quartz veins and minor stockwork veining and veinlets. (see plates 1, 2 & 3)

Background

The Epeius Project, comprised of 9,300 hectares of tenements granted for gold and precious metals is contiguous with the Company’s wholly owned Kaburi Project of 2,600 Ha. The combined projects are located in Guyana South America , 165km southwest of the country’s capital Georgetown and between 3.5 and 25 kilometres from the 1 Mtpa Karouni Mine Mill of Troy resources. 35 km to the ESE lies the Omai gold mine which produced 3.7Moz @ 1.3g/t. Results subject of today’s announcement are located 9 km north of the Karouni Mine Mill.

The Acquisition of the Epeius Project by execution of a binding LOI was announced 24 th June, 2020 and is pending share approval at the Company’s next AGM scheduled for 2 nd February, 2020. Sampling reported today has been undertaken as part of the company’s Due diligence on the Epeius Project.

The Chairman’s Comments

Executive Chairman, Dominic O’Sullivan observed: “Having worked extensively in and around the Kaburi and Epeius Projects over the past 14 years and having led the team which in part discovered and defined the two principal deposits of the Karouni Mine, I can say the results reported today present one of the better zones of saprolite gold anomalism in the district comparable to those that were returned by early saprolite auger drilling at the Smarts Deposit.

We took a big jump along strike from recently discovered mineralisation at Troy’s Goldstar Prospect and results have come up quite nicely for us right where the potential strike extensions of the Goldstar Prospect were projected to be. It doesn’t cost much to hand drill and assay 12 auger holes but Bang there you go a potential 1.2km mineralised zone demonstrated for a few thousand US dollars.

The trenching program in progress should also prove a low-cost way to further our understanding of mineralisation prior to drilling, of which a substantial portion will be through shallow alluvial cover.

We of course await the assay results of our trenches before we can say with confidence we have a truly significant gold mineralised zone, but I take early encouragement not only from the auger results but from a recent announcement by Troy that they are undertaking a 15 x 10 metre resource definition drilling program at Goldstar over a 500m strike from our boundary southwards ( 7 th December, 2020) and have already commenced construction of a haul road between Goldstar and the Karouni Mill.”

Qualified Person

The Qualified Person under National Instrument 43-101 – Standards of Disclosure for Mineral Projects for this news release is Dominic O’Sullivan a geologist, member of the AusIMM, Executive Chairman of Tajiri and who has reviewed and approved its contents.

On Behalf of the Board,

Tajiri Resources Corp.

Graham Keevil ,

President & CEO

About Tajiri

Tajiri Resources Corp. is a junior gold exploration and development Company with exploration assets located in two of the worlds least explored and highly prospective greenstone belts of Burkina Faso , West Africa and Guyana , South America . Lead by a team of industry professionals with a combined 100 plus years experience the Company continues to generate shareholder value through exploration.

This news release may contain forward-looking statements based on assumptions and judgments of management regarding future events or results. Such statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking statements. The Company disclaims any intention or obligation to revise or update such statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE Tajiri Resources Corp.