- Sold 51% of all of the issued and outstanding securities of Marcon International to GRX Industries Inc.

- GRX acquired the Securities for an aggregate purchase price of CDN$ 981,499.71, which was satisfied through the assumption of debt and debt forgiveness.

- This transaction removes a significant amount of debt off of the Corporation’s balance sheet and will free up cash flow for investing activities

Toronto, Ontario–(February 12, 2019) – IntellaEquity Inc. (CSE: IEQ) (the “Corporation” or “IntellaEquity”) announces that it has sold 51% of all of the issued and outstanding securities (the “Securities”) in the capital of Marcon International (USA) Inc. (“Marcon”) to GRX Industries Inc. (“GRX), an arm’s length third party. Pursuant to the share purchase agreement, GRX acquired the Securities for an aggregate purchase price of CDN$ 981,499.71, which was satisfied through the assumption of debt and debt forgiveness.

“The sale of the Securities will allow the Corporation to focus on its mandate as a merchant bank and not an operator,” said Allen Lone, President of the Corporation. “This transaction removes a significant amount of debt off of the Corporation’s balance sheet and will free up cash flow for investing activities. As GRX is directly owned by a US resident, Marcon will now be able to qualify for 100% set-aside small business contracts with the US government. This will allow Marcon to continue to grow its business. Through its 49% ownership interest, the Corporation will benefit from the expanding business of Marcon.”

About the Corporation

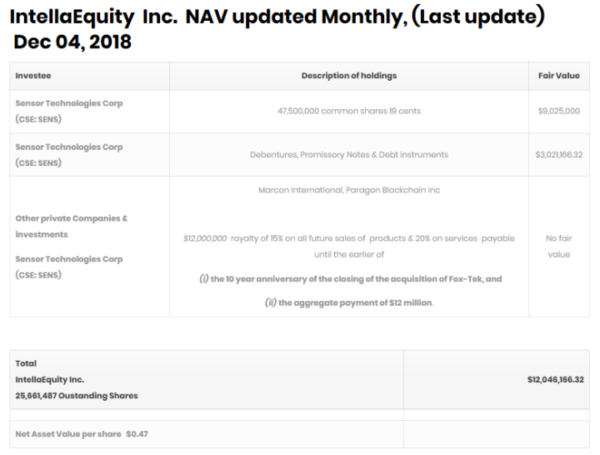

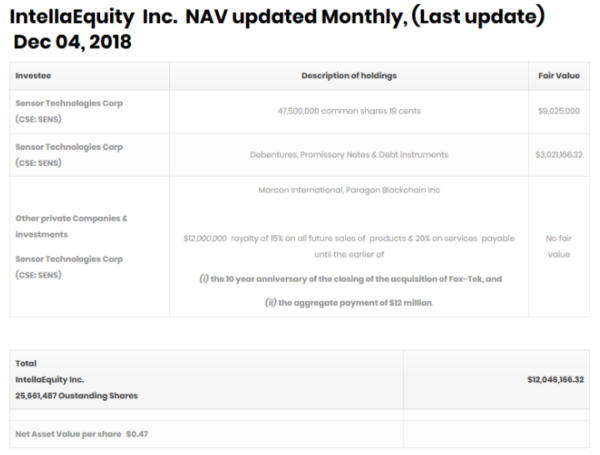

IntellaEquity is a publicly traded company, it is a diversified investment and venture capital firm focused on providing investors with long-term capital growth by investing in a portfolio of undervalued companies and assets. The investment portfolio may be comprised of securities of both public and private issuers primarily in technology, artificial intelligence, blockchain and may also include investments in certain other sectors, including water, green energy, and alternative energy. Target investments shall encompass companies at all stages of development, including pre-initial public offering and/or early-stage companies requiring start-up or development capital, as well as intermediate and senior companies.

Corporation contact:

Allen Lone

President and CEO

905-338-2323

Email: [email protected]

The CSE has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

Cautionary Note regarding Forward-looking Statements

This news release includes certain information and forward-looking statements about management’s view of future events, expectations, plans and prospects that constitute forward-looking statements. These statements are based upon assumptions that are subject to significant risks and uncertainties. Because of these risks and uncertainties and as a result of a variety of factors, the actual results, expectations, achievements or performance may differ materially from those anticipated and indicated by these forward looking statements. Although the Corporation believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurances that the expectations of any forward-looking statement will prove to be correct. Except as required by law, the Corporation disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward looking statements or otherwise.