- Update to the distribution of an aggregate of 25,629,564 common shares in the capital of Sensor Technologies Corp.

- Due to the fact that the Corporation is incorporated pursuant to the laws of the state of Delaware, it is required to obtain the approval of the Financial Industry Regulatory Authority (“FINRA”) of the United States.

- The Corporation has made the necessary filings with FINRA in order to obtain its approval. The Corporation will provide updates as they become available.

Toronto, Ontario–(Newsfile Corp. – April 5, 2019) – IntellaEquity Inc. (CSE: IEQ) (the “Corporation”) would like to provide an update with respect to the distribution of an aggregate of 25,629,564 common shares (the “Sensor Shares”) in the capital of Sensor Technologies Corp. (“Sensor”) to the shareholders of the Corporation, as previously announced in its press releases of December 12, 2018 and January 29, 2019.

The Corporation has provided the transfer agent of Sensor with the stock certificate and the necessary documentation to effect the transfer of the Sensor Shares from the Corporation to its shareholders on Feb 22, 2019. However, due to the fact that the Corporation is incorporated pursuant to the laws of the state of Delaware, it is required to obtain the approval of the Financial Industry Regulatory Authority (“FINRA”) of the United States. The Corporation has made the necessary filings with FINRA in order to obtain its approval. The Corporation will provide updates as they become available.

About the Corporation

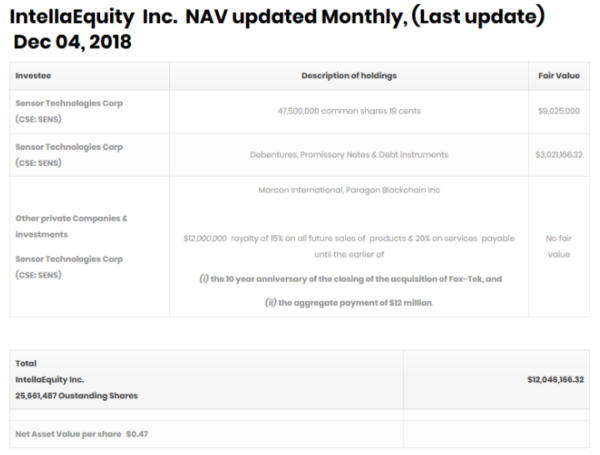

IntellaEquity is a publicly traded company, it is a diversified investment and venture capital firm focused on providing investors with long-term capital growth by investing in a portfolio of undervalued companies and assets. The investment portfolio may be comprised of securities of both public and private issuers primarily in technology, artificial intelligence, blockchain and may also include investments in certain other sectors, including water, green energy, and alternative energy. Target investments shall encompass companies at all stages of development, including pre-initial public offering and/or early-stage companies requiring start-up or development capital, as well as intermediate and senior companies.

Corporation contact:

Allen Lone

President and CEO

905.275.8111, ext. 226

Email: [email protected]