Multiple Intellectual Property Licensing Agreements:

Definitive Graphene Manufacturing Process License Agreement–

- This agreement licenses to ZEN the intellectual property created by scientists and laboratories in collaboration with ZEN, and provides that a royalty is payable by ZEN based on the annual amount of material processed under the intellectual property.

- Signed an 18-month exclusive initial option agreement with the University of Guelph for intellectual property regarding an electrochemical exfoliation (ECE) process to produce Graphene Oxide.

- Collaborative Research Agreement (CRA) Template – Forms the basis of each agreement with various UBC researchers and Universities.

- Each contributing significantly to unlocking the value of the Albany Graphite deposit and creating a strong intellectual property foundation.

Graphene Aerogel Battery Development Program:

Coordinating with the German Aerospace Center–

- A proprietary aerogel formulation containing doping with either ZEN’s reduced Graphene Oxide (rGO) or Graphene produced via ZEN’s licensed process was tested. The unoptimized results are believed to be better than those currently reported in the literature for Graphene Aerogel batteries.

- Graphene-containing aerogels could have the potential to be a low-cost, low-weight, high-performance composite materials for near future energy storage applications.

- Results extremely positive, and DLR applied for and received federal funding to create a new Innovation Lab (the Center for Aerogels) to work with industrial partners on the development of Aerogels and other graphene-based products.

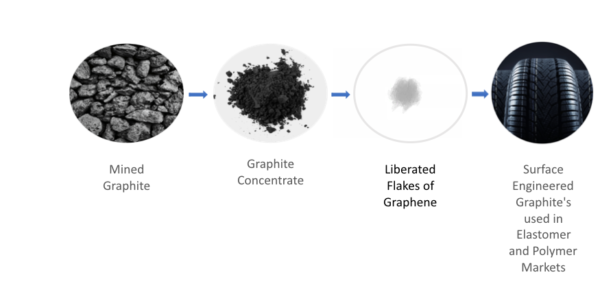

Albany Graphite:

- Significantly outperforms both flake/sedimentary graphite and synthetic graphite, demonstrating the uniqueness of ZEN’s graphite and its superior performance to exfoliate into graphene products.

- ZEN currently has an inventory of approximately 110 tonnes of graphite-mineralized material with an average grade of 6% graphitic carbon (Cg), 110 kilograms of 86% Cg material, 18 kilograms of 99.8% Cg, and 300 grams of GO.

- The Company will continue to process material and manufacture graphene-related products on an as-needed basis for research and development (R&D) and marketing

- ZEN’s is developing a proposed webstore which has an anticipated launch date in the first quarter of 2020, for which it is developing an inventory in advance of sales.

for Next-Level Performance.

About ZEN Graphene Solutions Ltd.

ZEN Graphene Solutions Ltd. is an emerging advanced materials and graphene development company with a focus on new solutions using pure graphene and other two-dimensional materials. Our competitive advantage relies on the unique qualities of our multi-decade supply of precursor materials in the Albany Graphite Deposit. Independent labs in Japan, UK, Israel, USA and Canada have demonstrated that ZEN’s Albany Graphite/Naturally PureTM easily converts (exfoliates) to graphene, using a variety of simple mechanical and chemical methods.

ZEN Graphene Solutions Hub on Agoracom

FULL DISCLOSURE: ZEN Graphene Solutions is an advertising client of AGORA Internet Relations Corp