Beauce Gold Fields (BGF: TSXV) is going to discover where the gold from Canada’s first historical placer gold rush came from.

Beauce is very close to locating the hard rock source that created Canada’s first gold rush. The area Beauce controls produced the largest gold nuggets in Canadian mining history (50oz to 71oz) and if these nuggets were to be found today each would be worth over $100,000 at today’s gold price. Beauce controls 100% of the 6km trend where the first gold rush in Canada occurred and is very close to finding the source of Canadas first gold rush through drilling in 2021.

The presence of alluvial (surface) gold is a great indicator for a modern exploration company to search for the source. It is an indication of a large gold source close by and Beauce has proven this with a Paleoplacer Resource that is one of the largest un-mined Paleoplacer deposits in North America.

If successful Beauce will be able to prove a major discovery and the lode source for all surface gold ever found at the Beauce Gold Fields project area, while potentially developing an increasingly economic paleoplacer surface deposit.

3 Reason Why Beauce is Going is to Find The Hard Rock Source of Canada’s First Gold Rush

1. Multiple Peers Have Already Proven The Exploration Model Works

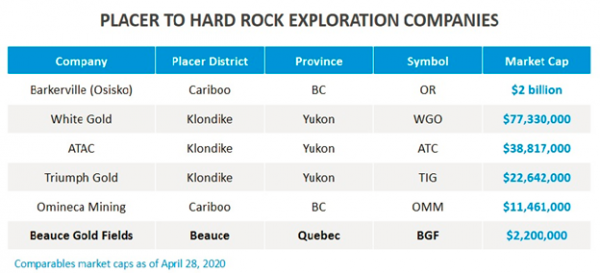

After decades of being overlooked, recent hard rock gold discoveries in the Yukon’s placer fields has led to a modern gold rush with major gold companies such as Goldcorp, Kinross, Barrick & Newmont investing hundreds of millions in Yukon juniors. Osisko Gold Royalties has invested $33 million in Barkerville alone. An easy peer review demonstrates the unexplored value that is a soon to be attraction to investors looking to capitalize on a proven exploration model, in an area without competition from peers that Beauce completely controls. An area that is waiting for a discovery to made.

Other companies have been very successful in leading the way for Beauce to demonstrate that placer gold has to come from a source, a source that is often superior to that which has already been found on surface.

2. The Project Area Has Seen No Modern Drilling For A Hard Rock Source.

Beauce controls the entire area, a 6 km long gold anomaly and fault zone

The project area hosts a six-kilometer-long unconsolidated gold-bearing sedimentary unit. There is gold in saprolite that indicates a close proximity to a bedrock source of gold along with the recent discovery of a fault underneath the historical gold placers, providing possible further exploration discoveries. All the signs point to a future drill program taking place.

Gold nuggets, geology, fault, angular gold – all point to finding the lode source (where it all came from)

Beauce controls an area that has never been systematically drilled for the hard rock source. Investors in 2021 are eagerly anticipating a drill announcement.

3. Beauce Already Has A Paleo Placer Gold Resource

Total gold potential ranges between 61,000 ounces to 366,000 ounces and is documented through the companies Beauce Paleo placer Project Business Model for Placer Mining (2015).

The Company has calculated a Gold Exploration Target for the entire historical placer channel ranges between 61,000 ounces (2,200,000 m3 @ 0.87g Au/m3) and 366,000 ounces* (2,200,000 m3 @ 5.22 g Au/m3).

If you think this is insignificant at first glance, the 2015 report pegs the all-in cost at US$630/oz at $1250 gold. Today gold is at $1900. The increase in the price of gold vastly improves the economic potential and development of the Beauce Paleoplacer deposit.

The cost to build the mine is only $8 million. This based of off a 2015 gold price of $1250 and an 8-year mine life that upon ccommencement of full-scale production the annual gold output should be between 8,000 oz. (base case) and 24,000 oz. This can generate annual cash flow between $6.5M (base case) and $25 Million. The operation is capable of producing around 40,000 oz per year within 4 years of commencing production.

At $1900 dollar gold, a modest 4000 ounces produced increases the revenue to $7.6 million from $6.5. At 24,000oz’s of production the revenue jumps to $45million. Enough to build a company, and certainly enough to fund exploring for where it all came from.

Click Here To Discover The Next Small Cap Canadian Gold Exploration Success Story