- Entering the Cannabis Industry utilizing e-commerce/technology in the marketing and sale of cannabis and cannabis-related products

- CannCentral is a private company aimed at becoming the planet’s leading lifestyle influencing digital publisher and e-commerce platform for all things cannabis

- The current shareholders of Intellaequity will own 10 per cent of the issued and outstanding shares of the resulting company

- CannCentral will own the remaining 90 per cent of the shares

For the past several months, Intellaequity Inc. has undertaken a process whereby it evaluated opportunities in the cannabis industry. One promising opportunity that presented itself was in the area of utilizing e-commerce/technology in the marketing and sale of cannabis and cannabis-related products.

As a result of these efforts, the corporation is pleased to announce that it has entered into a non-binding letter of intent, dated May 14, 2019, with CannCentral Inc., an arm’s-length party incorporated pursuant to the laws of the Province of Ontario. Pursuant to the terms of the LOI, Intellaequity will acquire all of the issued and outstanding securities of CannCentral. As a result of the proposed acquisition, the current shareholders of Intellaequity will own 10 per cent of the issued and outstanding shares of the resulting company and the shareholders of CannCentral will own the remaining 90 per cent of the shares. The proposed acquisition will be completed through a three-cornered amalgamation between Intellaequity, a wholly owned subsidiary of the corporation and CannCentral.

The closing of the proposed acquisition is subject to, among things, the successful completion of the corporation’s due diligence review of CannCentral and the execution of an amalgamation exchange agreement between the corporation, a wholly owned subsidiary of the corporation and CannCentral. The entering into of the amalgamation agreement will be considered a fundamental change under Policy 8 of the Canadian Securities Exchange and, as such, will subject to all of the requirements of Policy 8 including, but not limited to, CSE and shareholder approval.

About CannCentral Inc.

Led by seasoned professionals with extensive media, technology and capital markets experience, CannCentral is positioned to become the planet’s leading lifestyle influencing digital publisher and e-commerce platform for all things cannabis.

Award-winning content producers, thought-provoking editorial and crave-worthy design mix with CannCentral’s proprietary technology creating CannCentral, the leading lifestyle destination channel for those influencing culture, travel, food and arts. Expert data on strains, origins, breeds and terroirs, products and repositories combined with dynamic premium news, curated influencer lifestyle content and a matchless digital experience that geolocates users with global dispensaries, lounges and salons will cement CannCentral as the authority on knowledge, products and insight for cannabis enthusiasts, patients and investors across the globe.

Through the CannCentral website, CannCentral anticipates generating revenue through traditional and emerging advertising models to achieve organic growth. The company will be targeting complementary publishers to consolidate portions of the fragmented global media landscape, resulting in accretive earnings and growth.

The CannCentral website is designed to bring knowledge and insight to cannabis users, patients and enthusiasts across the globe. The website will be free to use for all lifestyle enthusiast, patients and investors and will be available in English, German, French and Spanish. The CannCentral website will provide cannabis enthusiasts, patients and investors with on-line resources and functionality including but not limited to:

- Official strain library;

- Cannabis dispensary directory and reviews, matched to user preferences;

- Cannabis products directory, reviews and purchase fulfilment;

- Cannabis business and legislative news;

- Cannabis fact checker;

- Loyalty programs providing continuing incentives for engagement.

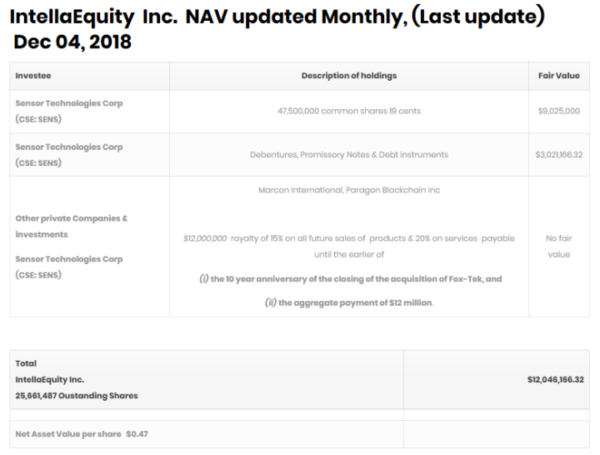

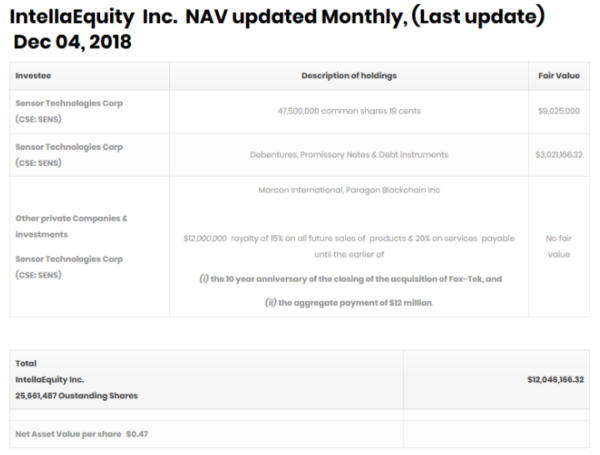

About Intellaequity Inc.

Intellaequity is a publicly traded company; it is a diversified investment and venture capital firm focused on providing investors with long-term capital growth by investing in a portfolio of undervalued companies and assets. The investment portfolio may comprise securities of both public and private issuers primarily in technology, artificial intelligence, blockchain and may also include investments in certain other sectors, including water, green energy and alternative energy.