OTTAWA, ONTARIO–(Jan. 19, 2015) – Stria Lithium Inc. (TXS VENTURE:SRA) (“Stria” or the “Company”) is pleased to report the following update on its proprietary, environmentally sustainable lithium ore processing technologies and the extension of its non-brokered private placement until February 2nd.

Market Outlook

The Energy Storage sector is growing substantially faster than the Electrical Vehicle (EV) battery sector. According to Industrial Minerals, a reliable global source of mineral data, commercial energy storage applications using lithium-ion phosphate batteries has become a multi-billion industry.

Industrial scale energy storage for regional energy storage installations in California, Hawaii and Bolivia, complement the corporate electrical storage requirements of EV pioneer Tesla, for example, for use in its trans-American charging network.

While lithium markets have held their price values in a soft commodities market during the last 18 months, lithium juniors face other challenges in securing a toehold into the lithium space.

In his year-end 2014 market outlook, analyst Chris Berry stated:

“Lithium production is an oligopoly. Despite the strong growth rates in lithium demand (estimated at 8% per year), oligopolies do not welcome competition and therefore if you’re a company aspiring to join the ranks of producers, you need some sort of a competitive advantage or strategic relationship which allows you the possibility of achieving the lowest cost of production. The growth rate in demand is key.”

Stria Lithium’s business advantage is built through its strategic clean energy alliance with Focus Graphite Inc., and Grafoid Inc.

Industrial Minerals, reported that despite real or perceived barriers, “… new sources of raw material are likely to be needed to prevent price inflation as demand from the battery sector grows.”

Mineral markets expert Simon Moores, in his January 15, 2015 commentary in Benchmark Notes, admonishes investors to consider the impact rapid growth in lithium demand had on the smartphone industry:

“The smartphone uptake took the battery supply chain by surprise. Such was its unprecedented nature, leading lithium suppliers of the key battery raw material continually underestimated the speed of growth in demand which ranged from 8-12% each year in that period. Lithium saw a supply squeeze and its price spike three-fold between 2004 and 2009 as a result.

And with EVs and utilities, the batteries are bigger… much bigger. For supply chain disruption, EV sales would not need to be in the billions or millions, global annual sales of over 200,000 would force significant change.”

Stria’s novel technology, is designed to produce low-cost and high purity lithium directly from spodumene lithium ore.

Stria is currently at the design stage of its pilot plant and has engaged an external, third party engineering firm to validate and audit its proprietary process. The pilot plant will be designed to produce up to 140 kg per month of lithium compound over a minimum six months with the aim of providing potential customers with sufficient 99.99% purity materials for validating process economics and product quality.

Non-Brokered Private Placement

The Company is pleased to announce its private placement offering of non flow-through and flow-through units will remain open until February 2nd, 2015.

On October 30, 2014, Stria Lithium announced the close of its first tranche of a non-brokered private placement offering of up to $1,000,000.

The total private placement consisted of the sale of up to 2,666,667 non flow-through units (the “Units”) at a price of $0.15 per Unit for gross proceeds of $400,000 and up to 3,157,895 flow-through units (the “Flow-Through Units”) at a price of $0.19 per Flow-Through Unit for proceeds of up to $600,000.

Each Unit consists of one (1) common share of the Company and one (1) warrant (a “Warrant”). Each Flow-Through Unit consists of one (1) flow-through common share of the Company and one (1) Warrant. Each Warrant entitles the holder to acquire one (1) additional common share of the Company at a price of $0.35 for a period of 24 months from closing.

The closing of the first tranche of the non flow-through portion of the Offering realized gross proceeds of $26,650.05 from the issue of 177,667 Units. The closing of the first tranche of the flow-through portion of the Offering realized proceeds of $154,770.20 from the issue of 814,580 Flow-Through Units.

About Stria Lithium Inc.

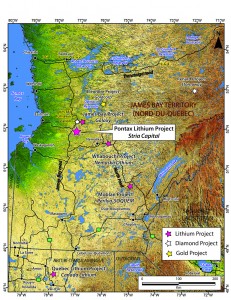

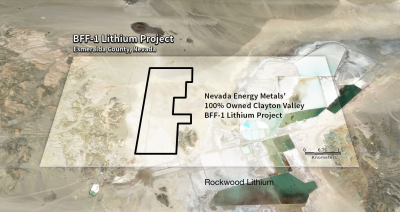

Stria Lithium (TSX VENTURE:SRA) owns the Pontax spodumene lithium property in Northern Quebec and the Willcox brine lithium property in southeastern Arizona, that are currently at the exploration stage. They host no mineral resources or reserves.

As announced in January 2014, Stria’s core business is the development of proprietary, in-house processing technologies. Stria’s technologies, based on recovering lithium metal directly from ore and from brine liquids, will be more efficient, will require fewer controls, less chemistry and require less energy from compact facilities designed to enable easy automation.

Qualified Person: This news release has been reviewed and approved by Mr. Julien Davy, P.Geo., M.Sc., MBA, President and COO of Stria and a Qualified Person under NI 43-101 Guidelines.

Forward Looking Statement – Disclaimer

This news release may contain forward-looking statements, being statements which are not historical facts, and discussions of future plans and objectives. There can be no assurance that such statements will prove accurate. Such statements are necessarily based upon a number of estimates and assumptions that are subject to numerous risks and uncertainties that could cause actual results and future events to differ materially from those anticipated or projected. Important factors that could cause actual results to differ materially from the Company’s expectations are in our documents filed from time to time with the TSX Venture Exchange and provincial securities regulators, most of which are available at www.sedar.com.

This puts the electric vehicle industry at a very interesting inflection point. Back in 2011, McKinsey & Co. made

This puts the electric vehicle industry at a very interesting inflection point. Back in 2011, McKinsey & Co. made