As you all know very well by now, I love to share data pertaining to our accomplishments.  Why? Talk is cheap and data is the only way to differentiate who is actually getting the job done in the world of online investor relations.

Despite what all the “Johnny Come Lately IR Experts“ have been telling you as of late, AGORACOM has been proving to small-cap CEO’s for years that online investor relations is the key to attracting the widest possible audience of investors.

ONLINE INVESTOR RELATIONS PLATFORM IS BEST FOR SMALL-CAP INVESTOR RELATIONS

Moreover, we’ve been pounding the table on the fact that a unified small-cap investor relations platform such as AGORACOM is a cheaper, faster and easier way to achieve that goal.  We simply don’t agree that solo social media efforts are sufficient because individual small-cap companies simply don’t push out enough content and information to attract a meaningful audience and presence.

To this end, AGORACOM has been working hard at casting the widest net possible via our own site, sister sites, social media and small-cap videos.  That effort is paying big dividends in terms of driving traffic into our network.

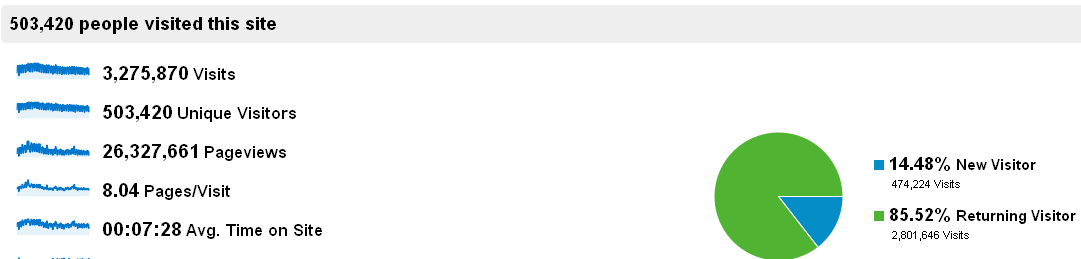

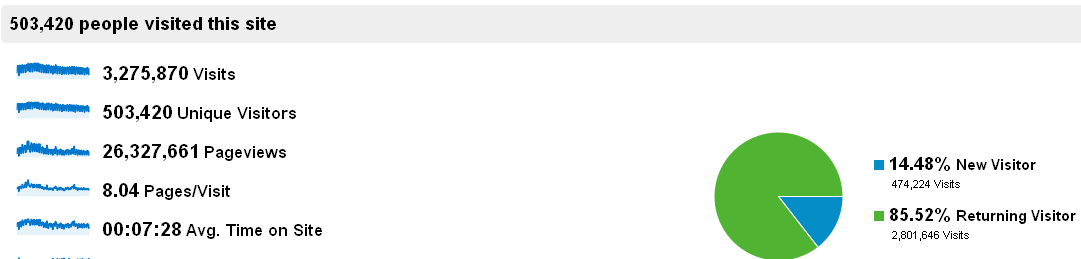

THE PROOF IS IN THE PUDDING – 503,420 INVESTORS IN 2011 … AND COUNTING

Here is the irrefutable visitor data (independently tracked by Google Analytics), as well as, the list of Top 10 countries … and here is how you contact us to discuss your online investor relations needs.

To put this success into further perspective, this traffic does not include data from our social media sites (Twitter, YouTube and Facebook) which are enjoying their own success per our January 5, 2011 post. Â Look for an update on these in the coming week.

Regards,

George Tsiolis, Founder