SPONSOR: Tartisan Nickel (TN:CSE)Â Kenbridge Property has a measured and indicated resource of 7.14 million tonnes at 0.62% nickel, 0.33% copper. Tartisan also has interests in Peru, including a 20 percent equity stake in Eloro Resources and 2 percent NSR in their La Victoria property. Click her for more information

Fact Sheet

—————————-

EV Metals Demand: The Calm Before The Storm

Summary

- Right now, many cannot see the forest for the trees. By that I mean the big picture for EVs and EV metals demand.

- What percentage of buyers do you think will buy an electric car by end 2022 if it is cheaper to buy, cheaper to run, and cheaper to maintain?

- What if 50% of buyers want to buy an electric car in 2022, and 75% by 2025.

- In a recent British survey, 71% of British car buyers said they are considering an electric car as their next vehicle.

In this article, my goal is to remind investors that the electric vehicle [EV] and EV metal miners (lithium, cobalt, graphite, nickel) opportunity is a long-term event. By this I mean the next decade or two. If as I have forecast electric cars continue to gain in popularity, then the demand boom for EVs and the EV metal miners will be unprecedented in history and we will see an EV metals super-cycle over the next decade or two.

Right now, many cannot see the forest for the trees

Quite often in investing we get so caught up in the details that we forget the big picture. In other words “we can’t see the forest for the trees.”

In the world of electric vehicle metals (particularly the key battery metals lithium, cobalt, graphite and nickel) market participants continually focus on what will happen this year, and what will stock prices do in the next 1 year. The problem here is that short-term market events can mean we sell down our stocks at the worst possible time when the market is negative and we forget to see the big picture.

Take the lithium and cobalt markets the past year. Concerns of oversupply have caused large sell-offs in the lithium and cobalt miners. Retail investors have fled the market. Does this really make sense when we look at the big picture over the next decade?

The big picture for EVs and EV metals over the next decade or two

Investors should focus on what lies ahead in the next decade or two. For example:

- According to Bloomberg, we can expect EV sales to increase (from 2017 levels of 1.1%) 10x by 2025, 27x by 2030, 50x by 2040.

- CNBC reported that JP Morgan forecasts “electric cars would take 35 percent of the global market by 2025 and 48 percent by 2030.”

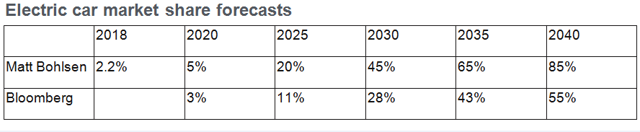

- The chart below compares my electric car penetration forecast to Bloomberg’s forecast.

Bloomberg forecasts annual electric vehicle sales – 30m by 2030, 60m by 2040

Source: Bloomberg research

Do these forecasts sound realistic or possible? Only readers can decide for themselves.

My view remains that by end 2022, an electric car will start to become cheaper than a conventional Internal Combustion Engine [ICE] car (assuming zero subsidies). This is based on lithium-ion battery prices falling ~16% pa, which has been the case the past decade. With 76 lithium-ion battery megafactories to be in production by about 2028 (~45 in production now) this looks highly realistic as scale and fierce competition take effect.

My model forecasts a 60kWh battery will sell for less than an ICE engine system by end 2022 (earlier for a 50kWh battery)

Source: My Model

My forecast above states by end 2022, a 60kWh lithium-ion battery will sell for US$5,300 which is less than the cost of a standard car’s engine system (includes the engine, exhaust, transmission, petrol tank, etc.).

If the above forecast is correct, it will mean a consumer by end 2022 can buy an electric car cheaper than a comparable ICE car. Furthermore, the electric car will have up to 10x cheaper running costs (electricity vs. gasoline) and up to 10x cheaper maintenance costs.

Once this happens, who would buy an ICE car if they are happy with a range of at least 208 miles or 335 kms (Tesla (TSLA) Model S 2012 model range).

The 2022 Tesla Model S

Source: TopSpeed

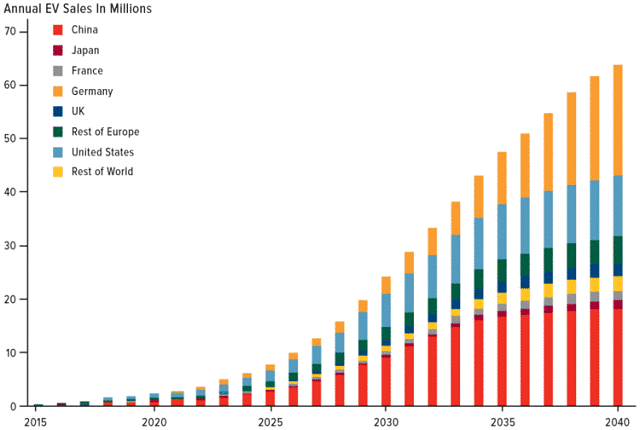

The chart below shows by ~2017/18, an electric car can sell cheaper than the average US conventional car, and by ~2031, an electric car can be cheaper than the lowest priced new US conventional car. In 2018, Reuters reported in ‘VW plans to sell electric Tesla rival for less than $23,000: source’ “Volkswagen intends to sell electric cars for less than 20,000 euros ($22,836).”

Electric car selling prices are forecast to fall rapidly as battery costs fall

(Source: Powur)

What percentage of buyers do you think will buy an electric car by end 2022 if it is cheaper to buy, cheaper to run, and cheaper to maintain than a comparable ICE car?

Added to the above headline the electric car will have better acceleration and be more trendy than an ICE car.

Given the above, it would seem quite clear to me that most people if given the option will choose an electric car post 2022. Certainly, by 2025, when an electric car is even cheaper it would seem almost everyone will want one.

If again the above assumptions are correct, then electric car penetration rates will be way higher than my forecasts above. For example, my end 2022 forecast is at 10%, and end 2025 is at 20%. The real demand could in fact be 3-5x higher than my forecasts, and higher than Bloomberg’s forecasts. Perhaps JP Morgan’s forecasts of 35% by 2025 (and 48% by 2030) will be a better guide.

On March 1, Auto Trader UK reported:

Nearly 75% of car buyers are considering an electric car as their next vehicle. Sales of electric and hybrid cars will overtake petrol and diesel by 2030, report claims. Searches for alternative fuel vehicles on Auto Trader up by 40% in 2018. The British public’s appetite for electric vehicles is growing significantly, according to a new report published by Auto Trader. Almost three quarters (71%) of car owners said they’d consider buying an electric vehicle as their next car, which is a huge leap from the 25% who answered positively when asked the same question in 2017.

What if 50% of buyers want to buy an electric car post 2022, and 75% by 2025

Clearly, if we get to levels above 50% by 2022, the electric car industry would probably not be able to meet this demand.

For example, the lithium demand to meet 50% electric car penetration rates by end 2022 would be ~2.6mtpa. This would be almost 10x the level of lithium demand from 2018. Similar problems would occur with the other EV metals as well as the battery and electric car producers.

In other words, we could very well see a period post 2022 until perhaps 2030 where people will be on waiting lists to get an electric car. Similar to the ~400,000 list for the Tesla Model 3, but several magnitudes higher. Even the expensive Porsche Taycan (OTCPK:POAHY) already has a 20,000 waiting list.

Porche Taycan – All electric

Source: The Drive

The car companies and 76 megafactories confirm the boom is coming

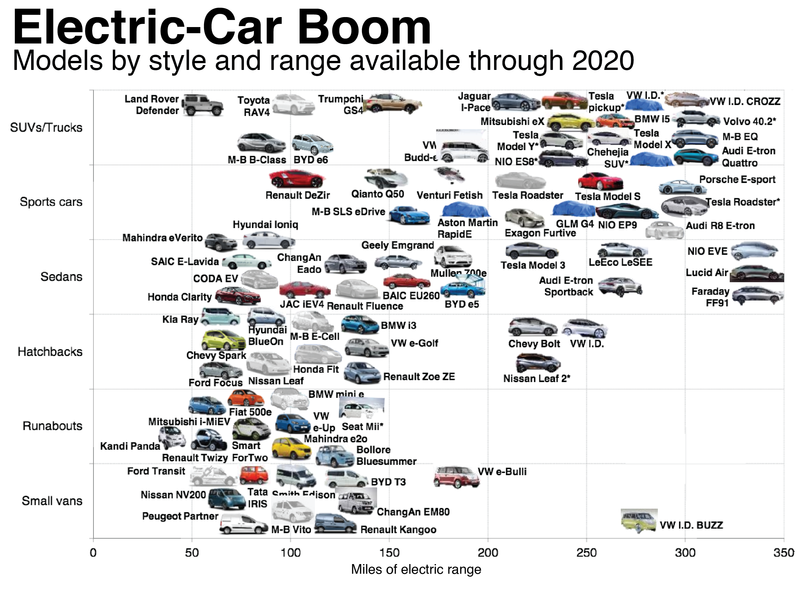

BNEF forecasts by 2020 there will be over 289 different models of electric cars across the spectrum. Added to this will be electrification across the entire transport sector (limited for planes) and widespread adoption of energy storage (home, office, utility).

A vision for the car of the 2020s is shown below. All electric and very trendy.

BMW iNext (OTCPK:BMWYY) exterior and interior

Conclusion

My purpose in this article is to encourage investors to think outside the box, or to have a clearer view of the big picture. Demand levels of 50% electric cars by end 2022 once an electric car is cheaper to buy/run/maintain would seem very logical.

Should this occur, then we will see an EV metals super-cycle. Waiting lists for electric cars will become normal, battery shortages the norm, and very strong EV metal prices a reality.

While 2018 and early 2019 have been bleak for the EV metal miner stocks, I would encourage investors to think beyond 2019, and towards 2022 which is less than 3 years away. The quality EV metal miners that are very oversold today may look like absolute bargains tomorrow.

I suggest to investors that 2019 is very likely the “calm before the storm of demand” for the EV metal miners.

Source: https://seekingalpha.com/article/4265357-ev-metals-demand-calm-storm

Tags: CSE, nickel, nickel demand, small cap stocks, stocks, tsx, tsx-v