- The River Valley Project is the largest undeveloped primary Platinum Group Metal (PGM) mineral resource in North America. The Project has excellent infrastructure and is within 100 kilometres of the Sudbury Metallurgical Complex. The Project is 100% owned by New Age Metals.

- The Project’s first economic study a Preliminary Economic Assessment (PEA) is underway and management plans to release the summary press release by the end of the second quarter.

- The price of an ounce of Palladium represents a 35% price increase in the last 12 months. As such, for 2019, precious metals consultancy, Metals Focus believes that professional investors will eventually return to palladium, with an annual average price of US$1,490 per oz. in 2019. Rhodium, which is also present at River Valley, has seen a price increase of over 15% this YTD at US$2,860 per oz.

- For Platinum, a turnaround in investor sentiment stimulated heavy buying of platinum Exchange Traded Funds (ETF’s) in early 2019. Investors were motivated by supply disruption risks and an improving outlook for auto demand.

- Drill permits for our Lithium Two and Lithium One Projects in Manitoba have been applied for and the company is in the final approval process from the province of Manitoba.

- The Company is actively seeking a strategic partner for our Genesis PGM/Polymetallic Project in Alaska

May 28th, 2019 / Rockport, Canada – New Age Metals Inc. (TSX.V: NAM; OTCQB: NMTLF; FSE: P7J.F) Harry Barr, Chairman & CEO, stated; “We are pleased to update our shareholders and interested parties as to our ongoing activities in both our PGM and Lithium divisions. Specifically, give a progress update on the River Valley Project Preliminary Economic Assessment (PEA). This update will detail our exploration and development plans for both the PGM and Lithium divisions in 2019. Furthermore, we will highlight the current PGM market and particularly Palladium and Platinum price trends.”

Update on the PEA

NAM commissioned both P&E Mining Consultants (P&E) and DRA Americas (DRA) to complete the River Valley Project’s first economic study, a Preliminary Economic Assessment (PEA) in August 2018.

The company has been informed by its engineering consultants that the preliminary PEA mine plan, production schedule and financial model is nearing completion, and we plan to release the highlights of the study in a press release before the end of the second quarter this year.

At this stage, the PEA is focused on investigating the mining potential of the project, including the latest discovery, the Pine Zone and other footwall mineralization potential. The study will also help define areas of the project that require additional exploration and development.

The objective of the PEA would be to create a conceptual mine plan, mine schedule, a capital cost estimate, and operating cost estimate incorporated into a financial model to provide total cash flow, net present value (NPV), and internal rate of return (IRR).

River Valley PGM Project Goals & Objectives

During 2019, the company’s exploration & development objectives are as follows:

- 1.Complete the re-stated resource calculation (Q1 2019);

- 2.Complete the Projects first economic study, PEA (Q2 2019);

- 3.Complete surface exploration on additional target areas based on recommendations of the updated 43-101 and the 2017/2018 geophysics (slated for Q3-Q4 2019);

- 4.Arrange additional funding for continued development of the project (ongoing);

- 5.Conduct a 5000-metre drill program focusing in the northern portion of the Project;

- 6.Solicit a strategic partner to aid in further exploration and development of the Project. Potential major partners are waiting for the PEA results to complete additional due diligence on River Valley.

Palladium, Platinum, Rhodium Price & Performance

There are various reasons why the Palladium (Pd) price movement has occurred and more to suggest that Pd price may continue to rise. First, there are continued supply deficits forecasted for Pd and in 2019 alone Johnson Matthey (JM) expects that it could exceed a million ounces (PGM Market Report – May 2019). Emissions standards are increasing worldwide as is the preference for larger vehicles, both of which require more Pd to be used in the catalytic converters.

The PGM’s Platinum, Palladium and Rhodium are extensively used in catalytic converters to convert harmful gasses like hydrocarbon emissions into less harmful substances. The allowable limits of carbon monoxide (CO) and hydrocarbon (HC) from gasoline passenger vehicles in China will be reduced by 60% by 2025 (SFA Oxford, 2019).

The Chinese emission standard story alone tends itself to the increase in Pd demand to grow by 500,000 ounces by 2021. To summarize, the Palladium fundamentals and forecasts align well with the timeline for development of our River Valley Project.

The platinum market is expected to move into deficit in 2019, with a resurgence in investor activity outweighing modest falls in industrial and jewellery demand. Johnson Matthey also expects a tentative recovery in autocatalyst consumption, as stricter heavy duty emissions legislation is enforced first in China and then in India. JM forecasts a modest increase in primary supplies, but this could be tempered by electricity shortages and, potentially, industrial action in South Africa, while growth in recycling may be dampened by processing capacity constraints in some regions.

Both Platinum and Palladium are considered precious metals, like Gold and are used as a store of value. Rhodium, which is also present at River Valley, has seen a price increase of over 15% this year at US$2,860 per oz.

2019 Mineral Resource Update

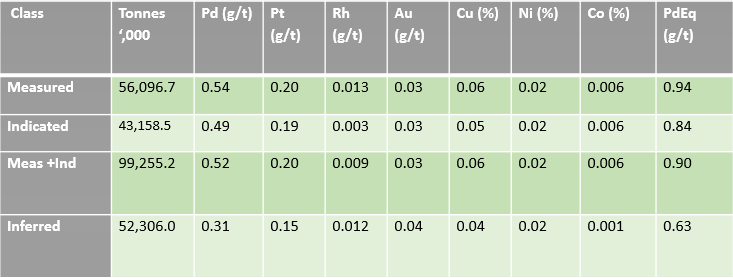

On January 9, 2019 NAM filed its latest Mineral Resource Estimate on the River Valley Project. The May 2018 Resource Estimate presented a global mineral inventory. The January 2019 Resource presents a pit constrained mineral resource that shows reasonable prospects for eventual economic extraction. The results of the updated Mineral Resource Estimate are tabulated in Table 1 below (0.35 g/t PdEq open pit and 2.0 g.t PdEq underground cut-off). This 43-101 Technical Report is available on SEDAR. See page 4.

Table 1: Results from the January 2019 NI 43-101 Mineral Resource Estimate.

Click Image To View Full Size

| Class | PGM + Au (oz) | PdEq (oz) | PtEq (oz) |

| Measured | 1,394,000 | 1,701,000 | 1,701,000 |

| Indicated | 983,000 | 1,166,000 | 1,166,000 |

| Meas +Ind | 2,377,000 | 2,867,000 | 2,867,000 |

| Inferred | 841,000 | 1,059,000 | 1,059,000 |

Notes:

- 1.CIM definition standards were followed for the Mineral Resource Estimate.

- 2.The 2018 Mineral Resource models used Ordinary Kriging grade estimation within a three-dimensional block model with mineralized zones defined by wireframed solids.

- 3.A base cut-off grade of 0.35 g/t PdEq was used for reporting Mineral Resources in a constrained pit and 2.00 g/t PdEq was used for reporting the Mineral Resources under the pit.

- 4.Palladium Equivalent (PdEq) calculated using (US$): $950/oz Pd, $950/oz Pt, $1,275/oz Au, $1500/oz Rh, $2.75/lb Cu, $5.25/lb Ni, $36/lb Co.

- 5.Numbers may not add exactly due to rounding.

- 6.Mineral Resources that are not Mineral Reserves do not have economic viability

7. The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

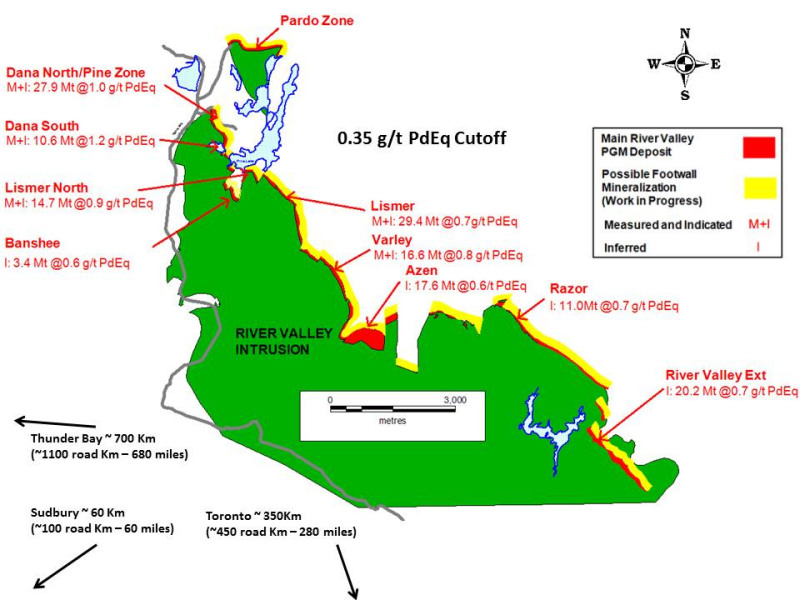

Click Image To View Full Size

Figure 1: The Yellow Band represents the footwall potential area of the River Valley Deposit based on the results of the Pine Zone where footwall mineralization was noted to extend 150 metres eastward from the Pine Zone/ T3 main deposit.

At present the only area that has confirmed footwall mineralization is in the Pine Zone (defined from 2015 to 2017 drilling). Geophysics and exploration continues to test other areas of the Deposit. Management’s specific focus is to outline a potentially economic Mineral Resource in the northern portion of the Project that can be subsequently developed as a series of open pits (bulk mining), crushed, and concentrate on site, with concentrate shipped to a smelter in Sudbury.

2019 Exploration Plan – River Valley PGM Project

To date an approximate 160,441 metres (481,323 feet) in 710 drill holes have been conducted by the company as operators on the River Valley Project. Several independent 43-101 compliant resource estimates have previously been generated for the deposit through the exploration and development phases. The River Valley Deposit’s present resource, with approximately 2.9M PdEq ounces in Measured Plus Indicated mineral resources and near-surface mineralization, covers a total of 16 kilometers of strike. The company continues to explore and enhance the River Valley PGM Deposit.

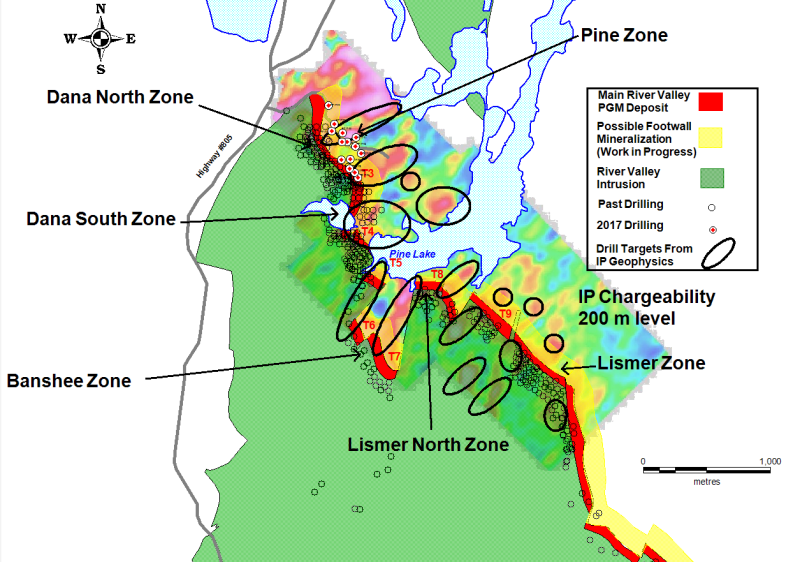

After the ground proofing and surface exploration program conducted in the Summer/Fall of 2018, (which followed up on the most recent induced polarization survey by Abitibi Geophysics) NAM management has designed a 5,000 metre drill programs to test the new geophysical anomalies. See Figure 2 below, which shows these new geophysical anomalies and potential targets for the next stage of drilling at River Valley superimposed over the upper 4 kilometres of the project map.

Click Image To View Full Size

Figure 2: Northern portion of the project with superimposed 2018 merged IP at -100m level. Retrieved from River Valley Geophysical review by Geoscience North (Alan King, P. Geo., M.Sc.)

2019 Exploration Plans for Lithium Division

The Company has eight pegmatite hosted Lithium Projects in the Winnipeg River Pegmatite Field, located in SE Manitoba. In 2018 NAM conducted surface exploration programs on our Lithman East, Lithman North, Lithium One and Lithium Two projects. The programs consisted of reviewing, characterising and sampling the known surface pegmatites. Samples were taken from the Eagle and FD5 pegmatites on Lithium Two and returned results of up to 3.8% Li2O. On Lithium One, samples were taken from the known Silverleaf and Annie pegmatites and returned significant Li20 assays of up to 4.1%.

In 2019, the Company plans to drill the Lithium Two Project first. Drill permits have been applied for and the company is awaiting approval from the province. The application has been accepted by the relevant parties to date and is in the final stages of the approval process. The first drill permit is expected to be issued in June 2019.

Genesis PGM / Polymetallic Project

On April 4th, 2018, NAM signed an agreement with one of Alaska’s top geological consulting companies. The company’s stated objective is to acquire additional PGM and Rare Metal projects in Alaska. On April 18th, 2018, NAM announced the right to purchase 100% of the Genesis PGM/Polymetallic Project, NAM’s first Alaskan PGM acquisition related to the April 4th agreement. The Genesis PGM/Polymetallic Project is a road accessible, under explored, highly prospective and multi-prospect drill ready Palladium (Pd)- Platinum (Pt)- Nickel (Ni)- Copper (Cu) property. A comprehensive report on previous exploration and future phases of work was completed by Avalon Development of Fairbanks Alaska in August 2018 on Genesis. (available here). A 2019 sampling program will be conducted to continue to outline additional mineralization along the 800-metre by 40-metre mineralized zone. Management is actively seeking an option/joint-venture partner for this road accessible PGM and multiple element Project using the Prospector Generator business model.

Opt-in List

If you have not done so already, we encourage you to sign up on our website (www.newagemetals.com) to receive our updated news.

QUALIFIED PERSON

The contents contained herein that relate to Exploration Results or Mineral Resources is based on information compiled, reviewed or prepared by Carey Galeschuk, a consulting geoscientist for New Age Metals. Mr. Galeschuk is the Qualified Person as defined by National Instrument 43-101 and has reviewed and approved the technical content of this news release.

On behalf of the Board of Directors

“Harry Barr”

Harry G. Barr

Chairman and CEO

For further information on New Age Metals, please contact Anthony Ghitter or Cody Hunt, Business Development at 613-659-2773, or [email protected]

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward Looking Statements: This release contains forward-looking statements that involve risks and uncertainties. These statements may differ materially from actual future events or results and are based on current expectations or beliefs. For this purpose, statements of historical fact may be deemed to be forward-looking statements. In addition, forward-looking statements include statements in which the Company uses words such as “continue”, “efforts”, “expect”, “believe”, “anticipate”, “confident”, “intend”, “strategy”, “plan”, “will”, “estimate”, “project”, “goal”, “target”, “prospects”, “optimistic” or similar expressions. These statements by their nature involve risks and uncertainties, and actual results may differ materially depending on a variety of important factors, including, among others, the Company’s ability and continuation of efforts to timely and completely make available adequate current public information, additional or different regulatory and legal requirements and restrictions that may be imposed, and other factors as may be discussed in the documents filed by the Company on SEDAR (www.sedar.com), including the most recent reports that identify important risk factors that could cause actual results to differ from those contained in the forward-looking statements. The Company does not undertake any obligation to review or confirm analysts’ expectations or estimates or to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Investors should not place undue reliance on forward-looking statements.

Tags: clean energy, CSE, green energy, palladium, PGM, PGM Demand, stocks, tsx, tsx-v