SPONSOR: New Age Metals Inc. The company owns one of North America’s largest primary platinum group metals deposit in Sudbury, Canada. Updated NI 43-101 Mineral Resource Estimate 2,867,000 PdEq Measured and Indicated Ounces, with an additional 1,059,000 PdEq Ounces Inferred. Learn More.

Palladium Weekly: Long-Term Uptrend Remains Intact

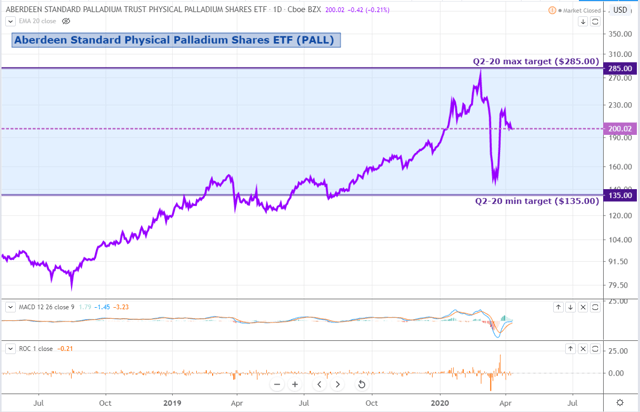

- PALL has rebounded by nearly 50% since it crashed to its lowest since last August at $137.51 on March 16, taking bears by surprise.

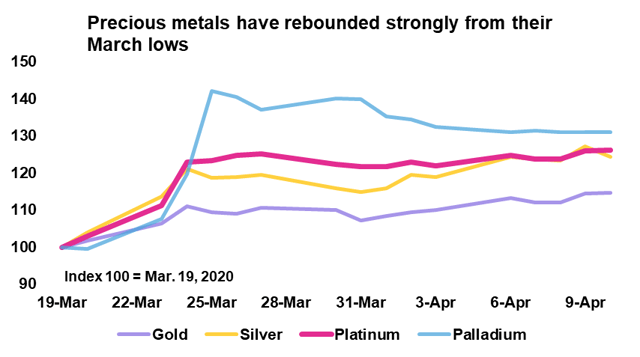

- The rebound in palladium prices has been driven by a broad-based recovery in the precious metals space following the COVID-19 panic last month.

- Palladium’s outperformance since late March confirms our view that palladium enjoys the relatively tightest fundamental backdrop.

- Financial flows are absent, with speculators and ETF investors reducing further exposure to palladium. This confirms that there is no bubble in the palladium market for now.

- For Q2, we see PALL trading between $135 and $285 per share.

Thesis

Welcome to Orchid’s Palladium Weekly report, in which we discuss palladium prices through the lenses of the Aberdeen Standard Physical Palladium Shares ETF (PALL).

PALL has rebounded by nearly 50% since it crashed to its lowest since last August at $137.51 on March 16, taking bears by surprise.

The rebound in palladium prices has been driven by a broad-based recovery in the precious metals space following the wave of ugly deleveraging caused by the COVID-19 panic last month.

That said, palladium is the clear winner, which we attribute to its relatively stronger fundamental backdrop. Before COVID-19, the palladium market was expected to register a deficit exceeding 1 million ounces this year. Although the deficit is likely to be much smaller than initially envisaged due to the likely contraction in automotive demand for palladium, the market is forward-looking and therefore, rises on expectations for a large deficit in 2021.

Source: Bloomberg, Orchid Research

Against this, we express the view that the long-term uptrend in PALL remains intact.

For Q2, we see PALL trading between $135 and $285 per share.

Source: Trading View, Orchid Research

About PALL

For investors seeking exposure to the fluctuations of palladium prices, PALL is an interesting investment vehicle because it seeks to track spot palladium prices by physically holding palladium bars, which are located in JPM vaults in London and Zurich. The vaults are inspected twice a year, including once randomly.

The Fund summary is as follows:

PALL seeks to reflect the performance of the price of physical palladium, less the Trust’s expenses.

Its expense ratio is 0.60%. In other words, a long position in PALL of $10,000 held over 12 months would cost the investor $60.

Liquidity conditions are poorer than that for platinum. PALL shows an average daily volume of $3 million and an average spread (over the past two months) of 0.33%.

Speculative positioning

Source: CFTC, Orchid Research

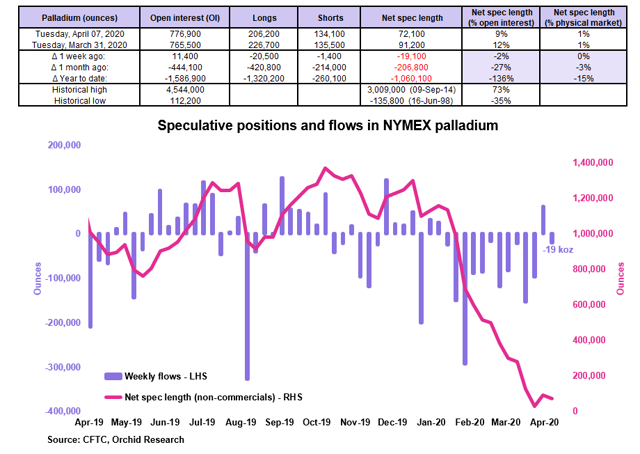

Non-commercials cut marginally by the equivalent of ~19 koz and their net long position in NYMEX palladium in the week to April 7, according to the CFTC. This was the 12th week of decline in palladium’s net spec length over the past 13.

Over March 31-April 7, the NYMEX palladium price tumbled 6.1%. This suggests the presence of additional OTC selling activity.

Non-commercials have slashed by the equivalent of around 1 million oz their net long positions in NYMEX palladium since the start of the year, which represents 15% of annual supply. Yet, the NYMEX palladium price remains up 14% on the year, even outperforming gold (which is up 11% YTD), a clear confirmation of fundamental strength.

Implications for PALL: The absence of speculative participation in the palladium market in spite of 1)the strong uptrend in prices since 2016 and 2)the tight fundamentals of the market makes us even more bullish on PALL. We would turn cautious on PALL once palladium’s spec positioning becomes too bullish.

Investment positioning

Source: Orchid Research

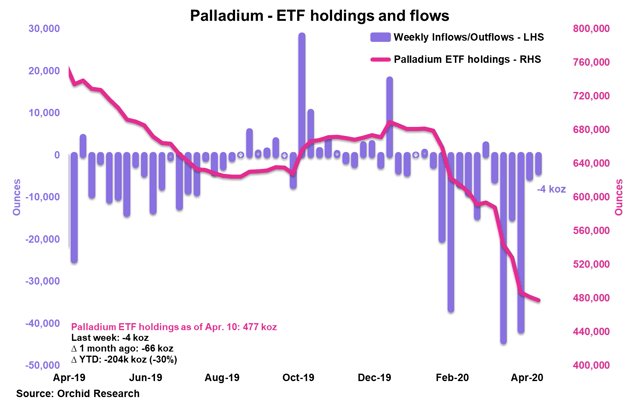

ETF investors sold 4 koz of palladium in the week to April 10, marking a 6th straight week of selling.

In March, ETF investors liquidated 106 koz, representing the largest monthly net outflow since October 2018.

ETF holdings are now below 500 koz, which represents an extremely low level of visible inventories when remembering that the palladium market was supposed to post a 1+ moz deficit this year.

Implications for PALL: The palladium ETF activity has had a muted impact on the NYMEX palladium price because volumes exchanged are impactless on the global palladium market. Low visible inventories are bullish for PALL over the long term.

Seasonal patterns

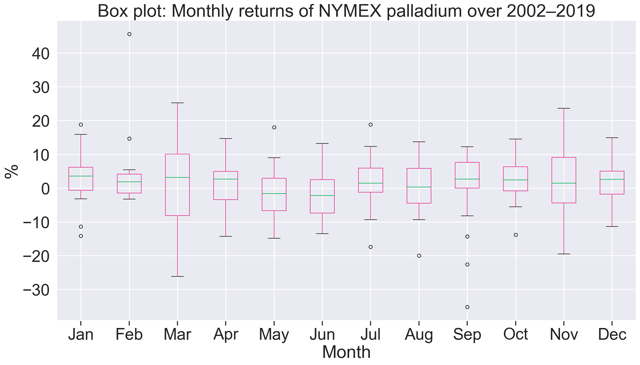

Source: Bloomberg, Orchid Research

As the chart above shows, the volatility in palladium prices tends to be extreme in March. 2020 did not disappoint in this regard. Lower volatility in the months ahead should be expected based on palladium’s seasonal patterns.

For April, the seasonality is slightly friendly, with palladium prices recording a median performance of +2.7% (over 2002-2019).

Implications for PALL: The high volatility regime is behind us, in our view. The seasonality is positive for the NYMEX palladium price and thus PALL in April.

Closing thoughts

The recent outperformance of palladium over the rest of its complex confirms our view that palladium enjoys the relatively strongest fundamental backdrop.

The absence of financial flows in palladium despite its price uptrend since 2016 leads us to believe that 1)there is no bubble in the palladium market yet and 2)prices are essentially driven by their fundamental dynamics.

The sudden sell-off in PALL in March was exacerbated by the COVID-19 panic. Although palladium’s fundamentals will prove weaker than expected in 2020 due to a likely contraction in automotive demand, the market seems increasingly focused on 2021 when a large deficit is likely to re-emerge as global economic growth bounces back and automotive demand rebounds.

We maintain that PALL is in a clear long-term uptrend and even though volatility cannot be ruled out, we would only turn cautious when investor sentiment reaches an extreme high. We are far from it.

For Q2, we see PALL trading between $135 and $285 per share.

Source: https://seekingalpha.com/article/4337297-palladium-weekly-long-term-uptrend-remains-intact

Tags: CSE, palladium, PGM, PGM Demand, Platinum