The most pessimistic forecasts of copper demand, and pricing, during the worst pandemic in 102 years, have failed to materialize.

From a four-year low in March, when the coronavirus slammed into Europe and North America, the red metal used widely in construction, communications, transportation and energy transmission, has mounted a serious comeback.

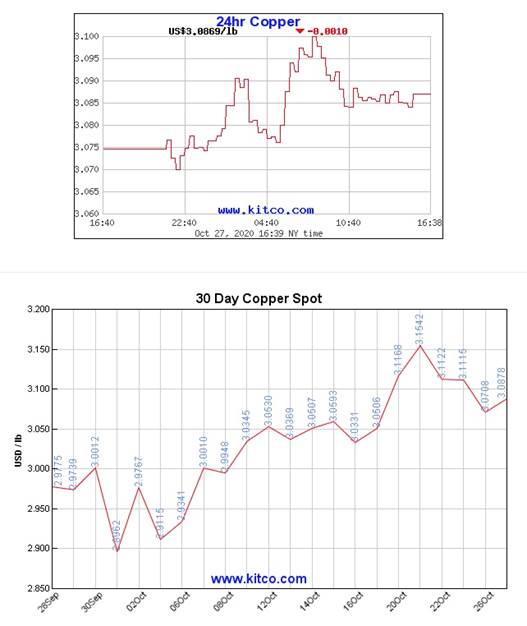

As of this writing spot copper is trading at $3.08 per pound, compared to around $2.10/lb in mid-March – a gain of 46%. The spot price has stayed above $3.00 since Oct. 8 – which is remarkable considering the reports of impending economic doom, amid a second wave of covid-19 infections in Europe and North America.

The following analysis by AOTH has copper showing no signs of slowing down; in fact, while the copper market was tight before the pandemic began, we expect it to tighten even further, due to a constellation of factors, starting with China.

The Chinese economy became the first major world economy to return to its pre-virus growth trajectory, when it posted positive numbers in the second quarter. Recent figures from China’s National Bureau of Statistics indicate that third-quarter GDP growth is up 4.9% from a year ago. Between April and June, Q2, the bureau reported a 3.2% rise. The Chinese are well ahead of their trading rivals as they strive to put the pandemic for which they were responsible, behind them.

According to the World Bank and the OECD, the Chinese economy in 2020 will grow 2% – the only G20 country to mark positive economic output this year. Beijing has managed to largely contain the virus in recent months after the pandemic shut down its economy. Commerce and travel have been allowed to resume, which is driving economic growth and fueling demand for copper and other industrial metals, like aluminum and nickel, whose prices are also climbing.

Other reasons for a rising copper price include covid-related restrictions imposed on the copper mining industry, along with speculative interest in the metal due to a weaker US dollar.

Copper output from the world’s top 10 producers declined 3.7% during the second quarter, due to nation-wide lockdowns in Chile, Peru and Mexico.

China’s copper dominance

Chinese growth statistics have always figured prominently in copper price forecasts – no surprise considering that China is responsible for just under half of the world’s production of copper and copper alloys semis, the industry term for first-stage products made from refined copper.

The Asian superpower is also the largest importer of unwrought copper, along with copper ores and concentrates.

Its manufacturing sector back on track, China’s copper imports rose sharply over the past four months; in September, the country imported 62% more copper than the same month in 2019. Unwrought copper imports of 4.9 million tonnes during the first nine months of the year, were up 41% from the same period last year.

According to Reuters columnist Clyde Russell, China has been vacuuming up copper, boosting the price at a time when demand elsewhere in the world was looking sickly as the virus spread.

Why is China importing so much copper? Russell claims the buying spree is being driven by Beijing’s stimulus spending following the national lockdown during the first four months of the year. But he also says it is likely that substantial volumes of copper are flowing into stockpiles, either strategic or commercial.

We agree, and have been writing quite a bit about this lately.

Obviously we can’t say for sure, given China’s opaque statistics, but we suggest a good chunk of the raw materials are going into bulking up the Chinese Military, in particular its navy patrolling the South China Sea. In other words, China is preparing for war.

The mining industry’s experience of China locking up the world’s mineral resources testifies to how far the Chinese will go to ensure their ever-growing demand for mined commodities is met.

Locking up supply

While iron ore ad copper were the hot targets of overseas acquisitions by Chinese firms as they sought to feed an economy that up until 2015 was growing at double digits, the Chinese have also gone after gold, nickel, tin and coking coal. More recently the most desired metals are those that feed into the global shift from fossil fuels to the electrification of vehicles. This has meant a hunt for lithium, cobalt, graphite, copper and rare earths – metals that are used in electric vehicles, of which China has become the world’s leading manufacturer. EVs use a lot of copper, four times as much as a regular vehicle, and China hasn’t been shy about boosting its copper reserves to meet expected demand.

Two large Peruvian copper mines are owned by Chinese companies. Chinese state-run Chinalco owns the Toromocho copper mine, while the La Bambas mine is a joint venture between operator MMG (62.5%), a subsidiary of Guoxin International Investment Co. Ltd (22.5%) and CITIC Metal Co. Ltd (15%). The Chinese-backed Mirador mine in Ecuador opened in 2019.

Most of the metal produced under these off-take agreements will NEVER come to the market anyplace other than in China. Those metals that do, can have their supply shut down any time the Chinese want.

In Brazil, Chinese banks and investment groups have committed $15 billion of a $20b China-Brazil Fund, launched in 2016 to finance infrastructure projects.

The Made in China 2025 initiative, which aims to make China’s copper industry more efficient, is expected to grow Chinese copper demand by an additional 232,000 tonnes by 2025. This isn’t counting the need for more copper for railways, electric vehicles, car motors and power transformers.

SOURCE: http://www.marketoracle.co.uk/Article67933.html

Tags: #Canariaco, #copper, #Fortesque, #Freeport, #Gold, #GoldmanSachs, #mining