Morgan Stanley on Nickel Forecast:

- 6.4% demand growth in 2021

- outpacing supply as Indo NPI growth offset by China’s decline

- Market moving from 85kt surplus in 2020 to -18kt in ’21

- Supporting average price of $7.29/lb, with risk skewed to bull case $8.75/lb

Tartisan Investment Highlights:

- Kenbridge Nickel Deposit is a Class 1 Nickel project which can safely be put into production quickly at low capital cost

- Updated Mineral Resource Estimate: 7.47 Ktonnes 0.6% Ni, 0.32% Cu open pit and underground

- Measured and Indicated resources 985 Ktonnes Inferred at 1% Ni, 0.62% or 117 million pounds of Nickel and 66 million pounds of Copper

- Potential to double the underground resource at Kenbridge through anticipated drill program

- Kenbridge North – Untested Potential to Discover additional Class 1 Deposits

Tartisan Strategic Investment Holdings $9+ Million

- Eloro Resources, Class One Nickel and Technologies , Peruvian Metals Corp. provide Tartisan shareholders an opportunity to participate in other high-quality projects

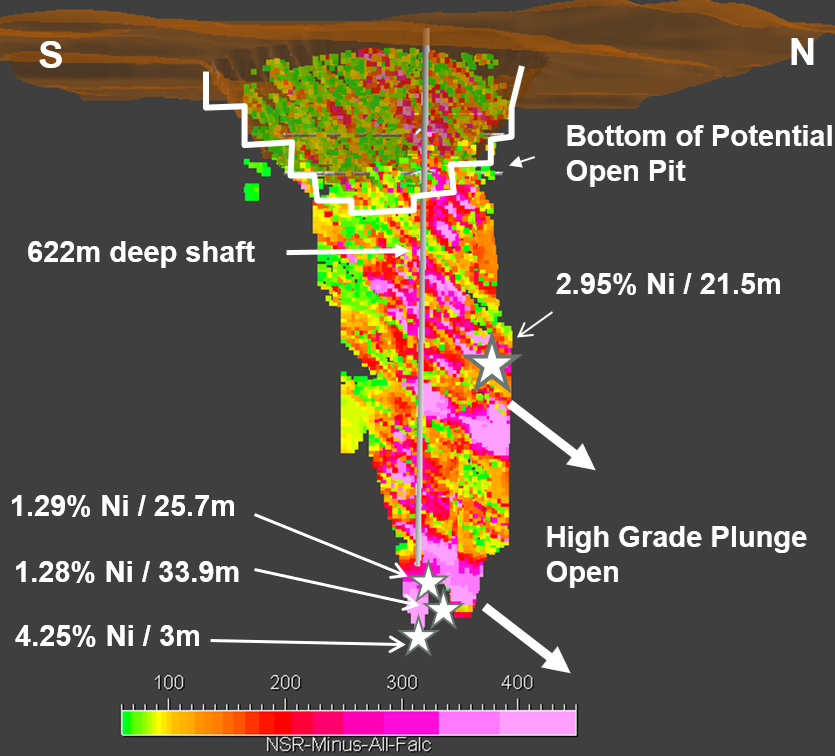

Kenbridge Ni Project (Kenora, Ontario)

- Property is accessible via gravel roads from paved Highway 71

- Underground development of the deposit extends from surface to a depth of 623 metres in a 3 compartment shaft, with 244 metres of drifts and 168 metres of crosscuts at the 110 and 150 metre levels

- The minimum drill spacing is at 15.2metres on all levels.

- The deepest hole extends to 838.4 metre depth and intersected mineralization grading 4.25% nickel and 1.38% copper over 10.7 metres, indicating that the deposit remains open at depth.

- Historical surface drilling was completed at 30.5metre spacing

- Preliminary Economic Assessment completed and updated returned robust project economics and operating costs including a NPV of C$253M and cash costs of US$3.47/lb of nickel net of copper credits

Look for Tartisan Corporate updates in 2021 at Tartisan.com

Tags: #Battery, #Demand, #ELO, #ElonMusk, #TN, CSE, EloroResources, Kenbridge, nickel, nickel demand, PEA, small cap stocks