On August 7th, Omagine (OMAG:OTCBB)Â filed a 10-QÂ for the period ended June 30, 2012 outlining – amongst other things – the results of a recent meeting with the Minister of Tourism.

In the filing, the company stated:

Representatives of the shareholders of Omagine LLC (the Company, Royal Court Affairs, and Consolidated Contractors) met on July 1, 2012 for several hours with His Excellency Ahmed Al-Mahrizi and a lawyer for MOT …

… The meeting concluded with the Minister confirming that he is in agreement with and enthusiastic about the development of the Omagine Project. He also stated that he was entirely satisfied with our project presentation, that he agreed it will be a wonderful project for Oman, that he was completely satisfied with our response to his May 9th Minister’s Letter and that he is agreeable to sign the DA as soon as possible …

… The Holy Month of Ramadan extends from approximately July 20 to August 20 and is immediately followed by the EID holiday celebration (which in Oman is expected to extend through August 31). Her Excellency Maitha returns on July 26. It is management’s expectation that while we may sign the DA in August, given the occurrence of Ramadan and the EID holiday, the DA signing could be postponed into September or even October 2012. Management is optimistic that the Government will soon memorialize its agreement to the Final DA in a signed written document.

With Ramadan completed on August 18th, investors now appear to be anticipating signing of the Development Agreement as shares of the company closed at $1.74 on Friday with higher than usual volume. The shares closed 10.83% higher on the day and 40% higher from the August low of $1.25.

The Company’s updated financial model presently forecasts net positive cash flows for Omagine LLC of approximately $900 million dollars over the seven year period subsequent to the signing of the Development Agreement, with a net present value of the Omagine Project of approximately $450 million dollars.

With 14.3 Million shares outstanding, the current market capitalization of the company sits at $25 Million.

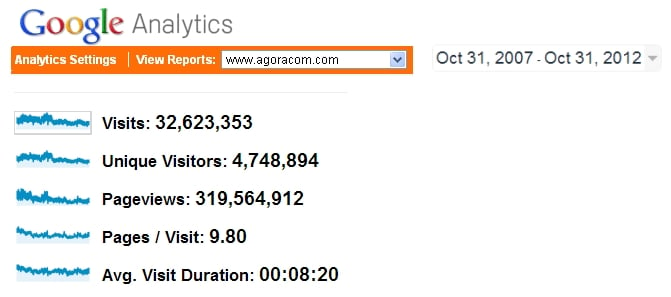

For those of you that are new to the Omagine story, please find enclosed the following profile. Â Omagine is an AGORACOM client:

The Omagine Project

The Company has proposed to the Government of Oman (the “Government”) the development of a real-estate and tourism project (the “Omagine Project”) to be developed in Oman by Omagine LLC (the “Project Company”). Omagine LLC was formed in Oman as a limited liability company in 2009 for the purpose of designing, developing, owning and operating the entire Omagine Project.

The Omagine Project is planned to be developed on one million square meters (equal to approximately 245 acres) of beachfront land facing the Gulf of Oman (the “Omagine Site”) just west of the capital city of Muscat and approximately six miles from Muscat International Airport. It is presently planned to be an integration of cultural, heritage, educational, entertainment and residential components, including: a “high culture” theme park containing seven pearl shaped buildings, each approximately 60 feet in diameter, associated exhibition buildings, a boardwalk, an open air amphitheater and stage; open space green areas; a canal and an enclosed harbor and marina area; associated retail shops and restaurants, entertainment venues, boat slips, and docking facilities; a five-star resort hotel, a four-star resort hotel and possibly a three or four-star hotel; commercial office buildings; shopping and retail establishments integrated with the hotels, and approximately two thousand residences to be developed for sale.

The Company’s updated financial model presently forecasts net positive cash flows for Omagine LLC of approximately $900 million dollars over the seven year period subsequent to the signing of the Development Agreement with a net present value of the Omagine Project of approximately $450 million dollars. The Company intends to continually update this model at regular intervals as new facts and information become available, as the development program and design process unfolds and as market conditions require.

Development Agreement

The agreement between the Government and Omagine LLC which will govern the design, development, construction, management and ownership of the Omagine Project is the “Development Agreement” (“DA”). The DA will be the contract between the Government of Oman and Omagine LLC. The Development Agreement has now been approved by all the required Ministries of the Government of Oman.

The Omagine Project and the Omagine DA have received multiple Government approvals over the past several years including at least three written approvals of the project from the Government. In July 2011, after many drafts and several years of negotiations, the Omagine Development Agreement was agreed by Omagine LLC and all required ministries of the Government (the “Final DAâ€). In September 2011, as requested by the Ministry of Tourism (“MOTâ€), Omagine LLC registered its new shareholders (see “Shareholder Agreement†below) with the Ministry of Commerce & Industry and, to the best knowledge and belief of the Company and its attorneys, no further barrier to signing the Final DA now exists.

A new Minister of Tourism, His Excellency Ahmed Al-Mahrizi, was appointed on March 1, 2012. Representatives of the shareholders of Omagine LLC (the Company, Royal Court Affairs, and Consolidated Contractors) met on July 1, 2012 for several hours with His Excellency Ahmed Al-Mahrizi and a lawyer for MOT.

The meeting concluded with the Minister confirming that he is in agreement with and enthusiastic about the development of the Omagine Project. He also stated that he was entirely satisfied with our project presentation, that he agreed it will be a wonderful project for Oman, that he is agreeable to sign the DA as soon as possible.

The Shareholder Agreement

In May 2011, Omagine, Inc. and three (3) investors (the “New Shareholdersâ€) signed a shareholders’ agreement dated as of April 20, 2011 with respect to Omagine LLC (the “Shareholder Agreementâ€).

The Office of Royal Court Affairs (“RCA”), is an Omani organization representing the personal interests of His Majesty, Sultan Qaboos bin Said, the ruler of Oman. Consolidated Contractors International Company, SAL, (“CCICâ€) is a 60 year old Lebanese multi-national company headquartered in Athens, Greece. In 2010 CCIC had approximately five and one-half (5.5) billion dollars in annual revenue, one hundred twenty thousand (120,000) employees worldwide, and operating subsidiaries in among other places, every country in the MENA Region. Consolidated Contracting Company S.A. (“CCC-Panamaâ€) is a wholly owned subsidiary of CCIC and is its investment arm. Consolidated Contractors (Oman) Company LLC, (“CCC-Omanâ€) is an Omani construction company with approximately 13,000 employees in Oman and is CCIC’s operating subsidiary in Oman.

The New Shareholders are (i) RCA, (ii) CCC-Panama and (iii) CCC-Oman.

The ownership percentages of Omagine LLC presently are:

Omagine, Inc.60%

RCA25%

CCC-Panama10%

CCC-Oman5%

Pursuant to the provisions of the Shareholder Agreement, the total amount of cash investment into Omagine LLC by Omagine, Inc. and the New Shareholders will be $70,169,125 and although Omagine, Inc. and the New Shareholders will invest an aggregate of $936,000 of that $70,169,125 before the Financing Agreement Date, 98.7% of such $70,169,125 equal to $69,233,125 (the “Cash Infusionâ€) will not be invested by the New Shareholders or received by Omagine LLC until the Financing Agreement Date.

The Shareholder Agreement also recognizes the PIK capital contribution to be made by RCA to Omagine LLC as a portion of the payment by RCA for its shares of Omagine LLC. The PIK represents the value to be ultimately assigned to the approximately 245 acres of beachfront land constituting the Omagine Site which His Majesty the Sultan owned and transferred to the Government for the specific purpose of developing it into the Omagine Project. After the DA is signed, the value of the PIK will be determined by a professional valuation expert in accordance with Omani law and with the concurrence of Omagine LLC’s independent auditor, Deloitte & Touche, (M.E.) & Co. LLC.

The Financing Agreement Date is presently projected by management to occur within twelve months after the signing of the DA. If however the financial resources are available to Omagine, Inc., management may choose to trigger the Financing Agreement Date earlier (and therefore the $69,233,125 Cash Infusion) by having Omagine, Inc. make a secured loan to Omagine LLC to finance the first phase of the development of the Omagine Project. The first phase of the development of the Omagine Project is expected to constitute primarily initial design work and its scope and budgeted cost will be decided upon by Omagine LLC shortly after the DA is signed. Pursuant to the provisions of the Shareholder Agreement such a loan from Omagine, Inc. to Omagine LLC would constitute a Financing Agreement Date. Management is presently examining several alternative methods of making such financial resources available to Omagine, Inc.

In order to move into the actual design and development stage of the Omagine Project, Omagine LLC and the Government must first sign the Development Agreement. Notwithstanding the foregoing, no assurance can be given at this time that the Development Agreement actually will be signed.

Please be advised that the foregoing assumptions and this discussion are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 which involve uncertainties and other factors which could cause the outcomes described herein to differ from future Company achievements as expressed or implied by such forward-looking statements.

.